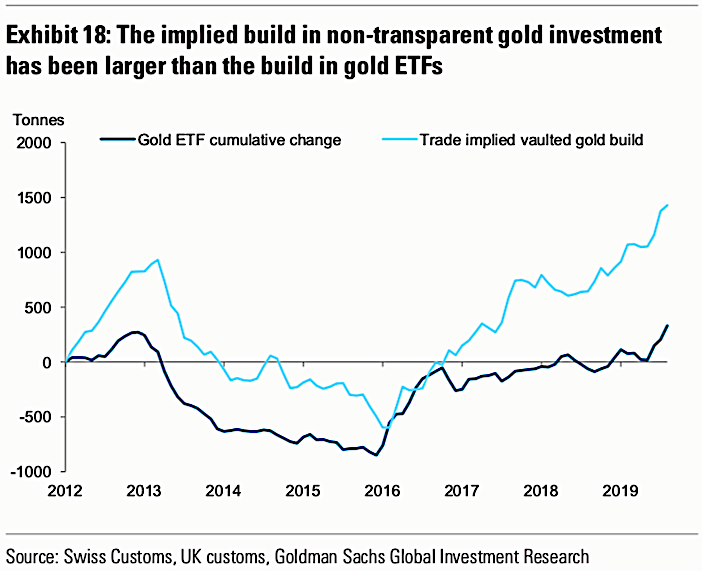

"Since the end of 2016 the implied build in non-transparent gold investment has been much larger than the build in visible gold ETFs."

Subscribe to MasterMetals

Search This Blog

December 15, 2019

The World’s Wealthy Are Hoarding #Gold - Physical not #ETF‘s

July 27, 2019

How Awesome was Anil #Agarwal’s @AngloAmerican Adventure

In our article, we explain that Agarwal has made about $500m in gross profits on the trade. BUT, that is before the substantial costs required to service the instruments involved in making the stake happen. Coupon costs alone will have totalled about $300m since he first put on the two legs of the trade.And we've learned that Agarwal is likely to reveal that he is up about $100m from the overall project. We assume that means a hefty chunk of the remaining $100m will be headed to the folks at JPMorgan.Agarwal's trade strongly resembles an equity collar, which DD's Rob Smith and Arash Massoudi explained last year has become a hot money spinner for Wall Street banks looking to make money from deep pocketed clients. In short: collars do not come cheap.

In short:

Read the whole story here: https://www.ft.com/content/53b77de8-af35-11e9-8030-530adfa879c2

July 25, 2013

What diverging #monetary policies signal- Xie

#Gold prices will top $3,000/oz in 5 years

What diverging monetary policies signal: Andy Xie

Commentary: Gold prices will top $3,000 per ounce in five years

The dollar’s long shadow

Changing places

Commodity currencies

Gold moves East

What diverging monetary policies signal: Andy Xie - Caixin Online - MarketWatch

July 9, 2013

Analysis of the day:Rogoff: collapse of #gold has not changed investment case- policymakers: be cautious interpreting it as vote of confidence

ROGOFF: It's Best Not To Make Too Much About Plunging Gold Prices: CAMBRIDGE – In principl... http://t.co/bfUjBo6rDk #Gold #MasterMetals

— MasterMetals (@MasterMetals) July 8, 2013

Twitter / MasterMetals: collapse of #gold has not changed ...

The MasterMetals Blog

#Paulson #gold #fund plunges 65% through June

With roughly $300 million in assets, the gold fund is the smallest portfolio in his New York-based firm's lineup with less than 2 percent of its assets and it invests mostly Paulson's personal money

The fund's assets have fallen from roughly $700 million at the end of the first quarter

John Paulson's gold fund has lost 65% of its value so far this year after it declined 23% last month, says people familiar with the matter.

Paulson gold fund plunges 65% through June

BOSTON (Reuters) -

Hedge fund manager John Paulson's gold fund has lost 65 percent of its worth so far this year after the portfolio declined 23 percent last month, two people familiar with the fund said on Monday.

Gold had been one of the billionaire investor's winning bets a few years ago, but not this year. His investments in gold and gold miners have suffered double digit losses for the past three months.

