Subscribe to MasterMetals

Search This Blog

September 19, 2023

September 1, 2023

Wanted!: #Mining Engineers & Geo’s

Coming labor precipice in mining sector as shortage of skilled engineering and geo's risks crimping output of critical #metals.

It's getting harder to find the Mining engineers the world needs.

June 21, 2023

What Really Happened the Night the #Nickel Market Broke

Hundreds of pages of legal filings describe how the LME sleepwalked into a crisis, "that the LME was largely in the dark about Tsingshan's role as the major driver of the price spike until after it had decided to cancel billions of dollars of nickel trades; that the exchange's top decision makers were asleep as the market spiraled out of control; and that Chamberlain made the key decision that the market was disorderly in about 20 minutes after he woke up on March 8 – unaware until much later that the LME's staff had allowed prices to move more rapidly by disabling its own automatic volatility controls."

…

Jane Street alleges the very fact that the LME's key decision makers were asleep was a breach of the exchange's regulatory duties, since it meant that "no-one had been monitoring transactions in order to assess whether there were disorderly trading conditions." The LME disputes that it was in breach.

What oversight there was came from the exchange's trading operations team. They were in charge of operating the LME's price bands, a form of speed bump designed to limit extreme price moves, such as in the case of "fat finger" trades.

But in the early hours of March 8, the operations team received numerous complaints from market participants that the price bands were preventing them from booking trades. At 4:49 a.m., they suspended them altogether.

Dizzying Ascent

It was soon after this that nickel prices started the most dizzying part of their ascent. By the time Chamberlain woke up, at 5:30 a.m., the price was already $60,000 a ton. In the next 38 minutes, it rose another $40,000.

"The abandonment of price bands caused or at least materially contributed to the speed and scale of the increase in prices," Jane Street said in its court filing. "Without price bands in place, the LME could not control price volatility at all."

Chamberlain wasn't aware that his operations team had suspended the price bands, as he made his pivotal decision to suspend the nickel market.

The exchange still didn't have a handle on the scale or the importance of Tsingshan's position — the real reason behind the runaway rally.

…

Brokers on the LME would normally need to pay their first margin call of the day by 9 a.m., based on prices prevailing at around 7 a.m. If that had happened on March 8, the LME would have needed to request $19.75 billion from 28 banks and brokers – an unprecedented sum that was more than 10 times the previous daily record before March 2022.

See the whole article on Bloomberg here:

March 11, 2022

#LatinAmerica Wastes Billions of Dollars of #Metals

July 30, 2021

$550BN will shift from #Commodities importers to exporters in 2021, nearly 2X the $280BN reverse transfer in 2020 as prices collapsed.

Winners & Losers From Surge in Commodity Prices

Gains for commodity exporters will easily outweigh their losses last year as the pandemic spread and crushed demand for raw materials:

Bloomberg Economics estimates that $550 billion will shift from importers to exporters in 2021, nearly double the $280 billion reverse transfer last year when prices collapsed.

May 17, 2021

#GOLD: Getting ready to break out —UPDATED! $GLD

February 24, 2021

“I used to go with 500,000 pounds to London…” #Commodities Traders’ Long History of “Commissions” to Seal Deals

"In those days paying so-called "commissions" was both legal and even tax-deductible for a Swiss company…"

January 10, 2021

Appian Capital Raises $775 Million for New #Mining #PrivateEquity Fund

It plans to target additional investments in countries including Brazil, Australia, Mexico, Peru, Chile and Canada, and where Appian has existing operations. The second fund will run for 10 years.

See the whole article on the Financial Times here:

https://www.ft.com/content/3a31eec3-4603-453b-9daf-6e4e0d7036d2

June 9, 2020

Junior #MiningStocks Investor Checklist How to Avoid Common Mistakes -Part 1: Team

Management Team Checklist

March 12, 2020

#Gold has given back most of 2020's gains, still much better than the $SPX...

March 2, 2020

#Gold's Slump Unlikely to Signal End of Rally

We've been here before. In 2008 Gold dropped before marching higher to record $1920/oz three years later.

