Subscribe to MasterMetals

Search This Blog

February 25, 2025

To those who say you can’t have too much of a good thing…meet Cobalt

May 10, 2023

Top 20 #Copper Mines

March 31, 2022

The Motley Crew Behind #Nickel’s Big Squeeze

February 24, 2021

“I used to go with 500,000 pounds to London…” #Commodities Traders’ Long History of “Commissions” to Seal Deals

"In those days paying so-called "commissions" was both legal and even tax-deductible for a Swiss company…"

March 6, 2020

There Are 316 Men Leading #Commodities Houses and Only 14 Women - Bloomberg

See the whole report here : https://www.bloomberg.com/news/articles/2018-03-19/there-are-316-men-leading-top-commodity-houses-and-only-14-women

December 11, 2018

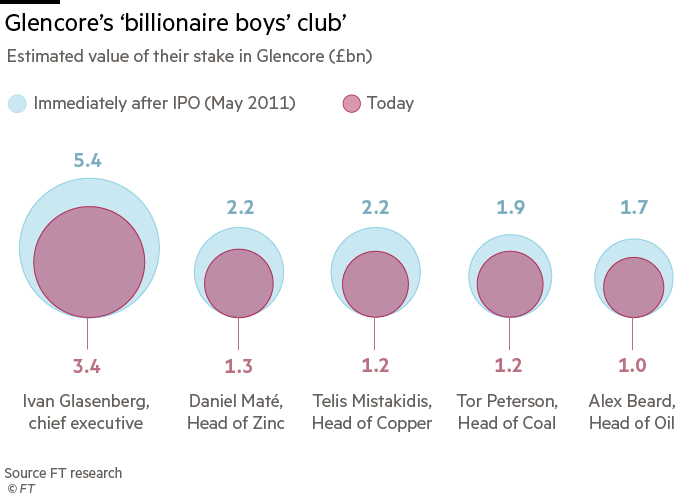

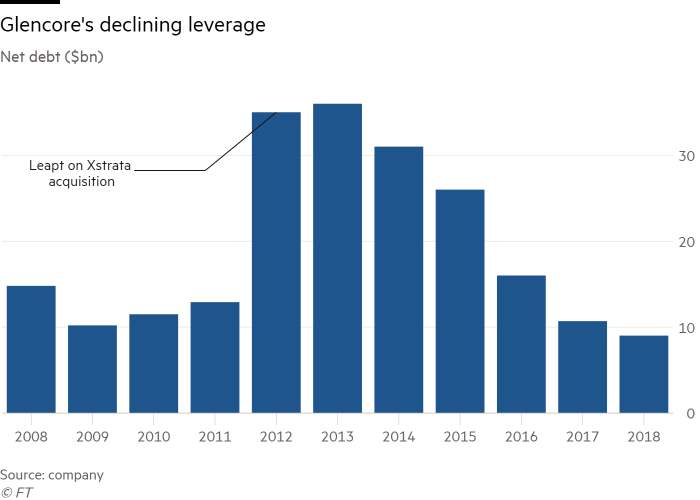

Impending retirement of #Glencore’s #copper chief Mistakidis marks start of generational shift at the world’s most powerful commodity trader

Departure of trader's head of copper signals break-up of 'billionaire boys' club'

March 31, 2014

The changing world of energy trading #MasterEnergy @PlattsOil

Banks involved in energy have pulled back from the sector while merchant

traders known largely for their secrecy are strengthening their

position

The changing world of energy commodity trading

The Barrel Blog

By Jeff Ryser | March 28, 2014 11:48 AM Comments (2)world of energy commodity trading has gone through a rather extensive

reshuffling over the past few months. The key thing to note is that

banks involved in energy have pulled back from the sector while merchant

traders known largely for their secrecy are strengthening their

position.

The most notable deal came last week when Swiss-based merchant firm Mercuria agreed to buy the entire physical commodity trading business of JPMorgan Chase

for $3.5 billion. Mercuria, which is headquartered in Geneva and is

predominantly a crude and refined products trading shop, has a team of

approximately 1,200 people working in some 37 offices around the globe

and has annual “turnover,” or essentially gross annual revenues of

around $100 billion.

JPMorgan, whose overall size is an

astounding $2.4 trillion in terms of the value of all its assets, had

valued the oil trading portion of the business it sold to Mercuria at

$1.7 billion. It valued its US and European natural gas trading business

at approximately $800 million, its metals business at $500 million and

its electricity and coal trading businesses at approximately $300

million, prior to the sale.

