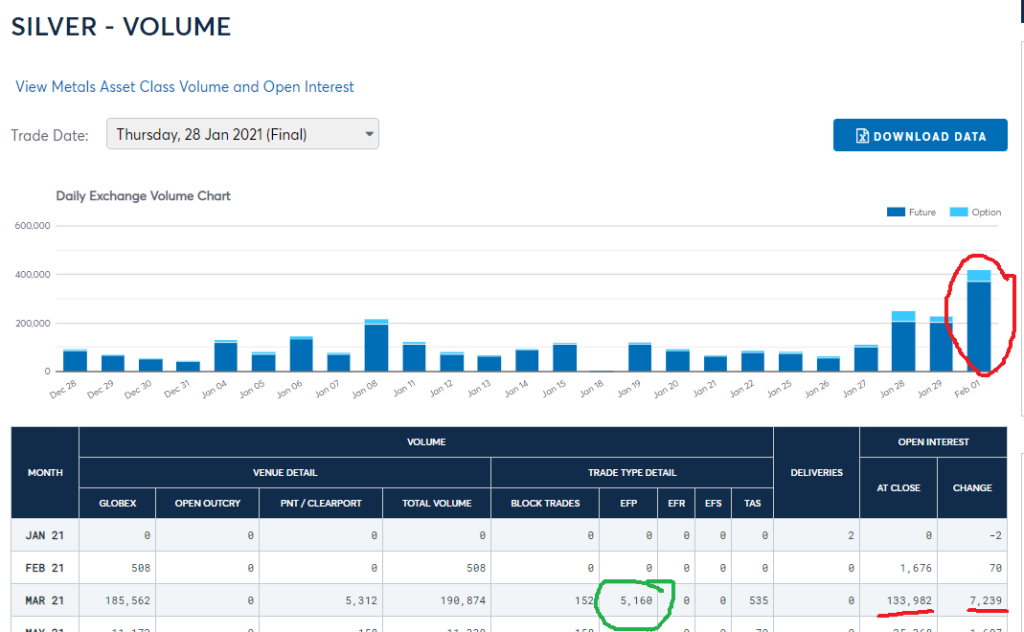

The main issue with the COMEX is that, on average, they allow sales of 200x daily production almost every day. The COMEX was setup to allow hedging of production. You know, you are a wheat farmer and you want to hedge your production. Well, for most commodities, this is 125% daily production. Yesterday, you saw price go up $2, then smacked down $2 on approximately NINE HUNDRED DAYS PRODUCTION "UP FOR SALE" IN A DAY.

Why the silver longs, and Eric Sprott, can defeat the silver shorts – an education in 4D chess

Worldwide silver shortage. Bullion stores sold out for weeks, if not months. No one selling their product to them for spot price. Bullion priced $10-$13 over spot. Silver deficit of mine supply of 350 million ounces.

And of course, you expect to wake up at silver $2 less than a day before. Actually – I did, many of you did not. The price is actually in "contango", where the futures price the last time I checked is wayyyyy above spot. I know how they play this game. At issue here is the disconnect between the REAL physical price and the "paper" price.

When you see a contango like this, you can, in essence, sell a futures contract, then go to the spot market and buy silver. You can then deliver the product on the futures contract. This contango was $.75 a few minutes ago, per ounce. For a contract of $5,000 ounces, that is $3,750 you can pocket on this deal. Of issue, NO ONE will do this, because anyone trying to buy on the spot market may get months of delays to get product.

Yet, prices are falling because we obviously have all of this supply!!!

Watch Andrew Maguire – he walks you through everything.

But this supply – it's falling off the rafters!! Just yesterday, did you know they put on sale 2 BILLION ounces of PHYSICAL SILVER? Yeah. No. They didn't. But they did write pieces of paper to sell 2 billion ounces.

Let me explain what you are seeing: you are seeing institutions conjure up fake metal to sell in the futures market. The metal does not exist. Some of these banks say, "look, I have metal!". It is LEASED. They count it on their books so they can then sell it. The lessor counts it on their books so they can sell it. And, the metal that IS there is:

- Allocated – assigned to a group or person and not for sale – at this price.

- Unallocated – this is a pool of silver which is a fractional reserve, which they sell over, and over, and over. It is thought there are perhaps 250-500 paper claims on each one of these bars in vaults.

