Subscribe to MasterMetals

Search This Blog

April 14, 2025

April 9, 2025

Gold Just Had Its Best Day Since 2023

Market Updates

News

Gold prices, which had tumbled from record highs over the past week, reversed course and rose roughly 3% today, the biggest percentage jump since October 2023.

Spot gold was up 3.4% at $3,085.50/ounce. At $88.10 a troy ounce, gold futures' daily gain was the precious metal's largest in dollar terms since March 24, 2020, when markets were being convulsed by Covid lockdown orders and investors were fleeing into the haven asset.

Today's move came amid a bond market rout overnight and in the morning, followed by a historic surge in stock prices in the afternoon after President Trump’s reversal authorizing a 90-day pause on new tariffs for many countries—except for China which got hit with a 125% rate, effective immediately.

Silver gained 3.1% to $30.80/oz., Platinum slipped 1.2% to $931.87, and Palladium was up 1.9% at $923.75

U.S.-listed shares of South African miners: Gold Fields GFI up 7.5%, AngloGold Ashanti

AU rises 8.9%, Harmony Gold

HAR jumps 13.8% and Sibanye Stillwater SW.N> soars nearly 19%

Shares of Canadian miners: Kinross Gold K and Agnico Eagle Mines

AEM up 7.6% and 4.5%, respectively.

March 25, 2025

Gold rally finally attracts investors back to mining stocks after months of outflows

According to LSEG Lipper data, funds investing in physical gold and gold derivatives attracted a net $17.8 billion in 2024, the highest in five years, while funds investing in gold miners lost a net $4.6 billion, the most in a decade.

Gold mining Funds saw their first net monthly inflow in six months in March, attracting $555.3 million, the highest since November 2023, according to Lipper data.

The Gold ETF's have seen continued interest all around the world:

Global Inflows: Gold ETFs have seen significant inflows in 2025, with a total of

February 6, 2025

Gold Miners waking up!

Nice day for the larger miners -- large cap no longer applies to these minnows... the biggest, $NEM & $AEM @ ±USD50BN each, are still worth less than what the mag 7 lose in a day... pic.twitter.com/1v3bDAVNfg

— MasterMetals (@MasterMetals) February 6, 2025

____________________________________________________Break out spreading out among the Gold producers—even $SSRM. Can’t really say the same for $BTG… $AAUC.TO $AEM $LUG.TO $FVI.TO $FSM $EQX $MKO.V $CXB.TO $GMIN.TO $SKE.TO pic.twitter.com/M9ZMsbLdEn

— MasterMetals (@MasterMetals) February 5, 2025

July 8, 2021

#Gold - #GoldenCross at hand?

This is called a golden cross. The golden cross is a technical chart pattern indicating the potential for a major rally.

The MACD (lower chart) is very oversold and crossing the red line. This supports higher prices. The Relative Strength (RSI) (upper chart) is also pointing higher.

There's a feeling that the gold price is currently being held back by silver prices, as the July silver futures contract is in the delivery month and the open interest, which is high, indicates holders of the contracts are demanding delivery. 😥

May 17, 2021

#GOLD: Getting ready to break out —UPDATED! $GLD

December 13, 2020

#Gold’s recent sell off had less to do with fundamentals, and everything to do with clearing out the “jokers” who wanted to take delivery of their December Gold Contracts.

#Gold - Some #TechnicalAnalysis on the Current State of the Market

Gold futures prices (paper gold) were able to cross on the upside the 200-day moving average (pink line). It all looks like the low of around US$ 1'760 per ounce may just have been an aberration and the result of technical selling by the Powers That Be, aka the PPT. It had nothing to do with fundamentals, and everything to do with clearing out all the jokers who wanted to take delivery of their December Gold Contracts. The MACD turned positive as it crossed the red line.

What is needed now is a consolidation period in the next few weeks before year end, at which time Gold always outperforms?

Only B2Gold (BTO) is selling at a premium, while Lundin Gold (LUG), Pretium Resources(PVG) and Kirkland Lake Gold (KL) are close to neutral. All the rest are selling at a discount, and some at a heavy discount. The red figure represents the average, currently close to a 20% discount.

PG=Premier Gold,

AR=Argonaut Gold,

OGC=Oceana Gold,

KNT=K92 Mining,

TXG=Torex Gold,

GAU=Galiano Gold,

NGD=New Gold,

CG=Centerra Gold,

SSRM=SSR Mining,

EQX=Equinox Gold,

DPM=Dundee Precious Metals,

AGI=Alamos Gold,

GSS=Golden Star Resources.

The upper percentage figure is historically the high, and the lower percentage figure historically the lower level of trading in relation to the spot gold price. The blue diamond is the current status.

(Source Scotiabank)

Attachment 5 displays the holdings.

Attachment 5 displays the holdings.It should always be remembered that at the heart of any successful strategy, is to buy low and sell high. Currently, we’re still in the Buy Low point of this Precious Metals Bull Market.

