Goldbug´s Achilles Heel as of October 15th, 2020. Source: Midas Touch Consulting, © Florian Grummes 2020

As in the last few months again and again in time announced, Bitcoin should and likely will substantially outperform gold. The two-and-a-half-year correction in the Bitcoin/Gold ratio ended this summer in favor of Bitcoin. Since then, Bitcoin has clearly outperformed gold and the Bitcoin/Gold ratio should be on its way towards 1:10. Given the outperformance of the last ten years, a gold investor can no longer afford to ignore Bitcoin.

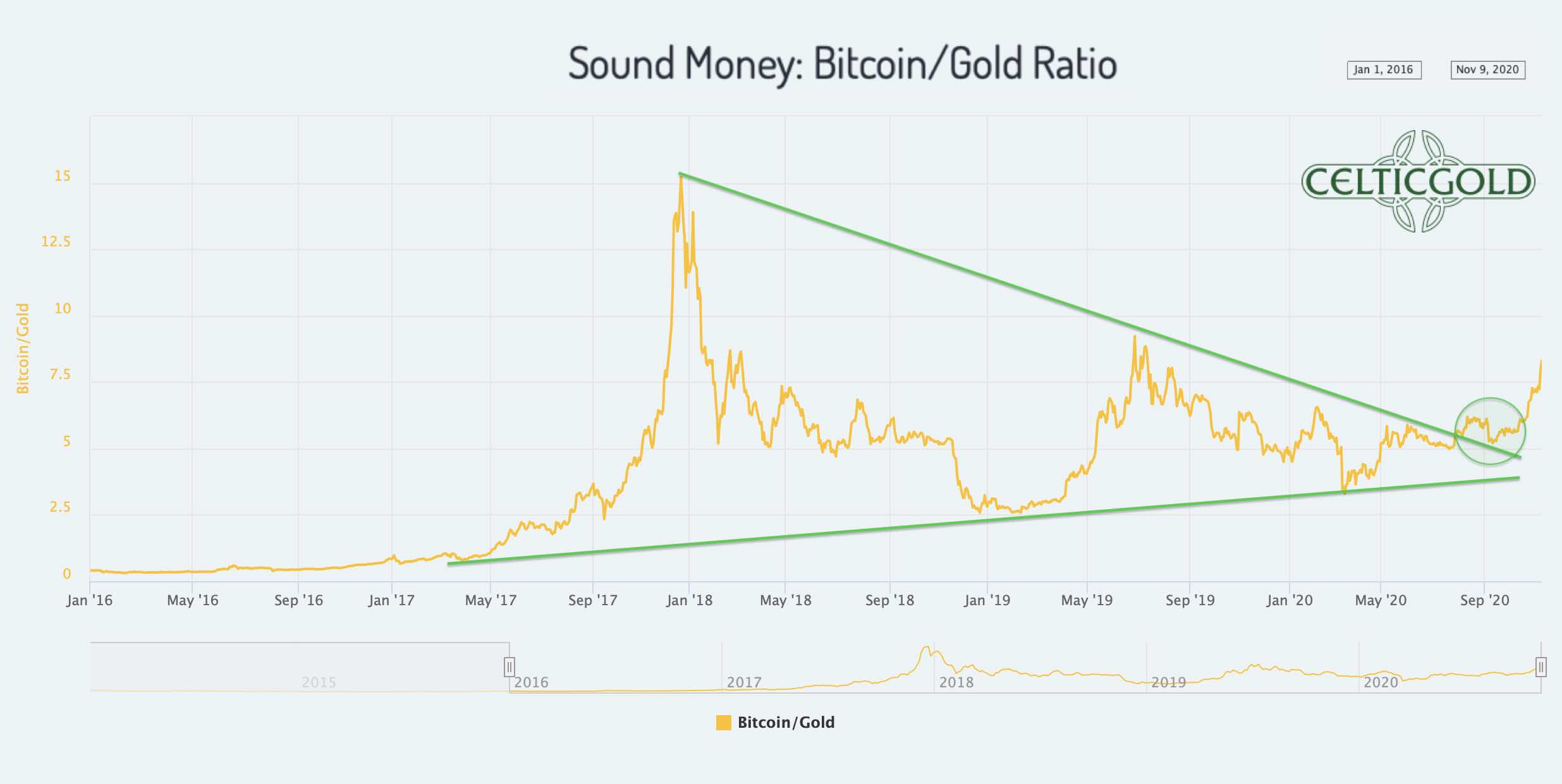

Bitcoin/Gold Ratio

Sound Money Bitcoin/Gold-Ratio as of November 9th, 2020. Source: Chaia

At prices of US$15,977 for one Bitcoin and US$1,889 for one troy ounce of gold, the Bitcoin/Gold ratio is currently at 8.45. This means that you now must pay more than 8 ounces of gold for one Bitcoin. In other words, a troy ounce of gold currently costs only 0.118 Bitcoin, which is a decrease of over 30% in the last six weeks!

As in the last few months again and again in time announced, Bitcoin should and likely will substantially outperform gold. The two-and-a-half-year correction in the Bitcoin/Gold ratio ended this summer in favor of Bitcoin. Since then, Bitcoin has clearly outperformed gold and the Bitcoin/Gold ratio should be on its way towards 1:10. Given the outperformance of the last ten years, a gold investor can no longer afford to ignore Bitcoin.

Generally, buying and selling Bitcoin against gold only makes sense to the extent that one balances the allocation in the two asset classes! At least 10% but better 25% of one's total assets should be invested in precious metals (preferably physically), while in cryptos and especially in Bitcoin, one should hold at least 1% but not. more than 5%. Paul Tudor Jones holds a little less than 2% of his assets in Bitcoin. If you are very familiar with cryptocurrencies and Bitcoin, you can certainly allocate higher percentages to Bitcoin and maybe other Altcoins on an individual basis. For the average investor, who usually is primarily invested in equities and real estate, 5% in the highly speculative and highly volatile bitcoin is already a lot!

"Opposites compliment. In our dualistic world of Yin and Yang, body and mind, up and down, warm and cold, we are bound by the necessary attraction of opposites. In this sense you can view gold and bitcoin as such a pair of strength. With the physical component of gold and the digital aspect of bitcoin (BTC-USD) you have a complimentary unit of a true safe haven in the 21st century. You want to own both!"– Florian Grummes

.jpg)

No comments:

Post a Comment

Commented on MasterMetals