What is in progress, and has been for some time, is a good old fashioned bank run, of sorts. There are two strategies here:

- Take unallocated "in to your possession" and get the unallocated titled to you in their vaults. No one seems to trust this actually happens. They just shuffle paper around

- Take unallocated "in to your possession" by removing it from the vaults and putting them in your own vaults.

The main issue with the COMEX is that, on average, they allow sales of 200x daily production almost every day. The COMEX was setup to allow hedging of production. You know, you are a wheat farmer and you want to hedge your production. Well, for most commodities, this is 125% daily production. Yesterday, you saw price go up $2, then smacked down $2 on approximately NINE HUNDRED DAYS PRODUCTION "UP FOR SALE" IN A DAY.

People – this is dangerous. This is how empires fall. Mike Maloney forecasted a lot of this with his brilliant series "The Hidden Secrets of Money". Check episode 9, which we are living now. Things to look for in the last stages:

- Loss of trust in government institutions. Vote recently? How about silver manipulation with the governments' blessing of allowing these guys to continue ripping us off?

- Loss of faith in money. Money is defined in our constitution as GOLD AND SILVER.

They first start with the coin…This was money:

They then write pieces of paper pegging that fiat paper to the coin, to make it more portable

Then they eliminate the tie to the coin, only printing paper out of thin air. This is what causes the end of all civilizations.

The hunt brothers

In 1980, the Hunt Brothers were accused of "cornering the market". They were patsies. Demonized. Estimates had them moving the price of silver like $.50. Bigger picture is they were terrified of inflation and wanted to get as much of their shitty currency put into real money. And for this, they paid a steep price with the government.

Disinformation

Right now, we made a strong dent. And those of you who actually watch the news for news, have been disappointed over the last decade as corporate interests now feed you what they want you to know. I've heard the below on news clips:

- The Reddit crowd is trying to do what the Hunt brothers did. No, they are not. Some on reddit are helping, perhaps many. But this movement was with the silver bugs for decades, we just now found an ally who has mobilized correctly to centralize forces. No one is trying to corner the market. In fact, we are trying to force the bank cabals from continuing to corner the market – they are 400 million ounces short. This makes the GME play look like a popsicle stand. There was 1.5 million WSB folks. Now it's 8.2 million.

- They can't win. Those saying this come from the camps of trying to keep anyone from trying this, and others trying to tell you the manipulation is so far gone that the banks can continue to conjure up whatever they want.

- They are losing steam. In the futures market, that is their battleground. The futures market has a lot to do with spot prices, but you are literally going up against the same banks who see where you put your stops and provide you the margin to make silver "bets" on futures. The truth is, losing this battle hurts from a perspective of those just joining the battle and only looking at spot price as a current win/loss. The truth is there's no real physical for sale in the world, any quantity

- "oversupplied". This guy I really wanted a few rounds with. While there are 3 billion ounces in vaults, you have to understand…."at what price". This is where they wave their magic wand and want you convince you that the owners of the 3 billion ounces are just pouncing to sell their bars or run to the coin shop at $27. No. The supply at $27 is non-existent, worldwide. Only paper trading "bets" are telling you this is the case. Nice jedi mind trick. Apparently, the big banks have been playing this game the last decade to convince you silver is worthless so they could then accumulate it themselves. JPM now has over 300 million ounces and is the custodian of SLV, who has 600 million ounces. And – they were recently fined almost a billion dollars for…metals manipulation and were called a criminal enterprise by our government. Yet they accumulated a billion ounces to control.

- "Manufacturers have ample supply". LIAR!! As of this moment, futures prices are $27.75 and spot is $27.02. This is a massive contango. Most of the time the difference between spot and futures is $.15. This exists because the market is telling you there is NO SUPPLY at that price. For example, let's say a hedge fund wanted to arbitrage that difference – free money, right? Sell 1,000,000 futures contracts. Buy 1,000,000 spot contracts. When you take SPOT delivery, turn around and use that metal to service your futures contracts. That's a $3 billion free money exchange!! Problem is this – no one believes the metal is there at the spot market to be delivered within 7 weeks, which is when the futures contract is up and they would have to deliver. So – that genius you got to talk about ample supply? That expert? He doesn't understand contango and some idiot like me does? Expert?? Anyone ever hear of "just in time delivery?". If your company uses a million ounces of silver a year, are you really buying a years' supply? No. Prices can fluctuate a lot. You have storage costs. Hedging costs. And 2 months from now, silver could drop 80%, so why not buy more then cheaper? Andrew Maguire is a wholesaler, and he's been pounding the table for a year that no one can get bars of size from the refineries or spot market. This is why the COMEX is now delivering 17,000+ contracts in their delivery months. They have become the supplier of last demand. And, Maguire states that anyone trying to take metals off of the COMEX are being outright threatened, and being advised to settle for cash to go away, roll over to the next delivery month, or pushed to LBMA contracts through "exchange for physical" which isn't actually exchanging for physical – it is giving you an LBMA contract in a London vault because they don't have it…at that price. And…they cannot get it at that price. But…they SOLD it to you at that price. That is the green circle from yesterday. And these guys…good luck then pulling it from London.

