MasterMetals

@MasterMetals

This is called a golden cross. The golden cross is a technical chart pattern indicating the potential for a major rally.

The MACD (lower chart) is very oversold and crossing the red line. This supports higher prices. The Relative Strength (RSI) (upper chart) is also pointing higher.

There's a feeling that the gold price is currently being held back by silver prices, as the July silver futures contract is in the delivery month and the open interest, which is high, indicates holders of the contracts are demanding delivery. 😥

Daily platinum futures chart with the recent strong advance.

Platinum has been the best performing precious metal so far this year. The metal has been underperforming for years on oversupply and suffering from Volkswagen's emission scandal and the subsequent phasing out of Diesel worldwide —as platinum is used extensively in the catalytic converters on vehicles powered by diesel engines.

A new element for platinum now in the market is U.S.President Joe Biden's "new green wave," considered bullish for platinum, as it is used for hydrogen fuel cells in the drive of heavy- and light-duty vehicles.

The market never waits until the last investor has seen all the details. The time to jump in is now!

A new study by Auctus Metals gives a lot of details regarding PGM's (Platinum Group Metals).

Attachment 2 shows the estimated platinum end-use in 2020 with the automotive sector consuming 30% of supply.

Attachment 2 shows the estimated platinum end-use in 2020 with the automotive sector consuming 30% of supply.

Attachment 3 indicates platinum estimated to be in deficit in 2020 due to COVID-19 and the Anglo American Platinum converter plant outage during the first two quarters of 2020 and additional closure announced in early November 2020 following a series of water leaks.

Attachment 3 indicates platinum estimated to be in deficit in 2020 due to COVID-19 and the Anglo American Platinum converter plant outage during the first two quarters of 2020 and additional closure announced in early November 2020 following a series of water leaks.

Attachment 4 displays a 5-year chart on platinum futures with the breakout on the upside in December 2020 at US$ 1'050 per ounce. Platinum is now in a long-term bull market.

A new element for platinum now in the market is U.S.President Joe Biden's "new green wave" is considered bullish for platinum as it is used for hydrogen fuel cells in the drive of heavy- and light-duty vehicles. The market never waits until the last investor has seen all the details.

https://bit.ly/MasterMetals

The main issue with the COMEX is that, on average, they allow sales of 200x daily production almost every day. The COMEX was setup to allow hedging of production. You know, you are a wheat farmer and you want to hedge your production. Well, for most commodities, this is 125% daily production. Yesterday, you saw price go up $2, then smacked down $2 on approximately NINE HUNDRED DAYS PRODUCTION "UP FOR SALE" IN A DAY.

Worldwide silver shortage. Bullion stores sold out for weeks, if not months. No one selling their product to them for spot price. Bullion priced $10-$13 over spot. Silver deficit of mine supply of 350 million ounces.

And of course, you expect to wake up at silver $2 less than a day before. Actually – I did, many of you did not. The price is actually in "contango", where the futures price the last time I checked is wayyyyy above spot. I know how they play this game. At issue here is the disconnect between the REAL physical price and the "paper" price.

When you see a contango like this, you can, in essence, sell a futures contract, then go to the spot market and buy silver. You can then deliver the product on the futures contract. This contango was $.75 a few minutes ago, per ounce. For a contract of $5,000 ounces, that is $3,750 you can pocket on this deal. Of issue, NO ONE will do this, because anyone trying to buy on the spot market may get months of delays to get product.

Yet, prices are falling because we obviously have all of this supply!!!