Mercuria therefore agreed to pay $200

million or so above book and will add JPMorgan physical assets, trading

books and contract to its already extensive trading portfolio.

Included

in the deal, apparently, is a trading team in London, New York, Houston

and Singapore that numbers more than 400 people. When JPMorgan bought

the trading operations of RBS Sempra in 2010 for $1.9 billion, it saw

its trading staff balloon to almost 700 people. It spent several years

bringing that staffing level down to a more manageable level.

Now,

Mercuria, founded by Swiss nationals Marco Dunand and Daniel Jaggi in

2004, will begin the task of integrating the various JPMorgan trading

teams with its own teams. Also now under discussion, according to

JPMorgan, is the future role at Mercuria, if any, of Blythe Masters, the

45 year-old British-born global head of JPMorgan’s commodities unit.

Dunand

and Jaggi have both spoken recently, and publicly (at places like

Davos), acknowledging the fact that the merchants’ penchant for secrecy

runs counter to the push by governments to instill far greater trading

transparency. With its deal to buy JPMorgan, Mercuria, for example, will

have to report physical US natural gas sales to the Federal Energy

Regulatory Commission. Its US affiliate already reports its quarterly US

wholesale power sales to FERC.

Mercuria’s vision of its business model is fairly clear. In a recent interview with the newspaper Neue Zurcher Zeitung,

Dunand offered that there are “two schools” for commodity trading. He

said, “One is the Marc Rich school, with Glencore and Trafigura, which

is obviously successful. And then there is the investment bank school,

which has more of a risk approach.”

Marc Rich, of course, is the

legendary commodities trader who, while working for Philipp Brothers in

the late 1960’s and early 1970’s essentially created the spot market for

crude, thereby breaking the hold over the market that big oil companies

had using long-term supply contracts with supplier countries.

The

key idea behind March Rich-style trading is to have access to your own

logistics, such as shipping and storage, and to strike deals with big

bulk buyers. The merchants are also not subject to Dodd-Frank trading

restrictions, as are the banks.

On the other hand, the investment

bank school of trading implies a far greater dependence on the

financial markets to not only hedge positions but also to hedge

positions for fee-paying clients. When trading for their own book–which

banks will be prohibited from doing when the so-called Volcker rule is

implemented in mid-2015–the investment banks rely heavily upon churn, or

buying and selling and re-buying and re-selling, to generate revenue

from large volumes of trading. This activity also provides markets with

liquidity.

Joining Glencore, Trafigura, and Mercuria as exemplars of the Rich school of commodity trading are Gunvor and Vitol.

On

Monday, the head of Vitol, Ian Taylor, made a comment on the impact of

the banks leaving the energy commodities trading business. He said, “The

withdrawal of some investment banks from commodity related activities

has reduced liquidity in markets such as power.” This is no doubt true,

since the pull-back by the banks has been most pronounced in the

wholesale power trading business due in no small part to tightened

regulations and lower prices and thus dampened price volatility.

It

was Taylor’s next comment, though, that also caught some people’s

attention. He said that the reduced liquidity “created longer-term

opportunities and our footprint in both the US and Europe is growing.”

Taylor

conceded that 2013 was “a very challenging year for many in the

physical energy distribution business.”” He said that “markets remained

extremely competitive with new entrants increasing margin pressure on

certain regional activity.” “While these market conditions aren’t

expected to change overnight, changing supply and demand balances are

generating some new opportunities,” Taylor said.

Meanwhile,

Barclays PLC and Deutsche Bank are understood to be selling their power

trading books, as the big UK and German banks announced they are exiting

the business.

While Citibank has been trying to strengthen its

trading in Europe and the US, Bank of America Merrill Lynch, strong in

the US, has shutdown European natural gas and power trading.

Morgan

Stanley, of course, is in the process of selling its Global Oil

Merchant unit to the Russian oil company Rosneft, for an undisclosed sum

that is nonetheless estimated to be in the range of $400 million.

Roughly 100 Morgan trading executives are expected to go to work for

Rosneft in London and New York, or about a third of Morgan’s entire

global commodity trading team. Rosneft earlier established a trading

unit in Geneva that is headed up by a former Shell trader.

One

question that has popped up is whether there are any future US or

European sanctions in the offing against Rosneft chief Igor Sechin, and

whether such sanctions could hurt the deal with Morgan Stanley. The US

and the EU have already leveled sanctions against individuals in

retaliation for Russian President Vladimir Putin’s move into Crimea.

Sechin is a former chief of staff to Putin and was appointed head of

Rosneft by Putin in 2004.

