Despite bullish forecasts - especially with accelerating production of #EV's electric vehicles -- lithium may have a funding problem.

Banks are wary, citing everything from the industry's poor track record on delivering earlier projects to a lack of insight into a small, opaque market.

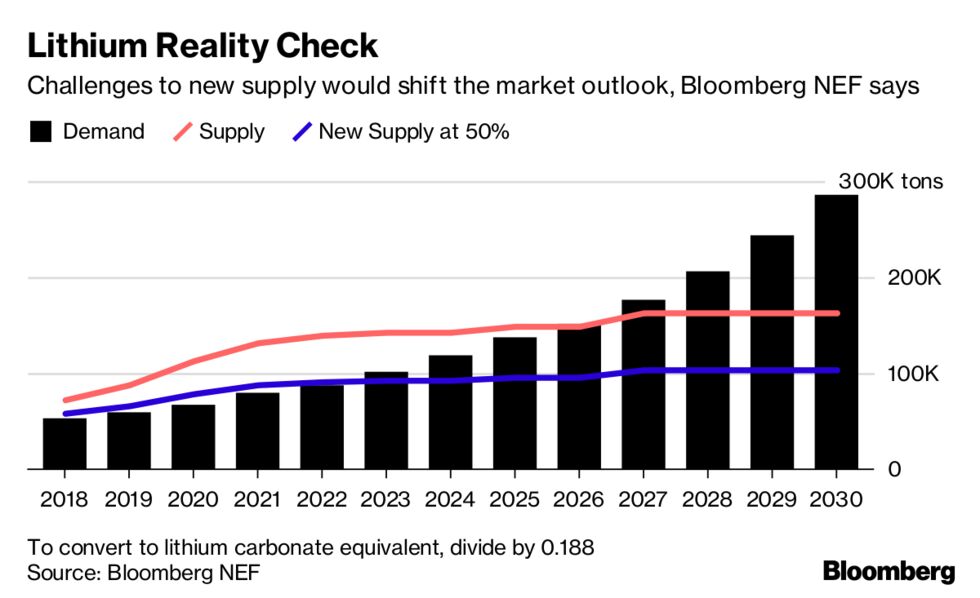

Without more investment, supplies of the commodity could remain tight, sustaining a boom that already has seen prices triple since 2015.

Lithium companies will need to invest about $12 billion to increase output fivefold by 2025 and keep pace with the world's growing appetite for batteries, according to Galaxy Resources Ltd., an Australian producer seeking to build further operations in Argentina and Canada.

Developers say that, so far, projects aren't getting financed fast enough to achieve that leap.

Lithium's Top Challenge Is Finding Funds, Not the Battery Metal

Battery producers and automakers "have absolutely no clue on how long it takes to be able to put a mining project into operation," said Guy Bourassa, chief executive officer of Nemaska Lithium Inc., which spent about 18 months piecing together a complex C$1.1 billion ($830 million) funding program for a mine and processing plant in Quebec. "There will be a big problem -- it's going to be an impediment" to raising supply, he said.

...

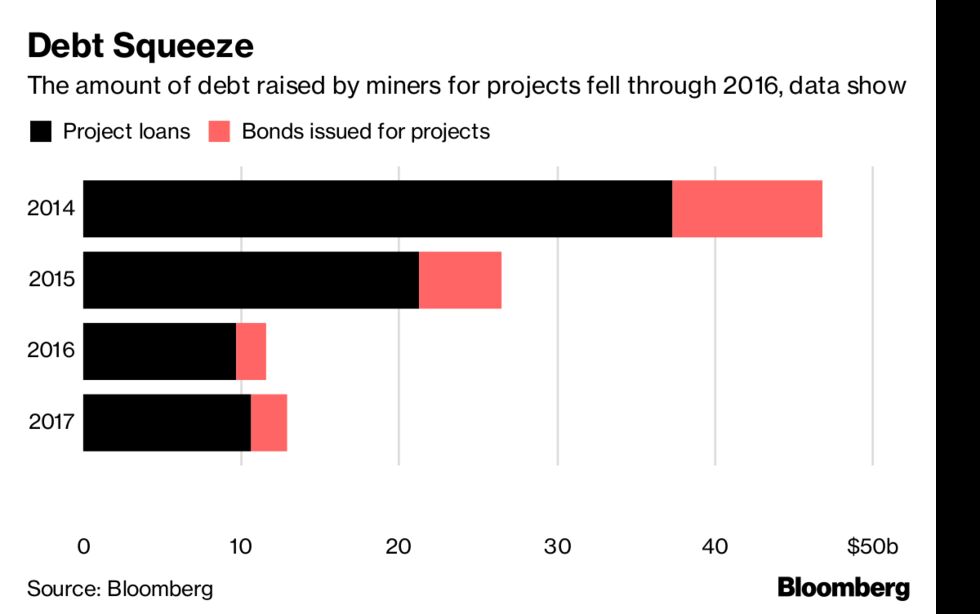

While the amount of debt raised by miners, including loans and bonds, rose in 2017 to about $255 billion, project-specific financing of about $13 billion last year is more than 70 percent lower than in 2014, according to data compiled by Bloomberg. So far this year, about $6.1 billion in total has been issued for projects.

There's also concern about pricing. ..exacerbated by the opaque nature of the market, the inability to hedge and forecast oversupply in the medium term, and the small scale of some of the local players," the bank said in a statement.

It typically takes two years to build a lithium operation and five years to repay the project loan, according to Simon Price, a partner and co-founder at Perth-based Azure Capital Ltd., which has advised miners on financing. That means lenders need confidence in a seven-year outlook for the market, he said.

That price outlook is an industry flash-point. Morgan Stanley says there will be a surplus as soon as next year because of rising output and forecasts lithium carbonate prices to halve through 2021, according to a note. Citigroup Inc. also expects prices to decline as production increases.

But boosting supplies may not be easy. By 2020, it's possible that only a third of planned new capacity will be available at the processing plants needed to convert mined raw materials into battery chemicals, Orocobre says.

Lithium demand is also being underestimated, according to Pilbara Minerals Ltd., a producer starting a mine in Australia.

Pilbara Minerals Ltd.'s Pilgangoora mine site, Western Australia in June 2018.

Photographer: Reid Smith/Pilbara Minerals Ltd.

Some alternative funding sources for lithium have emerged, including hedge funds offering higher-yield debt or credit funds formed to lend to projects. They're more expensive, but "you build your project and you are in business now when the market is very strong," Price said. The sector's biggest players are readying an IPO blitz, in part to fund expansions.

Lithium users also are stepping in with funding. Posco, the South Korean steelmaker that's ramping up its battery-making business, and Great Wall Motor Co., China's top SUV producer, have both invested in Pilbara Minerals to speed up project development. Tesla Inc. in May signed a supply deal with Kidman Resources Ltd., a boon for the Australian developer as it seeks to finance a mine and plant.

Supply deals and investments with end customers mean lithium projects are being financed differently from traditional commodities, according to Westpac Institutional Bank, a unit of Australia's second-biggest lender.

Some banks are lending. Perth-based Galaxy last year secured a $40 million general purpose debt facility with BNP Paribas SA.

...

Volkswagen AG alone plans to spend about 50 billion euros ($58 billion) on batteries as it seeks to build electric versions of 300 models. "Imagine how many tons of lithium salts it takes to make those batteries," Bourassa said.

.jpg)

No comments:

Post a Comment

Commented on MasterMetals