Gold's Swoon Echoes Financial Crisis Blip

The conditions are still there for an extended rally.

In times of coronavirus panic, even havens can be unreliable.

Gold closed off February on a tarnished note, ending last week with its steepest daily decline since 2013. As financial markets panicked over the spread of the pneumonia-like illness, stocks tumbled and dragged gold and other precious metals lower. That's a rare phenomenon for a metal that tends to shine brighter when everything else looks gloomy. It will also be a brief one.

Back in 2008, spot gold fell by more than a quarter between July and late October, before embarking on an unprecedented run toward $1,900 an ounce, once global rate cuts began in earnest.

February 28, 2020

#Gold getting slammed.

bit.ly/MasterMetalsCharts

January 15, 2020

"Ratio of share price-to-free cash flow among senior #Gold #Miners...still hasn’t caught up to the gold price...more room to run" for #miningstocks $GDX $GLD

MasterMetals

@MasterMetals

December 15, 2019

The World’s Wealthy Are Hoarding #Gold - Physical not #ETF‘s

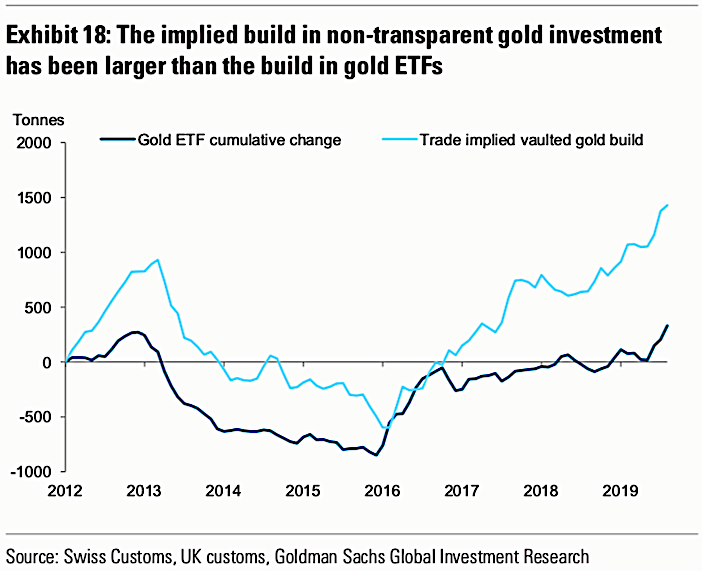

"Since the end of 2016 the implied build in non-transparent gold investment has been much larger than the build in visible gold ETFs."

November 26, 2019

#Digbee to bring “transparency and clarity to the #mining sector” with its #BigData & research #digital platform

Digbee is on the cusp of launching a ground-breaking accredited independent peer review system for complex mining projects

Founder Jamie Strauss is bringing to bear his years of experience in the mining industry

Founder Jamie Strauss is bringing to bear his years of experience in the mining industryJamie Strauss, the founder of Digbee, frames the process of making investment decisions in the mining sector in a remarkably simple way."People just want to know if the science has been done properly," he says."Or alternatively, are you trying to con me?"It's a conundrum that has vexed mining company investment decision-makers for years, but one which is about to be solved by new products that are being launched by Digbee, Strauss's new company that aims, according to the strapline on its website [www.thedigbee.com], to bring "transparency and clarity to the mining sector."Digbee is unique because it provides on-demand, cost-effective and easy-to-digest technical mining analysis using an expert network of accredited mining professionals that helps improve critical decisions and mitigate riskMore precisely, says Strauss, "Digbee offers accredited peer reviews of complex mining projects, with a specific focus on geology, metallurgy, mine engineering and project infrastructure."As Strauss tells it, the demand for this sort of product can only grow.