On March 20 the US sanctioned the

Russian Gennady Timchenko, who was co-founder of Gunvor. The

Geneva-based firm said that the day before the sanctions were announced,

Timchenko sold his shares in the firm to Swedish co-founder Torborn

Tornqvist, who now owns 87% of the 14 year-old company. Gunvor, mainly

an oil and products trader, employs approximately 500 front and back

office trading professionals and 1,100 people at logistical facilities,

has said that revenue in 2012 was roughly $93 billion.

The US

Treasury Department said it imposed the sanctions against Timchenko out

of the belief that Russian president Vladimir Putin had earlier

invested in Gunvor and “may have access to Gunvor funds,” an assertion

that Gunvor denied.

The changing world of energy commodity trading « The Barrel Blog

The MasterMetals Blog

February 2, 2012

Glencore and Xstrata close to $80bn merger

Glencore and Xstrata close to $80bn merger

Financial Times, 8:20am Thursday February 2nd, 2012

--

By Javier Blas, Commodities Editor

--

Glencore and Xstrata are in advanced talks for a nearly $80bn merger that could reshape the mining industry

Read the full article at: http://www.ft.com/cms/s/0/a672e172-4d6c-11e1-b96c-00144feabdc0.html

October 13, 2011

Bakries in refinancing talks with Glencore

Financial Times, 1:55pm Thursday October 13th, 2011

Bakries in refinancing talks with Glencore

--

By Javier Blas in New York and Anthony Deutsch in Jakarta

--

Two of the world's largest commodities trading houses are in negotiations to loan hundreds of millions of dollars to Indonesia's influential Bakrie family to help refinance a $1.35bn loan to Credit Suisse and several hedge funds

Read the full article at: http://on.ft.com/ojUaNW

May 19, 2011

Glencore gets off to a Rocky Start

The banks underwriting the initial public offering, led by Citigroup, Credit Suisse and Morgan Stanley, supported Glencore’s shares in the last five minutes of trading to prevent the price dropping below the 530p level.[...]Glencore’s stock market debut left investors who had hoped for a big first day rally unimpressed, after the shares closed at the offer price of 530p. [...]Following the issue of nearly $9bn worth of new shares, including an overallotment option, the enlarged company will have a market capitalisation of $62bn

Glencore’s advisers had hoped that the shares could rally by 5 to 10 per cent on Thursday after the$11bn IPO was more than four times subscribed. [...]

“If you are genuinely four or five times oversubscribed, why is the share price flat?”

Bankers had hoped that a strong initial performance from Glencore would hearten investors and reinvigorate the sluggish market for European IPOs. [ So much for that...!]

FT.com / Commodities - Glencore debut underwhelms investors

The MasterMetals Blog

May 4, 2011

Glencore lists fraud, criminal case among IPO risks - Yahoo! Finance

Glencore lists fraud, criminal case among IPO risks

By Clara Ferreira-Marques and Quentin Webb

LONDON (Reuters) - Commodity trader Glencore, set to list this month in one of London's largest-ever offerings, has detailed its involvement in a Belgian criminal probe as it outlines risks to investors, including fraud and corruption.

Glencore said in a prospectus on Wednesday, ahead of its planned $11 billion listing, that its subsidiary Glencore Grain Rotterdam, a former employee and a current employee had been charged in a criminal case in Belgium.

Glencore said the criminal investigation was probing a public official, the European Commission's Directorate General for Agriculture and others for "violation of professional secrecy, corruption of an international civil servant and criminal conspiracy."

Glencore's unit and its current and former employees have been charged with having committed corruption in exchange for information on European export subsidies, it added.

The case was initiated in 2003, with co-operation from Dutch and French police, and covers facts dating from 1999 to 2003.

Commission agriculture spokesman Roger Waite confirmed that the EU executive expected a trial into alleged corruption by former agriculture department official Karel Brus.

Brus, a Dutch national, is accused of having passed confidential information relating to EU export subsidy application decisions to a French farming lobbyist between 1999 and 2003.

"As far as the Commission is concerned, we cannot comment further on an ongoing investigation," Waite said.

Glencore declined to comment on the case beyond details included in the prospectus. It says it is not involved in legal proceedings which could have a material impact on its profits.

Belgium's federal prosecutor confirmed on Wednesday that there is a criminal case against Glencore but declined to comment further. The case will be heard in Brussels on May 12.

The Commission, the European Union's executive arm, has become a civil party to the case, Glencore said.

FRAUD RISK

Glencore also listed in its prospectus over 30 other risks to the broader company, its marketing and trading operations.

The formerly publicity-averse trader and miner operates around the world and says its willingness to move into riskier countries in Eastern Europe, Central Africa and South America before rivals gives it a "first-mover advantage."

