Some great hits at depth from Koula.

Koula RC Highlights16 metres (“m”) at 26.5 grams per tonne gold (“g/t Au”) in drill hole SGRD1084 from 233m including2m at 115.3 g/t Au from 234m and1m at 24.7 g/t Au from 246m and1m at 31.0 g/t Au from 248m15m at 18.5 g/t Au in drill hole SGRD1088 from 256m including5m at 24.2 g/t Au from 260m and3m at 45.1 g/t Au from 268m7m at 22.3 g/t Au in drill hole SGRC1085 from 256m including1m at 104.5 g/t Au from 261m17m at 7.7 g/t Au in drill hole SGRD1081 from 193m including2m at 41.6 g/t Au from 194m and1m at 15.3 g/t Au from 206m

Highlights from Reverse Circulation (“RC”) and Diamond tail (“RD”) drilling

Koula

16 metres (“m”) at 26.5 grams per tonne gold (“g/t Au”) in drill hole SGRD1084 from 233m including

2m at 115.3 g/t Au from 234m and

1m at 24.7 g/t Au from 246m and

1m at 31.0 g/t Au from 248m

15m at 18.5 g/t Au in drill hole SGRD1088 from 256m including

5m at 24.2 g/t Au from 260m and

3m at 45.1 g/t Au from 268m

7m at 22.3 g/t Au in drill hole SGRC1085 from 256m including

1m at 104.5 g/t Au from 261m

17m at 7.7 g/t Au in drill hole SGRD1081 from 193m including

2m at 41.6 g/t Au from 194m and

1m at 15.3 g/t Au from 206m

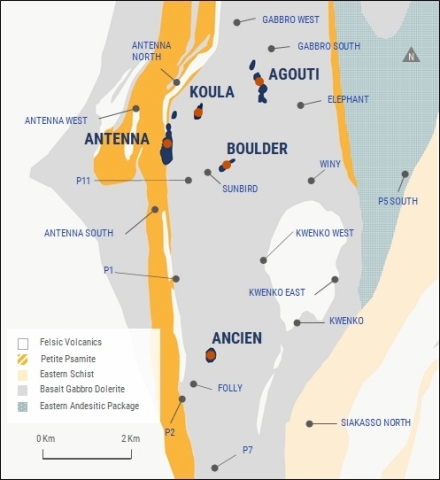

“As Séguéla moves closer to a construction decision, we continue to push towards the goal of defining additional mineralization in support of our vision of Séguéla becoming a 150,000 ounce per year producer over ten plus years,” commented John Dorward, President and Chief Executive Officer of Roxgold. “The assay results today, while still early, build our confidence in the potential for Koula to conceptually extend its life via a high-grade underground operation. The strength of mineralization at depth at Koula is similar to what we were seeing at depth down-plunge in Ancien last year – a program which was temporarily put on hold in order to infill and upgrade the in-pit defined Inferred Mineral Resource at Koula for inclusion into the upcoming Feasibility study. While we had initially viewed Koula as an attractive satellite opportunity it is now clear that it has the potential to be the most important deposit defined at Séguéla so far. In addition, our drills have resumed extension testing at Ancien, the other ultra-high grade deposit discovered to date.

“We continue to believe we have only begun to tap the potential of the Séguéla Project and are eager to continue to uncover and test the wealth of additional targets present on the property. While our exploration team continues their work at Séguéla, the critical path for the Séguéla project plan is on track with the Feasibility Study scheduled for the second quarter of this year, followed soon thereafter by a construction decision towards the goal of achieving first gold pour at Séguéla in 2022.”

Paul Weedon, Vice President Exploration commented “Building off the recent high grade results from the conclusion of the infill program, these new results highlight the potential for an underground target extending down-plunge from Koula and provide a high degree of confidence in the high grades over at least 150m down-plunge. Coupled with the 14m at 4.3 g/t intersected in SGRD971 we see mineralization extending at least 250m at depth and I am looking forward to the results from the next round of step-out drilling, which is testing the potential a further 120m down-plunge.”