How this can end

In any "war" there has to be defined goals, in order to win.

Here are the goals of the "good guys":

- Allow silver to be freely traded

- Eliminate naked shorting by banks, allow for more transparency

- Use COMEX for hedging. 2.5x yearly mine worldwide mine supply in a day is NOT hedging, it's open price suppression

- Use the CFTC and SEC to properly regulate. Separate bullion banks from trading, so they do not get intel on where stops are.

- Force reserve requirements of 85% in order to make a sale. If you don't have it, you cannot sell it. Banks are "selling" it based off of leased inventory, not owned inventory. Have higher reserves for purchase. No need to have that volume in a day. Only true hedging and futures supply should be traded. And, these contracts should be actually executed more than 1 in 500, which we currently see.

- Eliminate concentrated short positions. Hunt brothers were made public enemy number 1 for amassing 100 million ounces. Buffett was said to have 125 million ounces in late 1990s. JPM today is reported to have over 300 million ounces. Where is the consistency?

From above, you eliminate 95% of the bullshit trading every month. Weak hands are not speculating in futures, and big banks cannot just conjure up contracts to squash them like bugs and use them as an ATM.

Here are the goals of the bad guys:

- Reduce/eliminate anyone trying to challenge their control on this market, by any means, including media disinformation

- Amass as much physical supply as possible, so I can conjure up as many contracts as possible

- Do as much spoofing as possible to watch people come in, run up price, and whack price down to use them as a piggy bank, hundreds of thousands of times in a decade

- Discourage anyone buying metals, as the stronger a metals price gets, the less confidence in a worthless paper fiat system there is. The more metals are suppressed, the easier it is to hide REAL inflation and keep interest rates down and cheap money floating around

Now that the goals are established, there are several battlefields this will be fought on, and one savior I believe will take down Boss Tweed.

Battle grounds:

- Physical market. As of now, you are seeing $40 for silver and cannot keep it on the shelves. This higher premium reflects supply/demand and has a more clear indicator of "real" price. The price of something is not what you ask, it's what someone is willing to pay. And we just had worldwide inventories drained at $43 per ounce. Unfortunately, it takes awhile to reload these supplies. Why? Because not one soul is calling up Apmex to sell at spot price at $27. The dealers simply run out of inventory because spot price does not rise for them to refill inventories. Now, you see the dissonance with the paper/physical price. The continued pressure on the physical market may then have mints ordering more from refineries. Those with 1,000 ounce bars may mint their own rounds to sell at $43 per ounce. This also further tightens industrial supply, who may have zero problems paying $50 per ounce from a refinery, who in turn will not sell that supply to a US mint for spot price. Which starves the people of supply. This is indicative of a rigged market. Clearly, spot price should reflect the REAL price, so those selling it can re-stock supply. But…there IS NO PHYSICAL SUPPLY AT $27 DOLLARS. THAT IS THE PROBLEM THEY DISTRACT YOU FROM.

2. ETFs. There's two real ways of playing this. We all demonize SLV, but many of us have bought call options at OTM at SLV. Lots of us. Lots of call options – which will put pressure on the trust. The idea is they need to then buy silver, or futures, or something thereof. Supposedly, they got 37 million ounces on Friday and 20 million ounces Monday delivered to SLV. That's why no one believes it. It's logistically impossible. Someone just pointed at a pile of silver in a vault and said, "yeah, we can use that pile again" as it is suspected by many on the internets that SLV is not running a clean shop. Because, its custodian is….

With the ETFS – I also am involved with PSLV. More on this below, but this has physical silver and you cannot buy call options because they are legit and do not do derivatives. It's a closed trust, which means they aren't just creating shares daily and putting on a show of moving 37 million ounces into their vault daily. You are buying shares, and at some point the trust can purchase more. And that's where I think this is going. Again, more on that below.