July 27, 2019

How Awesome was Anil #Agarwal’s @AngloAmerican Adventure

In our article, we explain that Agarwal has made about $500m in gross profits on the trade. BUT, that is before the substantial costs required to service the instruments involved in making the stake happen. Coupon costs alone will have totalled about $300m since he first put on the two legs of the trade.And we've learned that Agarwal is likely to reveal that he is up about $100m from the overall project. We assume that means a hefty chunk of the remaining $100m will be headed to the folks at JPMorgan.Agarwal's trade strongly resembles an equity collar, which DD's Rob Smith and Arash Massoudi explained last year has become a hot money spinner for Wall Street banks looking to make money from deep pocketed clients. In short: collars do not come cheap.

In short:

Read the whole story here: https://www.ft.com/content/53b77de8-af35-11e9-8030-530adfa879c2

December 19, 2018

March 15, 2018

What are the steps to finding a #Mine? #Exploration #Infographic

Finding a new deposit is tough, but here's how to better your odds. This infographic shows the steps of mineral exploration, from prospecting to production.

Infographic: The Mineral Exploration Roadmap:

The MasterMetals Blog

@MasterMetals

March 24, 2017

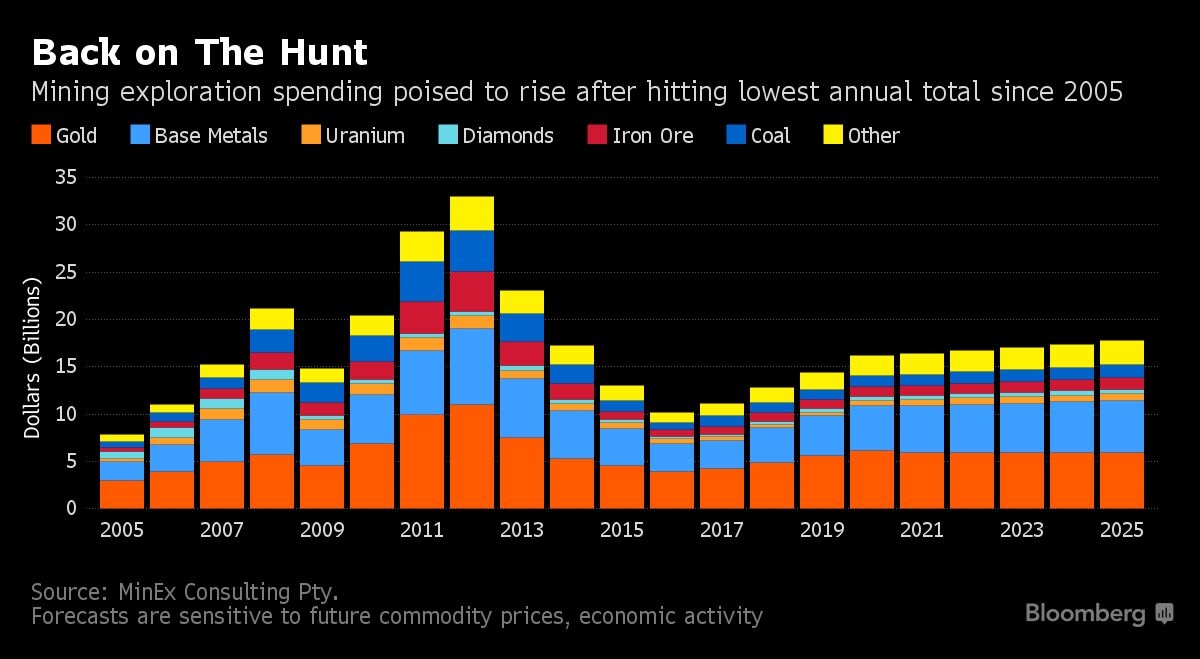

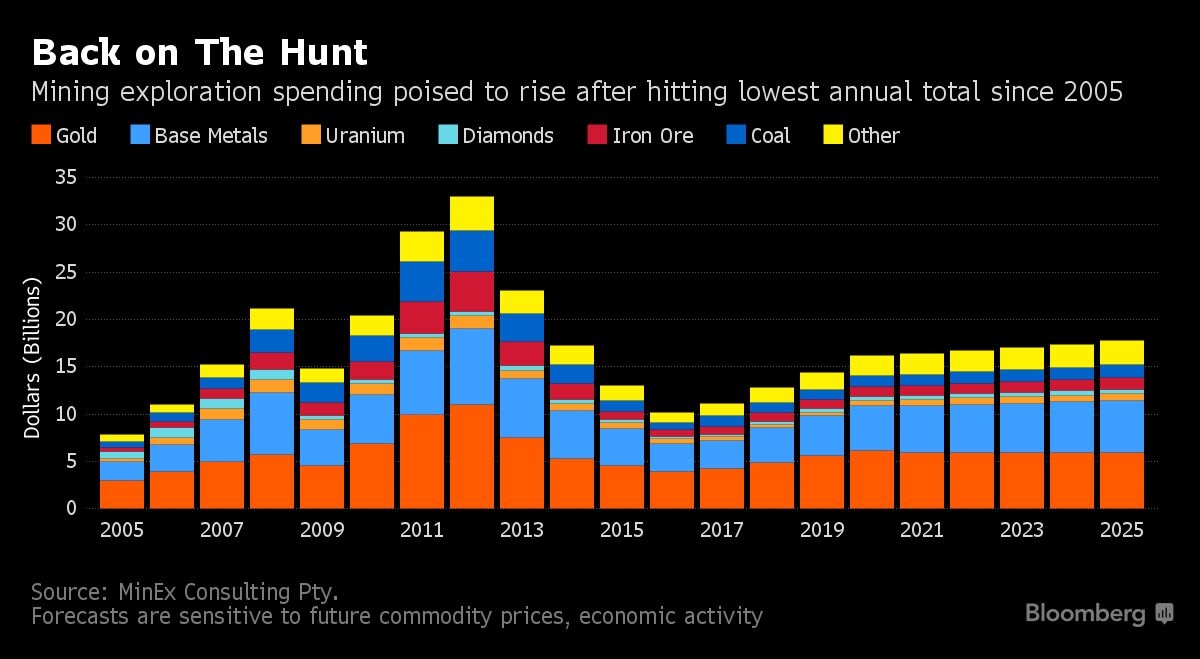

After years of underinvestment, #Miners finally increasing #Exploration spending in Hunt for new deposits Bloomberg

Exploration Spending forecast to rise more than 75% through 2025 to $18 Billion: MinEx

Exploration Spending forecast to rise more than 75% through 2025 to $18 Billion: MinEx- Discovery of world-class deposits has slowed in past decade

Miners Regain Mojo to Spark $18 Billion in Exploration Hunt

- Spending forecast to rise more than 75% through 2025: MinEx