In June, gold tumbled 12 percent in the wake of fears the Federal Reserve might taper its economic stimulus by cutting monthly bond purchases. It is unclear how a 12 percent drop in the price of the precious metal translated into a 23 percent fall in the fund in June, and whether it is the result of the bet having been leveraged up through borrowing and the use of derivatives

A spokesman for Paulson declined to comment.

With roughly $300 million in assets, the gold fund is the smallest portfolio in his New York-based firm's lineup with less than 2 percent of its assets and it invests mostly Paulson's personal money, the people familiar with the fund said.

The fund's assets have fallen from roughly $700 million at the end of the first quarter, according to those people.

They did not want to be identified because the information is private.

The gold fund, which at one point managed almost $1 billion, rose 35 percent in 2010 and contributed to Paulson's estimated $5 billion payday that year.

As the heavy losses made for outsized headlines in recent months, Paulson decided a few weeks ago to report the gold data only to the gold fund investors, not investors in his bigger and better performing funds. In April, Paulson garnered unwanted attention when the gold fund lost 27 percent as the price of the metal plunged 17 per cent over two weeks.

"Paulson's impact on the gold market is dramatic. In particular his size alone, on the way in or way out," said John Brynjolfsson, managing director of global macro hedge fund Armored Wolf LLC. "But one needs to look beyond his size alone because his positions are relatively widely publicized, and representative of how others are thinking, so thereby their impact gets magnified."

The gold fund is one of a handful of funds that make up Paulson's New York-based hedge fund, which at its peak in 2011 managed about $38 billion. The firm now oversees about $19 billion in investor money.

Most of Paulson's bigger funds are in the black this year, but the gold investments have weighed down returns of the Advantage Funds, which lost 3.06 percent last month, shrinking the year's gains to 1.17 percent.

Paulson & Co's largest holding by market value at the end of the first quarter was the SPDR Gold ETF, with 21.8 million shares, according to a regulatory filing. The firm also had large stakes in gold mining companies through March, those filings showed.

Paulson launched his gold fund in 2010, requiring outside investors to commit $10 million each. He hired gold industry experts Victor Flores, HSBC's former senior gold mining analyst, and John Reade, a former senior metals strategist at UBS. The fund is now called the PFR Gold Fund, in a nod to their last names.

Paulson's investments in gold are one reason he rose to prominence on Wall Street.

After earning billions betting against the housing market before the financial crisis, Paulson made roughly $5 billion in 2010 thanks to prescient bets on the economic recovery and gold.

Paulson is not the only brand-name manager hit by the gold rout. David Einhorn's Greenlight Capital Management's offshore gold fund fell 11.8 percent in June, bringing year-to-date losses in the fund to 20 percent, Reuters has reported.

Paulson gold fund plunges 65% through June - GOLD NEWS - Mineweb.com Mineweb

The MasterMetals Blog

July 8, 2013

#Gold presents investors with a quandary

By Lucy Warwick-Ching

FT

Gold has lost some of its attraction as a haven for investors following a 25 per cent price drop since the start of the year, taking it to its lowest level in three years.

"Its fall has been a remarkable and painful drop for investors seeking financial protection," says Adrian Ash, head of research at BullionVault.com. "In the past 45 years we have only had three occasions when gold prices fell harder – in summer 1974, spring 1980 and early 1981."

www.ft.com/intl/cms/s/0/adda4ed8-e3f1-11e2-b35b-00144feabdc0.html#axzz2YRlNLiQ7

June 28, 2013

BofA: '#GOLD BEARS BEWARE'

"The downtrend remains for 1212/1200, but this decline is in its final stages. Bulls need a move above 1270 to indicate a base and turn.”

BofA: 'GOLD BEARS BEWARE'

Business Insider Australia

As the daily candlestick chart at right shows, the shiny yellow metal hasn’t spent many days in the green.

Today, the price of an ounce of gold dropped below $1200 for the first time since August 2010, hitting a low of $1196.10 this afternoon before bouncing back to current levels just above $1200.

BofA Merrill Lynch technical strategist MacNeil Curry argues today in a note to clients that “further gold downside [is] limited.”

“While Gold has been on a relentless downtrend, the weekly ADX (a measure of trend strength, not direction – see chart 1 for additional info) says further weakness is limited. Indeed, previous ADX readings of 50 have resulted in reversals of between 35% and 36% of the flat price,” writes Curry. “GOLD BEARS BEWARE. For now, the downtrend remains for 1212/1200, but this decline is in its final stages. Bulls need a move above 1270 to indicate a base and turn.”