3. Futures. While I think this is somewhat of a failed area, I believe holding the line here can buy time for what the final battle is. See, many of you do not realize that this whole goddamn thing was going up in flames before all of this with reddit. While many there now are trying to claim there's no silver play there, I had read a bunch of posts there that were deleted by mods because they wanted focus to stay on Game stop. Anyway – this whole system was going belly up, soon. They had continued to kick the can down the road. All of us fighting this battle for years were hoping for an assist from WSB to buy physical, PSLV, and SLV call options.

At issue is this. There's no worldwide supply, really, at $27 silver. Yes, some miners will sell because they need to keep the lights on. But remember, we ran a 350 million ounce deficit in 2020 and during this time, the COMEX said, "come here, we have it". Well, they don't. They have bullion, but not at $27. It's an illusion. They may stand there with a big pile of metal in the background, but it sure as hell isn't for sale at $27.

The last two delivery months were very large – about 80-85 million in a month. The last one, December, it took until the absolute last day to make deliveries. What happens is a lot of these guys sell that 85 million ounces, and the first few days, those with metal, hand it over. Great. Then, you find that half of the contracts don't have the metal, and they have to source it in the open market. They then have to lease it to hand over, or provide ammunition for a smash down, to then buy it on spot cheaper, then hand it over. So you have a contract you sold for $26. Price is $27. You have no metal. No problem. You just conjure up a billion ounces out of thin air, drop it on the COMEX, watch all of your customer stops get hit, then buy the physical metal for $24 and hand over.

But the pressure on the physical market, along with consistently rising futures prices, makes it harder to source this and make it require more energy in fake contracts to keep price in check. 2.5x worldwide mine supply dumped on "paper" market. No physical metal worldwide at $27. Yet, here we are at $27.

4. BASEL 3. This is the final nail, most likely, by Jun 28th. Apparently, many banks have been trying to amass metals ahead of this. This says, "hey, if you're going to sell something, you need 85% reserve". The idea of this is to protect the banking system from a "run on the bank". Right now, they dump unlimited quantities. Let me explain. There's thought to be 2-3 billion of "investment" grade silver above earth. Yesterday, the entire worldwide supply was sold. No, it wasn't. The same "bars" were sold 800 times, and these "bars" do not even belong to them. Bank runs happened during the great depression. One problem the fractional reserve system has is when there's TOO MUCH leverage. And, there is. This leverage makes rich people much richer. On the flip side, those poor people in third world countries mining this supply at the lowest wage possible just to not go out of business is on the other end of that leverage. By eliminating or reducing that leverage, you will see prices of commodities rise to reflect the true nature of inflation going on around us. Maybe silver hits $50 per ounce. Maybe miners go from an AISC from $15 to $25 by being able to pay their workers a better wage. This improves the lives of millions in third world countries and they buy good and services. This improves middle classes everywhere who provide those services.

5. The endgame

I'm a huge fan of Eric Sprott. However, I don't know a ton about him. I listened to him on his weekly radio show with Craig Hemke. Seems like a good guy. Silverbug. Loves his silver miners. Over the last few years, he has amassed a portfolio of over 150 miners, usually with less than 20% stake in any for regulatory purposes. One of the miners he has, that I love as well, is Discovery Metals. It was a low grade silver project that would be a great project over $20 silver. Problem is, silver has been depressed in price for a decade and because of this, new mines cannot come online. Taj Singh, the CEO, decided that he'd take the project to make it 600 million ounces of high grade. If Sprott owns 20% of this company, that's essentially 200 million ounces of low grade silver or 125 million ounces of high grade silver in the ground he owns. And that's 1 of 150 miners.

Sprott also owns PSLV. Or, he used to. I don't know. He's semi retired, and one of his companies I believe Rick Rule bought and runs. But PSLV did something interesting a few months ago. They are a closed trust, but put out an alert that they could make a buy order of $1.6 billion.

His closed trust essentially said, "we have the right down the road to buy $1.6 billion in silver". This article also shows he was selling his PSLV most of the year. If I had to guess, it was to untangle a shit storm that's about to happen and show he did not directly cause what's about to happen. Getting his hands clean, and allowing his trust to just do what they need to do.

Follow me here….

Most people do not realize how small the silver market is. At $25 silver, and 3 billion ounces above ground in vaults, coins, bars, and silverware, you are looking at about a $75 billion industry. That is, to say, Apple could buy every ounce of silver on earth, 10 times over, and still have enough cash to buy every primary silver miner on the planet.