- Discovery of world-class deposits has slowed in past decade

May 17, 2012

Global #gold demand in Q1 2012 was 1,097.6 tonnes (t), down 5% - China, central banks and ETFs underpin demand for gold World Gold Council

China, central banks and ETFs underpin demand for gold

17 May, 2012

Global gold demand in Q1 2012 was 1,097.6 tonnes (t), down 5% from the high demand levels seen in Q1 2011 (1,150.7t), according to the World Gold Council’s Gold Demand Trends report. This decrease was largely to be expected given the introduction of import taxes in India and high gold prices. Gold demand value however, showed a 16% increase year on year to an estimated US$59.7 billion. The average price of gold for the quarter was US$1,690.57, 22% higher than the average for Q1 2011. Demand for the quarter was underpinned by increased demand in China, continued central bank purchasing and inflows into exchange-traded funds (ETFs).

The main highlights from the report are as follows:

China’s investment and jewellery demand reached 255.2t up 10% on the previous year’s levels. Investment demand recorded strong growth with a quarterly record of 98.6t, up 13% from Q1 2011, demonstrating investors’ continued need to preserve wealth amidst ongoing concerns over inflation. Jewellery demand in China also increased significantly to 156.6t, accounting for 30% of global jewellery demand making China the largest jewellery market for the third consecutive quarter.

Gold demand in India was affected in Q1 2012 by a number of factors; a new tax on gold jewellery, two increases in the import duty for gold and weakness and volatility in the rupee. Jewellery demand fell 19% to 152.0t from Q1 2011. Investment demand was down 46% from the previous year at 55.6t. In May, the government withdrew the new tax on jewellery and the market is already responding positively.