The chart below shows the ADX, or “Average Directional Index,” that Curry references.

The second chart shows the potential support levels flagged by Curry.

The MasterMetals Blog

June 27, 2013

Who “murdered” the #gold price? Ian Gordon - Mineweb

The old highs of $1,900/oz will be surpassed by a long shot over the medium to long term.

Who “murdered” the gold price? Ian Gordon

INDEPENDENT VIEWPOINT

Posted: Thursday , 27 Jun 2013

Who “murdered” the gold price? Ian Gordon - INDEPENDENT VIEWPOINT - Mineweb.com Mineweb

June 26, 2013

Registered #Gold at the #Comex LT Chart on Jesse's Café Américain

Does this mean JPM has been accumulating all the ounces that have been sold out by the GLD ETF held by HSBC?

Jesse's Café Américain: Registered Gold at the Comex Long Term Chart: Someone asked me about this, and while I do not keep a history of it, I found a decent historical chart of the registered gold inventory a...

For your reference the number of registered ounces in the COMEX warehouses yesterday (June 24, 2013) was approximately 1,360,000.

June 18, 2013

#Gartman: #Gold Is A Broken Commodity

Dennis Gartman, Founder and Publisher of the Gartman Letter, thinks gold is going down.

“People forget that the high in gold is now almost two years behind us,” says Gartman. “We’ve broken all trend lines. We’ve broken all support. Gold, in dollar terms, is a broken commodity.”

To those cheering on the yellow metal, Gartman has bad news. “It’s probably going to head lower, not higher, despite all of the news that the monetary authorities are expanding the supply of reserves to the system,” he says. “Every gold bull knows that. Every gold bug reiterates that. Every gold bug continues to buy gold. And, they continue to lose a lot of money.”

Gartman has particular levels he’s watching. “The first signs of support may well be $1,200. If it starts to break under $1,200, I’m sorry but there’s not much support until you do get to $1,000,” he says. “The trend seems to be downward and those who are buyers find themselves in a very uncomfortable position.”

“Like an aging athlete, [gold] just keeps faltering. It cannot just quite get across the line to catch that pass any longer than it used to be able to do very readily,” says Gartman. “Even with all of the news that is supposedly as bullish of gold as you can get – a weakening dollar at times, continued monetary expansion by every central bank in the world – gold can’t rally.”

What’s a gold bull to do? Gartman has an idea.

“The oldest rule in commodity trading is, when something can’t rally when the news is bullish, it’s a bear market.”

-----

Follow us on Twitter:@CNBCNumbersLike us on Facebook:facebook.com/CNBCNumbers

Gartman: Gold Is A Broken Commodity | Talking Numbers - Yahoo! Finance

The MasterMetals Blog

June 7, 2013

Daily #chart: #Commodities Prices since 1950

The price of commodities "in the ground" have boomed while resources that can be grown have trended downwards

Daily chart

Daily chart

Vital ingredients

IN HIS 1968 book “The Population Bomb”, Paul Ehrlich, a biologist, argued that rising populations would inevitably exhaust natural resources, sending prices soaring and condemning people to hunger. In a new paper David Jacks, an economist at Simon Fraser University, assembles figures on inflation-adjusted prices for 30 commodities over 160 years. It turns out Mr Ehrlich was not entirely off the mark. Over the very long run commodity prices display a marked upward trend, having risen by 192% since 1950, and by 252% since 1900. But that upward trend has clearly not translated into global famine, and not all commodities are alike. Long-run rises have been most pronounced for commodities that are “in the ground”, like minerals and natural gas. Energy commodities especially have boomed, soaring by roughly 300% since 1950. In contrast, prices for resources that can be grown have fallen. The inflation-adjusted prices of rice, corn and wheat are lower now than they were in 1950. Although the global population is 2.8 times above its 1950 level, world grain production is 3.6 times higher. See full article.