Companies typically outline a vast number of risks to future performance in the run-up to a listing, in order to satisfy requirements to provide a full picture for future investors.

Glencore, however, detailed more than many, with risks including declines in demand for commodities, geopolitical risk and the risk it may not be able to retain key employees.

It also raised the risk of fraud and corruption, "both internally and externally."

"Glencore's marketing operations are large in scale, which may make fraudulent or accidental transactions difficult to detect. In addition, some of Glencore's industrial activities are located in countries where corruption is generally understood to exist," the company said.

Glencore said it has internal controls, external due diligence and compliance policies.

May 2, 2011

Glencore has bigger risk appetite than Wall St banks

Glencore has bigger risk appetite than Wall St banks

By Javier Blas in London

Published: May 2 2011 22:35 | Last updated: May 2 2011 22:35

Glencore’s appetite for risk in commodities trading is bigger than that of leading Wall Street banks, according to information released by the banks underwriting the trading house’s multibillion-dollar flotation.

The banks’ reports in advance of Glencore’s initial public offering shed new light on the financial activities of the world’s largest commodities traders. Glencore’s risk appetite will be an important factor for investors weighing this month’s offering in London and Hong Kong.

The research reveals that Glencore could have lost a daily $42.5m last year on average when measured by the so-called “value-at-risk” measure, much more than the average $25.7m put at risk each day in 2010 in commodities trading by Goldman Sachs, Morgan Stanley, Barclays Capital and JPMorgan.

The four banks are the largest commodities dealers by revenues in the financial sector.

Daily value-at-risk (VAR) is a common industry yardstick used to measure potential losses. The gauge has its critics, as it measures potential losses on regular trading days, but does not capture unusual trading situations such as during a war or in a crisis.

Glencore told the nine banks behind its IPO syndicate that it had a $100m limit on VAR, but added that it had not exceeded that limit since at least January 2008.

The trading house’s VAR fell to $26.4m in 2009 after peaking in 2008 at $50.1m.

The higher risk-taking by Glencore is partly explained by the physical nature of its business, which makes price hedging difficult.

For example, it trades a large amount of Russian oil, but hedging instruments such as Brent and West Texas Intermediate futures reflect the cost of crude in Europe and the US.

The physical nature of the trading implies that Glencore’s VAR starts from a base of about $25m-$30m, according to people familiar with the trading house.

But the higher figure also reflects the fact that Glencore does speculate in the market from time to time.

“Price exposures are normally hedged,” Ephrem Ravi, lead analyst on Morgan Stanley’s report, wrote in a note for investors.

He added: “Nevertheless, the company sometimes engages in deliberate price exposures to leverage on the insight it has into certain commodity markets.”

Olivia Ker, lead analyst for UBS, cautioned that, although Glencore had a limit of $100m for its daily VAR, the company had not explained how it responded when it sustained a loss.

“If it is in the habit of reducing risk after a loss, then we can be confident that risk is well controlled,” Ms Ker wrote. “But, if Glencore is in the habit of sticking with exposure after a loss to back the original trade, then the risks are that larger losses may accrue over a period of days.”

The Swiss-based company is aiming to sell a stake of 15-20 per cent, worth up to $12.1bn.

The company is set to issue its prospectus, providing detailed information about its activities, later this week.

April 15, 2011

More on the Glencore trading empire

Glencore trading empire unveiled

--

By Javier Blas in London

--

Rivals fear growing financial muscle of group heading for london and HK listing and its influence on prices

Read the full article at: http://www.ft.com/cms/s/0/6d347810-66bf-11e0-8d88-00144feab49a.html?ftcamp=rss

April 14, 2011

Glencore Versus Goldman - NYTimes.com

Short term yes, mid-long term, the commodity bull market still has some years ahead. If anything more like 1997, than 1999, when people were alredy calling the top in tech boom/bubble after doubling in 2 years, only to see the market triple form there again!!

April 14, 2011, 10:23 am

Glencore Versus Goldman

By DEALBOOKBut how similar are the global commodities trader and the global investment bank?

They’re both stalwarts in their respective industries. They’re both highly secretive about their businesses. And they’re both have corporate structures with influential partnerships at their cores.

The financial profiles aren’t all that different, either.

Glencore’s public offering could value the company at $60 billion. Recently trading at $160 a share, Goldman had a market capitalization of roughly $87 billion.

Glencore has the edge on revenue, notching $145 billion in 2010, an increase of 36 percent over the prior year. Goldman reported revenue of $39 billion in 2010, falling 13 percent from 2009. But Goldman is more profitable with net income of $8.3 billion, compared with $3.8 billion at Glencore.

