Despite bullish forecasts - especially with accelerating production of #EV's electric vehicles -- lithium may have a funding problem.

Banks are wary, citing everything from the industry's poor track record on delivering earlier projects to a lack of insight into a small, opaque market.

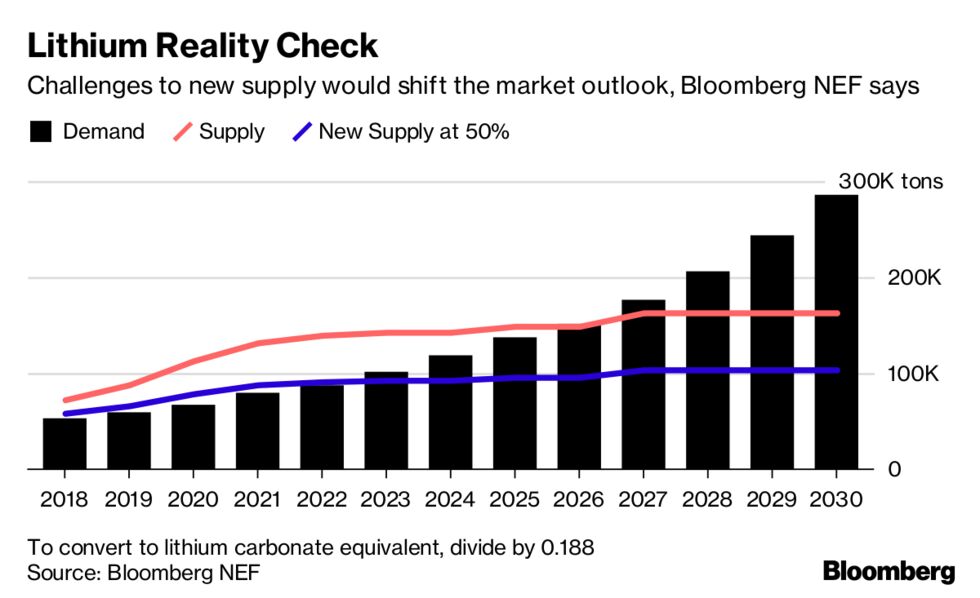

Without more investment, supplies of the commodity could remain tight, sustaining a boom that already has seen prices triple since 2015.

Lithium companies will need to invest about $12 billion to increase output fivefold by 2025 and keep pace with the world's growing appetite for batteries, according to Galaxy Resources Ltd., an Australian producer seeking to build further operations in Argentina and Canada.

Developers say that, so far, projects aren't getting financed fast enough to achieve that leap.

Lithium's Top Challenge Is Finding Funds, Not the Battery Metal

Battery producers and automakers "have absolutely no clue on how long it takes to be able to put a mining project into operation," said Guy Bourassa, chief executive officer of Nemaska Lithium Inc., which spent about 18 months piecing together a complex C$1.1 billion ($830 million) funding program for a mine and processing plant in Quebec. "There will be a big problem -- it's going to be an impediment" to raising supply, he said.