Daily chart: Vital ingredients | The Economist

May 31, 2013

Peter #Degraaf The Long Wait is almost over for #Gold

http://financialservicesinc.ubs.com/wealth/E-maildisclaimer.html

for important disclosures and information about our e-mail

policies. For your protection, please do not transmit orders

or instructions by e-mail or include account numbers, Social

Security numbers, credit card numbers, passwords, or other

personal information.

The Long Wait (nearly 21 months) is Almost Over

May 29, 2013

DOUG #KASS: The Case to Buy #Gold

• There is a time, place and price for every asset class.

• Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.

• The problem with commodities is that you are betting on what someone else would pay for them in six months. The commodity itself isn't going to do anything for you.... [I]t is an entirely different game to buy a lump of something and hope that somebody else pays you more for that lump two years from now than it is to buy something that you expect to produce income for you over time.

• Gold is a way of going long on fear, and it has been a pretty good way of going long on fear from time to time. But you really have to hope people become more afraid in a year or two years than they are now. And if they become more afraid, you make money; if they become less afraid, you lose money -- but the gold itself doesn't produce anything.

• I will say this about gold. If you took all the gold in the world, it would roughly make a cube 67 feet on a side.... Now for that same cube of gold, it would be worth at today's market prices about $7 trillion dollars -- that's probably about a third of the value of all the stocks in the United States.... For $7 trillion dollars ... you could have all the farmland in the United States, you could have about seven ExxonMobils, and you could have a trillion dollars of walking-around money.... And if you offered me the choice of looking at some 67-foot cube of gold and looking at it all day, and, you know me, touching it and fondling it occasionally.... Call me crazy, but I'll take the farmland and the ExxonMobils.

• The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets, especially paper money (of whose value, as noted, they are right to be fearful). Gold, however, has two significant shortcomings, being neither of much use nor procreative. True, gold has some industrial and decorative utility, but the demand for these purposes is both limited and incapable of soaking up new production. Meanwhile, if you own one ounce of gold for an eternity, you will still own one ounce at its end.

• What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade, that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As "bandwagon" investors join any party, they create their own truth -- for a while.

• I have no views as to where it will be, but the one thing I can tell you is it won't do anything between now and then except look at you. Whereas, you know, Coca-Cola will be making money, and I think Wells Fargo will be making a lot of money and there will be a lot -- and it's a lot -- it's a lot better to have a goose that keeps laying eggs than a goose that just sits there and eats insurance and storage and a few things like that.

-- All of the above quotes are from Warren Buffett

In many ways, I have shared Warren Buffett's skepticism on gold, as expressed in his seven quotes above.

Also, in support of Warren's ursine view of the precious metal, is Oaktree Capital Management's Howard Marks, who has written that gold is a lot like religion. In religion, you either believe in God or you don't. In the gold market, you either believe in gold or you don't.

In the past, I have agreedon the subject of gold with both The Oracle of Omaha and The Oracle of Oaktree. In fact, I recently debatedwith Peter Schiff about gold, providing the bear case for the asset class (albeit, at much higher prices).

In essence, the gold market is a state of mind -- the subject of gold is an emotional one. It neither represents a corporate franchise that increases over time as profits are earned and retained such as, say, Procter & Gamble ( PG), with a protected moat -- nor is it a productive asset. As such it is hard to ascertain what the intrinsic value of the commodity is.

On the latter point, gold doesn't produce profits or cash flow and, as such, fails to provide a stream of income. Its future price is simply dependent upon someone willing to pay more for the asset class compared to its price today.

While it might take time for the price of gold to build a real bottom, there is a time, place and price for every asset class.

Why Now?

This morning, I paid $133.30 for SPDR Gold Trust ( GLD) in premarket trading.

Below I will discuss my reasons for building a position in gold over the next few weeks and months.

Expectations for the price of gold are now low and diminished . Gold experienced a speculative blow-off top 18 months ago as the European debt crisis peaked, the threat of a U.S. default ceiling rose and coincident with the debt rating of U.S. being lowered.

A most unpopular asset class provides a contrarian's appeal . Weak price action since September 2011 has created an improved reward vs. risk. Hereis the price of gold since 1833. And below is a chart that follows the price of gold since 1970.

As you can see, the price of gold is more than $500 an ounce below the fall 2011 peak.