Perhaps the most striking similarity is the timing of their respective initial public offerings. Glencore and Goldman both picked opportune moments to go public — that is when the market offered the best potential for peak pricing.

Goldman went public in May 1999. It was the middle of the dot-com boom when financial firms were generating enormous fees and profits from taking technology companies and other upstarts public.

The investment bank raised $3.7 billion from its I.P.O., then the second-largest debut ever after Conoco’s offering in 1998. Shares of Goldman jumped 33 percent on the first day of trading, to close at more than $70. The bubble burst a year later, and Goldman’s stock stumbled in the bear market that followed.

Glencore’s offering, which is expected to take place in May, comes when gold, metals and the like are booming. And it is a commodities bull market, as Goldman recently said, that may be nearing its end.

-Glencore Versus Goldman - NYTimes.com

Glencore Versus Goldman - NYTimes.com: "- Sent using Google Toolbar"

-- The MasterFeeds

April 11, 2011

Glencore listing

Glencore says listing will boost firepower

By Javier Blas in Baar, Switzerland

Published: April 10 2011 22:09 | Last updated: April 10 2011 22:09

| Ivan Glasenberg, chief executive, said it would make sense to combine with Xstrata |

Ivan Glasenberg has broken a decade-long silence ahead of the launch of Glencore'sinitial public offering this week, saying that the flotation will give the world's top commodities trader the financial firepower it needs as consolidation gathers pace.

Mr Glasenberg told the Financial Times that the launch of the offering – the largest ever in London – was "imminent" after it received robust support from big institutional investors. Glencore plans to sell a 20 per cent stake worth about $10bn-$12bn, valuing the whole company at around $60bn, bankers said.

"The interest from the cornerstones was a lot stronger than we envisaged," Mr Glasenberg said. "Markets are in our favour too. We have a strong commodities market."Bankers close to the deal said the intention-to-float document will be filed on Thursday, although Mr Glasenberg declined to specify the day.

The company's chief executive mapped out a strategy of "opportunistic" acquisitions at a much larger scale than in the past and said it would make sense to combine with Xstrata, the London-based miner in which the trader owns a 34 per cent stake.

"We believe there is good value in the two companies being together," he said, but insisted that a deal was not on the table.

"Why has that not happened? It is a value debate. Xstrata . . . seems more comfortable for Glencore to go public and get a market price before they may or may not enter into discussions," he said.

Mr Glasenberg explained that having the flow of Xstrata's commodities production within the Glencore trading system was "advantageous" to both companies.

"There are a lot of benefits and synergies to put the two companies together," he said.

The flotation will move Glencore, run from a nondescript Swiss building, further from its origins under Marc Rich, the oil trader who was indicted for tax evasion in the US and pardoned by President Bill Clinton on his last day in the White House.

While insisting that Glencore would be disciplined and opportunistic, Mr Glasenberg said it could use its shares as currency to buy larger assets.

"We will get firepower and we can buy assets when opportunities present themselves in areas and sizes that we could not do before," he said, adding that Glencore could attempt purchases of $4bn-$5bn, up from $1bn-$2bn now. He said Louis Dreyfus, the family owned trader looking for a sale or IPO, would be a good complement for Glencore.

The trading house's IPO will be the third largest in history in Europe, only after the offerings of Deutsche Telekon and Enel of Italy in the late 1990, making it the deal of the year, bankers said.

The flotation will trigger massive gains for the 485 senior employees who own shares. But, in his first interview since becoming head of Glencore in 2002, Mr Glasenberg vehemently denied that the IPO marked the staff's cashing in at the top of the commodities cycle, saying that top employees will be locked in for up to five years. Mr Glasenberg said he was the largest shareholder, but declined to disclose his exact stake. He said he would not sell shares as long he worked in Glencore and added: "I have not intention to retire anytime soon."

He also insisted that being a public company would not alter Glencore's search for long-term returns. Over the past 10 years, it has delivered returns on equity of 38 per cent per year. "We will continue to be major shareholders of this company, and we are going to run this company to make maximum profits and maximum returns for our investors – including ourselves," he said.

"We are going to try to make maximum money for ourselves and investors could coat tail with us."

Glencore main advisors on the IPO are Morgan Stanley, Citigroup, Credit Suisse, Deloitte and Linklaters. BNP Paribas, Société Générale, Bank of America-Merill Lynch, Barclays Capital, UBS and Liberum Capital will also participate on the sale.

Copyright The Financial Times Limited 2011.