If you look at the numbers, I believe the physical sale of coins/bars/PSLV in the amount of roughly $4 billion in a short time would be enough to push price to $35. That's 5.3% of the PHYSICAL market in a short time (2 weeks) should be enough to push price towards $35.

The media wants you to believe this is a MASSIVE market at $1.5 T. It's not. That's counting the silver in TVs, band aids, iPhones, solar panels, and every electronic device over the last 40 years in dumps, as well as all of the derivatives of silver.

So the idiot talking heads are not walking to their local dump, finding a TV from 1985, spending hundreds of dollars to then separate out all of the boards, and then chemically separating lead from silver. No one is going to the salvage yard to get the one ounce of silver out of a car in 56 different parts, in trace amounts. The silver is there, but until we are talking $500 per ounce, that "supply" they talk about is not economical to "mine". There's a difference between:

- total supply

- economically mineable supply

- supply available at a price point

- economically recyclable supply

So my hypothesis is this….

- With a few billion in physical purchasing and PSLV purchasing, this will take price over $30.

- More media attention, FOMO sets in, and more people head to coin shops and online bullion dealers

- Around $35, shorts need to start covering as losses are mounting

- Very quickly, price runs to about $50. I believe here you will get a lot of physical selling, and much of the shorts can get unwound.

- March delivery month hits Feb 24th, and not only is the normal 85 million ounces standing for delivery, but Eric Sprott's PSLV dropped an additional 50 million ounce order on the COMEX and additional demand puts COMEX around 150-200 million for March delivery. They all want to take out of vaults. An "official" run on the bank starts

- Miners get more attention in February as Q4 2020 numbers come in and people realize they are making stupid profits. They see metals prices going up and realize they are about to make more profits

- March moves on, and silver supplies are coming loose at $75 and $100. End of March price anywhere from $65-$200 for silver. From what I THOUGHT I saw, Keith Neumeyer of First Majestic may hold sales for a month. I believe some other silver suppliers may follow suit to further starve the physical markets. Don't quote me on the KN thing, I can't find the article right now. He did hold back silver at $12 silver.

- Eric Sprott's 150 miners start to go ballistic, some making 10x.

- Most anyone bought into miners before Feb 2021 are retiring in Q2.

And that folks – is the endgame as I see it. PSLV I believe is there as the check and balance to the paper game. It WILL take 50 million ounces from the COMEX in March. It will be there, forever, as the great check and balance to the system and I believe other trusts like his will be set up to do the exact same thing. SLV will eventually do to dust, as people lose faith in the institutions running it and if the silver is actually there or not.

With Sprott's trust, if you have 5,000 ounces or more, you can take it out and get delivery to your home anytime you want. With SLV, you have to be one of 20 special participants, and no one else can take silver off.

I once played an 8 hour chess tournament game in the World Open in 1991 at the age of 15. I have a knack for trying to see the board, the players, the tactics, and the strategies involved. And…what I see is this…

Opening….

- years of putting together PSLV

- years of buying up miners under the radar

Middle game….

- Marketing PSLV and miners on weekly podcast

- Removing any personal stake in PSLV

- PSLV allowing the purchase of up to $1.5 billion in silver (about 50 million ounces in today's prices)

- Buying key stakes in miners like First Majestic who will benefit dozens of multiples on a massive run up in silver

End game

- Waiting until silver runs, which was inevitable. Be patient

- At the right time, unleash PSLV to buy 50 million ounces and take physical possession

- Watch all miners explode in price

- Watch the COMEX grind to a halt as they try and source 150 million ounces in March

Special thanks to Chris Markus at Arcadia Economics. He has no idea who I am, so I'm not friends with him nor is he paying me to promote his book. I've been listening to his show for over a year now and his research/interviews in the book "The Big Silver Short" helped educate me on a lot of what has been going on. Your guests have done the world a service in letting everyone know what's been going on. What many think and dismiss as a "tin foil hat" conspiracy is….actually all true. The day this book was first available on audio I bought from him and listened to the interviews as I walked my dog each day for a few days. I couldn't get enough. And…I'm now a silverbug for life. Check it out at amazon, and check his show out at Arcadia Economics on YouTube. Please re-share this story to get the word out.

.jpg)

No comments:

Post a Comment

Commented on MasterMetals