Last month's gold selloff looks like a selling price and volume climax . That first day of the mid-April collapse was a near 5 standard deviation move lower (or every 4,700 years) on huge notional volume of $20 billion. On the following Monday, gold took an even greater beating. Over the two-day period, there was a 8 standard deviation event, which occurs statistically about every billion years.

Negative sentiment extreme . The sharp price drop in gold has brought on a growing short position.

With it lies the seeds for a potential short squeeze or perhaps some latent demand from short sellers.

The growing consensus view of an acceleration in the rate of global economic growth may be too optimistic . As such, not only might the recent rise in real interest rates be nearly over (as it holds the seeds for detracting from growth) but it raises the prospects for more QE, lasting much longer than many market participants expect.

The U.S. dollar's recent strength might peter out . A higher U.S. dollar is typically seen as a gold negative. But the recent strength, reflecting a growing consensus of Fed tapering, might be short circuited if global growth moderates.

More currency debasing lies ahead . The currencies of all the major countries, including ours, are under severe pressure because of massive government deficits. The more money that is pumped into these economies (the printing of money, basically), the less valuable the currencies become and more valuable gold is.

Inflation is gold's friend . The world's debt load cannot be paid back in constant dollars. Reflating (and inflation) seem inevitable (though inflation may lie out into the distant future) and is the natural outgrowth of monetary policy.

Tail risks remain . I don't subscribe to the notion that all economic tail risks have been eliminated nor that the shoulders of growth will be borne by monetary policy. Rather I view an upcoming "aha moment," in which it becomes recognized that easing is losing its impact as the Fed is pushing on a string. Again, QE might be with us for a lot longer than many anticipate.

Demand for physical gold is rising . It is interesting to note that when the price of gold had its two-day crash in mid-April, the price for physical delivery (gold coins, etc.) held better (the premium increased) than future prices. (View about 33 minutes, 50 seconds into this presentationby Grant Williams.)

Previously bullish brokerages have given up on gold . Credit Suisse , JPMorgan and Goldman Sachs have recently slashed their gold price projections. I view this surrender as consistent with a possible contrarian signal.

Summary

Recognizing that the intrinsic value of gold is difficult to evaluate, now seems a propitious time to consider diversifying some portion of one's portfolio into gold.

There is probably no better time to consider diversifying one's portfolio into a depressed asset class (e.g., gold) than when the crowd is optimistic about a vigorous and self-sustaining global economic recovery and when the world's stock markets are at record high prices.

Gold, which had a speculative blow-off to the upside back in 2011 (18 months ago), now appears to have had a selling climax last month.

Investor sentiment toward gold probably can't get much worse, and the growing optimism regarding the trajectory of global economic recovery may not get much better in the weeks and months ahead.

Position: Long GLD

Douglas A. Kass

Seabreeze Partners Management Inc.

ShareThis

MasterMetals’ Tweets

- VANECK JUNIOR GOLD MINERS ETF $GDXJ UP 1.2366%! Last at 61.4. #Gold #MiningStocks #GDXJ #ETF #MasterMetals https://bit.ly/39s7ZgS https://bit.ly/4d2Ozls - 4/30/2025

- Now they have to try and find those rare earths. Well, they're definitely rare in Ukraine... https://bit.ly/4jPI3QU - 4/30/2025

- US & Ukraine sign “economic partnership” deal that will give 🇺🇸 access to 🇺🇦’s critical minerals & natural resources. The agreement will establish “reconstruction investment fund” for Ukraine that Trump insisted on as a way for Kyiv to repay America for past aid. https://bit.ly/4d6qHgD - 4/30/2025

- Global X Silver Miners ETF $SIL UP 1.4183%! Last at 40.76 https://bit.ly/39s7ZgS #Silver #SIL #MasterMetals #charts https://bit.ly/3RHMjpJ - 4/30/2025

- #Gold: SPDR Gold Shares ETF $GLD dropped by 0.7253%! Last at 303.84 #MasterMetals #GLD https://bit.ly/39s7ZgS https://bit.ly/4iC7moF - 4/30/2025

- Golden Start of the Year - 5/1/2025

- $BHP - Q3 2025 Activities Report - 4/17/2025

- Trump & Metals - 4/16/2025

- Gold Miners (Finally) Performing - 4/15/2025

- Gold Just Had Its Best Day Since 2023 - 4/10/2025