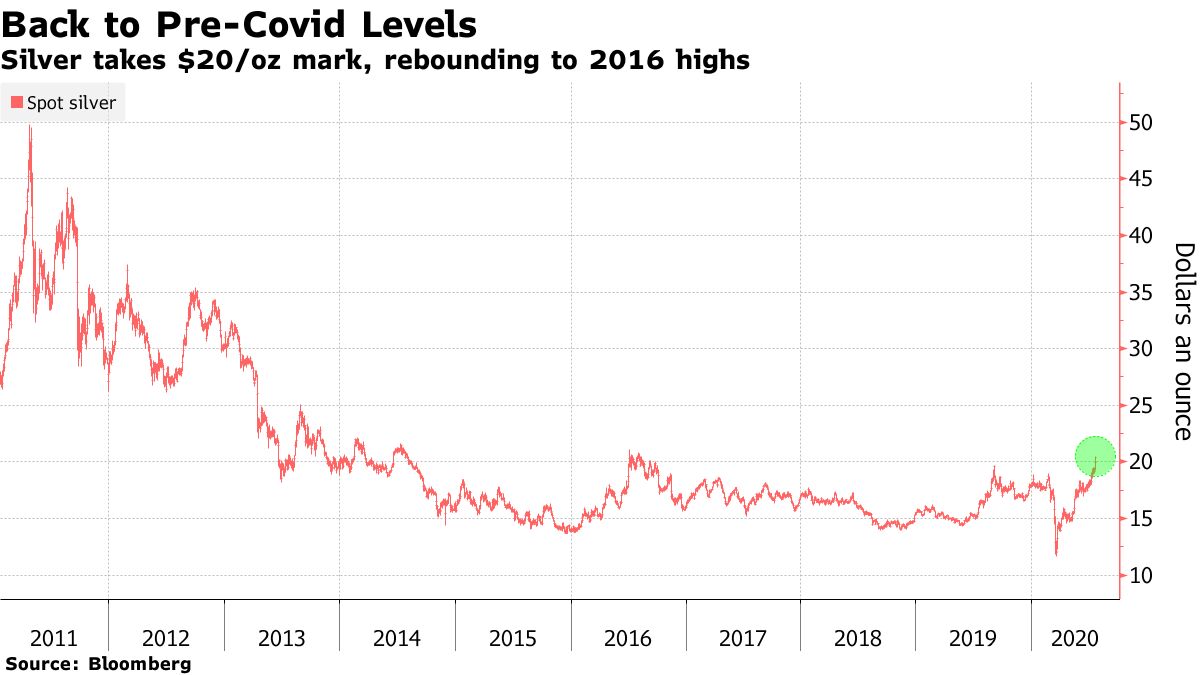

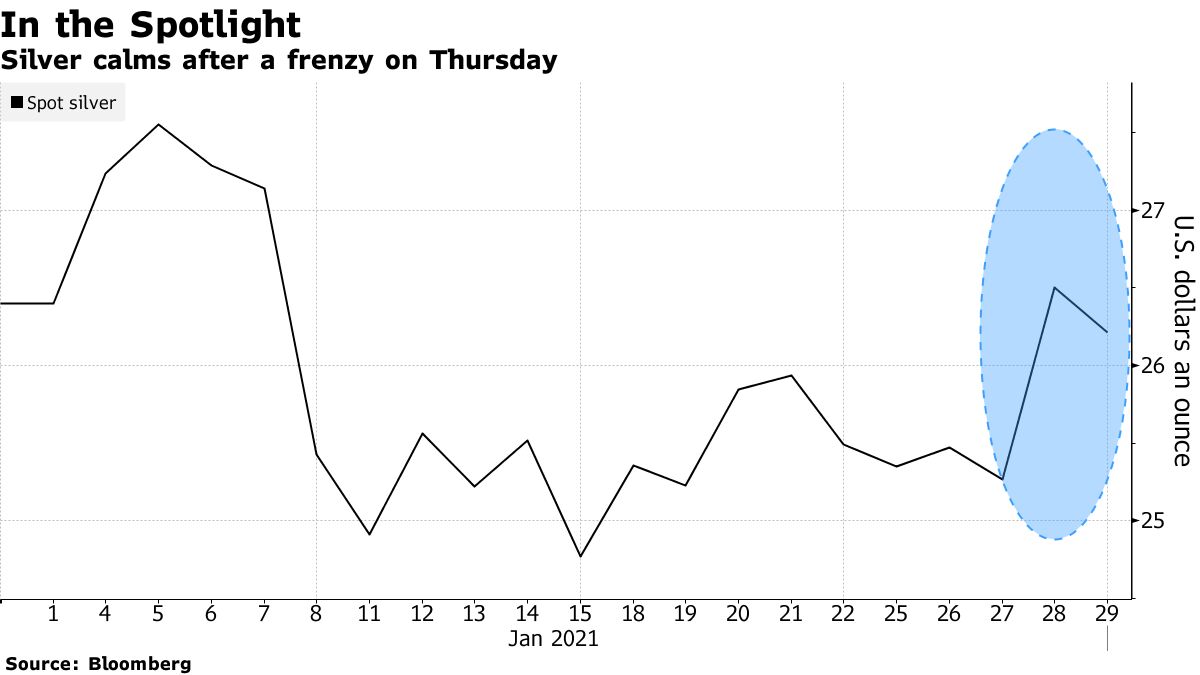

#Silver frenzy calmed on Friday as investors in miners' shares to ETF's and even the physical metal weigh whether a push by Reddit posters to create a short squeeze has legs. Silver has emerged as one of the latest targets of the r/wallstreetbets board

Posts encouraged people to pile into IShares Silver Trust, the largest silver exchange-traded fund, and one described it as "THE BIGGEST SHORT SQUEEZE IN THE WORLD".

"It is true that the combined efforts of those on the Reddit forums can dramatically influence the price of individual stocks, but if you compare the size of the entire silver market to the market cap of the individual companies that forums have recently targeted, we don't see this as having potential to significantly move silver into a short squeeze scenario," said John Feeney, business development manager at Guardian Vaults, a Sydney-based dealer.

"Silver's market cap is too large and those on the forums typically want to see quick gains, so I wouldn't read into it too much," he said.

| More on the silver market's volatile Thursday |

|---|

|

See the whole story on Bloomberg here: https://www.bloomberg.com/news/articles/2021-01-29/silver-seizes-the-spotlight-following-reddit-day-trader-frenzy?utm_campaign=socialflow-organic&cmpid%3D=socialflow-twitter-commodities&utm_source=twitter&utm_medium=social&utm_content=commodities&sref=VxHCy32x

ORENINC INDEX up as brokered activity surges again

ORENINC INDEX - Monday, September 7th 2020

North America's leading junior mining finance data provider

Last Week: 62.90

This week: 79.69

The Oreninc Index increased in the week ending September 4th, 2020 to 79.69 from 62.90 a week ago as brokered activity surged again.

On to the money:

Aggregate financings announced jumped to $135 million, a four-week high, which included nine brokered financings for $70.5 million, a two-week high, and two bought-deal financings for $52.5 million, a six-week high. The average offer size increased to $2.9 million, a two-week high, while the number of financings fell to 47.