Central banks across the globe continued the now established trend of net purchasing with demand in Q1 2012 reaching 80.8t. Demand was driven by Eastern Europe with Russia and Kazakhstan adding to their holdings and accounting for a substantial amount of the purchasing. Mexico’s central bank made the largest single purchase of 16.8t. The main driver for this demand by emerging market central banks is the need to diversify their holdings.

First quarter demand for ETFs and similar products totalled 51.4t, equivalent to a value of US$2.8bn; in stark contrast to the first quarter of 2011, when the sector witnessed net outflows.

Marcus Grubb, Managing Director, Investment at the World Gold Council said,

“China and India have seen continuing economic growth and whilst China’s economy is expected to slow, it will nonetheless surpass the rates of growth in the West. As we previously forecast it is likely China will become the largest source of demand for gold in 2012.

This growth story also extends to other emerging market economies and is reinforced by central banks’ continued buying of gold, as a diversifier and a preserver of national wealth. The current picture of the gold market is diverse and not withstanding a flight into US dollars and treasuries near term, we believe the fundamental reasons for investing in gold today remain very strong and compelling.”

Gold demand and supply statistics for Q1 2012:

First quarter gold demand of 1,097.6t was down 5% in comparison to Q1 2011 though in line with the average of the preceding eight quarters.

The value measure of gold demand was 16% higher year-on-year at US$59.7bn.

Demand in the jewellery sector of 519.8t was down 6% year-on-year, which when considered against a rise in prices of 22% shows resilience in jewellery demand. Increasing prices are leading to a re-premiumisation of gold, as it becomes even more exclusive. In US$ terms, the value of jewellery demand grew by 14% to a record US$28.3 billion.

The average gold price of US$1,690.57 was 22% higher than the average of Q1 2011. As a result, in value terms, virtually all sectors of gold demand posted year-on-year increases, with the exception of physical bar demand, which was broadly flat, and the official sector, where purchasing activity was below Q1 2011’s exceptional levels.

First quarter gold investment demand (including gold bars, coins, ETFs and similar products) grew by 13% year-on-year to 389.3t. In US$ terms, this equated to a demand value of US$21.2bn, 38% higher year-on-year. Increases in demand for ETFs and medals/imitation coins meant that demand reached 389.3t, 45.8t above Q1 2011 despite declines in demand for physical bars and coins.

At 107.7t, demand for gold used in the technology and industrial sectors was down by 7% compared with year-earlier levels.

The Q1 2012 Gold Demand Trends report, which includes comprehensive data provided by Thomson Reuters GFMS, can be viewed here.

17 May, 2012, China, central banks and ETFs underpin demand for gold Media World Gold Council

ShareThis

MasterMetals’ Tweets

- #Gold: SPDR Gold Shares ETF $GLD dropped by 1.4803%! Last at 310.81 #MasterMetals #GLD https://bit.ly/39s7ZgS https://bit.ly/43btkt5 - 5/7/2025

- #Silver: iShares Silver Trust $SLV DOWN 2.4322%! Last at $29.485 on May 7, 2025 at 02:00AM. https://bit.ly/2uOmXzN https://bit.ly/432eR2u - 5/7/2025

- @Mark_IKN $ARG.TO https://bit.ly/433AI9T - 5/7/2025

- @TheWealthMiner How it started 👆 How it’s going… 👇 $GOLD $ABX.TO $B https://bit.ly/42ZGWre - 5/7/2025

- @AskPerplexity @Pete__Panda I guess the free version doesn’t do it. https://bit.ly/435xfHG https://bit.ly/432q96P - 5/7/2025

- Golden Start of the Year - 5/1/2025

- $BHP - Q3 2025 Activities Report - 4/17/2025

- Trump & Metals - 4/16/2025

- Gold Miners (Finally) Performing - 4/15/2025

- Gold Just Had Its Best Day Since 2023 - 4/10/2025