____________________________________________________

June 22, 2020

Will #Gold #miners struggle to maintain 2019 production levels?

Prior to the coronavirus outbreak, peak gold supply was becoming a real possibility. Now, with exploration programs halted or cancelled and project disruptions hampering production, will Gold miners struggle to maintain 2019 production levels, as Wood Mac says?

May 18, 2020

Is #Gold Setting Itself Up For A Fall? #HeadAndShoulders? $GLD

May 14, 2020

April 9, 2020

#Gold looking to go into this holiday weekend with a strong push above $1700

____________________________________________________

MasterMetals

@MasterMetals

March 12, 2020

#Gold has given back most of 2020's gains, still much better than the $SPX...

March 4, 2020

After the Fed's 0.50% rate cut, #Gold remains strong.

bit.ly/MasterMetalsCharts

____________________________________________________

MasterMetals

@MasterMetals

March 2, 2020

#Gold's Slump Unlikely to Signal End of Rally

We've been here before. In 2008 Gold dropped before marching higher to record $1920/oz three years later.

Gold's Swoon Echoes Financial Crisis Blip

The conditions are still there for an extended rally.

In times of coronavirus panic, even havens can be unreliable.

Gold closed off February on a tarnished note, ending last week with its steepest daily decline since 2013. As financial markets panicked over the spread of the pneumonia-like illness, stocks tumbled and dragged gold and other precious metals lower. That's a rare phenomenon for a metal that tends to shine brighter when everything else looks gloomy. It will also be a brief one.

Back in 2008, spot gold fell by more than a quarter between July and late October, before embarking on an unprecedented run toward $1,900 an ounce, once global rate cuts began in earnest.

#Gold recovering from Friday’s sell-off this AM. #MasterMetals #Charts $GLD

bit.ly/MasterMetalsCharts … $GLD

____________________________________________________

MasterMetals

@MasterMetals

February 28, 2020

#Gold getting slammed.

bit.ly/MasterMetalsCharts

February 6, 2020

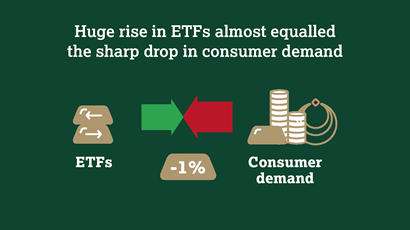

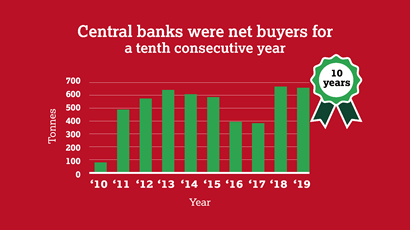

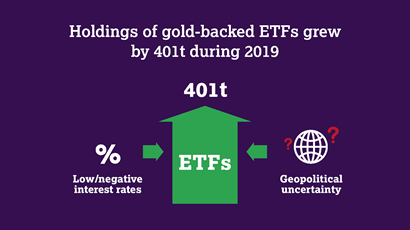

As #Gold prices rose in 2019, investors jumped into #ETF’s | World @GoldCouncil

Highlights

Annual gold demand in 2019 dips 1% to 4,355.7t

January 15, 2020

"Ratio of share price-to-free cash flow among senior #Gold #Miners...still hasn’t caught up to the gold price...more room to run" for #miningstocks $GDX $GLD

MasterMetals

@MasterMetals

January 12, 2020

#Gold & #Silver Bull Market Full Steam Ahead- even with the latest pullback!

This was originally set to be published on Jan. 6, 2020

ShareThis

MasterMetals’ Tweets

- #Gold: SPDR Gold Shares ETF $GLD dropped by 1.4803%! Last at 310.81 #MasterMetals #GLD https://bit.ly/39s7ZgS https://bit.ly/43btkt5 - 5/7/2025

- #Silver: iShares Silver Trust $SLV DOWN 2.4322%! Last at $29.485 on May 7, 2025 at 02:00AM. https://bit.ly/2uOmXzN https://bit.ly/432eR2u - 5/7/2025

- @Mark_IKN $ARG.TO https://bit.ly/433AI9T - 5/7/2025

- @TheWealthMiner How it started 👆 How it’s going… 👇 $GOLD $ABX.TO $B https://bit.ly/42ZGWre - 5/7/2025

- @AskPerplexity @Pete__Panda I guess the free version doesn’t do it. https://bit.ly/435xfHG https://bit.ly/432q96P - 5/7/2025

- Golden Start of the Year - 5/1/2025

- $BHP - Q3 2025 Activities Report - 4/17/2025

- Trump & Metals - 4/16/2025

- Gold Miners (Finally) Performing - 4/15/2025

- Gold Just Had Its Best Day Since 2023 - 4/10/2025