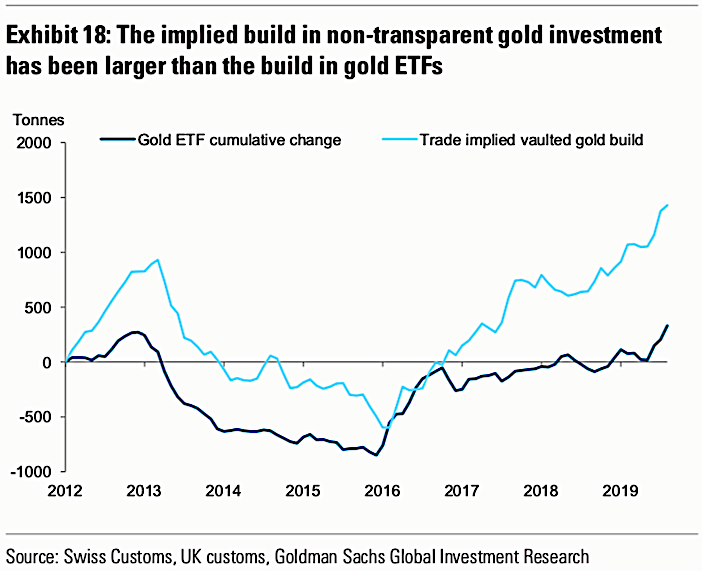

"Since the end of 2016 the implied build in non-transparent gold investment has been much larger than the build in visible gold ETFs."

Subscribe to MasterMetals

Search This Blog

September 10, 2020

#Gold’s Performance Continues To Be Stellar With Returns of 20-32% Across All Major Currencies

As of the beginning of September, #Gold is up by a wide margin vs. all other asset classes.

In USD +28%; GBP +30%. Even against the Mighty Swissy up +20%!

Gold Price Performance in USD, EUR, GBP, CHF, JPY, AUD, CAD, CNY, INR, continues to Outperform vs. all major stock markets.

See the Gold Price Performance Page

December 15, 2019

The World’s Wealthy Are Hoarding #Gold - Physical not #ETF‘s

August 6, 2019

#Gold Prices Hitting All-Time Highs In #GBP, #JPY, #CAD, #AUD

May 7, 2015

#Gundlach Reiterates $1400 #Gold Target as negative rates persist

Gundlach Reiterates $1400 Gold Target

Via Energy and Gold.com:Famed bond fund manager Jeffrey Gundlach gave a presentation at the New York Yacht Club today in which he reiterated a $1,400 target for gold by year end. From what I gather Gundlach has two primary tenets to his bullish gold thesis:

- Negative interest rates in Europe will make gold very attractive relative to holding negative yielding cash or extremely low yielding sovereign debt

- Fears of Fed rate hikes have been weighing on gold for some time and these fears are overblown because the US economy isn’t yet strong enough for the Fed to embark upon a protracted rate-hike cycle

Including central bank purchases both the euro area and Japan are shrinking the amount of sovereign debt in the market. This is quite significant and helps to explain why eurozone sovereign yields are at historically low levels. Gundlach is right, gold looks very attractive compared to holding euro cash or euro denominated sovereign debt. I wonder when the market is going to catch on….

@MasterMetals

November 2, 2012

If you only read one article on #Gold, this is it!! Scott Minerd - Return to Bretton Woods | Guggenheim Partners

Return to Bretton Woods

Scott Minerd - Guggenheim Partners

The gold-convertible U.S. dollar became the global reserve currency under the Bretton Woods monetary system that lasted from 1944-1971. This arrangement ended because foreign central banks accumulated excessive reserves of U.S. Treasuries, threatening price stability and the purchasing power of the dollar. Today, central banks are once again stockpiling massive Treasury reserves in an attempt to manage their currency values and gain advantages in export markets. We have, effectively, returned to Bretton Woods. The trouble is that the arrangement is as unsustainable today as it was during the middle of the last century.

Bretton Woods is a resort in the mountains of New Hampshire that was made famous by a series of meetings of world leaders and economists in 1944. Nine months before the last of Hitler's V-2 rockets struck Britain, 730 delegates from the 44 Allied Nations congregated in Bretton Woods to create a new world order, including a monetary system that could resolve the festering economic consequences of the First World War and the Great Depression.Under the Bretton Woods Agreement, the world's currencies would be pegged to the U.S. dollar and central banks would be able to exchange dollars for gold at a set price of $35 per ounce. It was this arrangement that firmly established the U.S. dollar as the global reserve currency. The system worked relatively well for almost three decades (1944-1971). During that time, Bretton Woods' member states achieved increasing levels of trade, economic cooperation, and initially, a period of relative price stability.

The trouble with the system was that global central banks had pegged their currencies at low levels to support exports to the U.S. This led to the accumulation of massive dollar reserves in the hands of foreign central banks. These dollars were used to buy interest-bearing U.S. Treasuries. The structural imbalance, which resulted in ever growing dollars reserves, created problems that would ultimately compromise the very existence of Bretton Woods.

Today, global central banks are once again managing the exchange values of their currencies relative to the dollar to ensure export competitiveness. Just as pressure mounted as a result of the accumulation of large Treasury reserves by foreign central banks under Bretton Woods, today, ever-expanding dollar-denominated reserves on central bank balance sheets around the world threaten global price stability and even dollar hegemony. Though a reversal of this unsustainable pattern is not imminent, the ultimate consequences could be even more severe than the precedent set 41 years ago.

By understanding the demise of Bretton Woods, we gain a better handle on how today's global monetary arrangement may result in a period of relative price stability in the short-run followed by a rapid depreciation in the purchasing power of currencies on a global scale. An historical perspective provides the framework to better understand the current monetary system and the impact these policies have on investment portfolios.

The Golden Years of Bretton Woods

At the outset of Bretton Woods, the value of the United States' gold reserves relative to the monetary base, known as the gold coverage ratio, was approximately 75%. This helped to support the dollar as a stable global reserve currency. By 1971, the issuance of new dollars and dollar-for-gold redemptions had reduced the U.S. dollar's gold coverage ratio to 18%.

The consensus view during the early years of Bretton Woods was that the dollar was as good as gold. Gold has no yield so central banks held interest-bearing Treasuries on the assumption that they could always be converted to gold at a later time. By the early 1960s, there was widespread recognition that the U.S. could never fulfill its commitment to redeem all outstanding dollars for gold.

Despite this disturbing fact, central banks did not call the Fed's bluff by selling their dollar reserves. They had become hostage to the system. By the end of the decade, the problem had intensified to the point that if any central bank attempted to convert its dollars to gold, its domestic currency would rapidly appreciate above the levels that were pegged under Bretton Woods. This would lead to severe economic slowdowns for any country who challenged the U.S.

Throughout the 1960s, foreign central banks implicitly imported inflation as a result of maintaining the exchange value of their currencies at the artificially low rates set in 1944. The overvalued dollar led to trade deficits versus a sizable trade surplus for the United States. Because of the undervaluation of non-U.S. currencies, Bretton Woods member states were forced to expand their money supplies at rates that compromised price stability. As foreign exporters converted dollars back to their local currencies, the dollar reserves on central bank balance sheets continued to grow.

This surplus of dollars held by central banks, and subsequently invested in Treasury securities, reduced the United States' cost of borrowing and allowed the country to consume beyond its means. Valéry Giscard d'Estaing, then finance minister of France referred to the situation as "America's exorbitant privilege," but he was only half right. As Yale economist Robert Triffin noted in 1959, by taking on the responsibility of supplying money to the rest of the world, the U.S. forfeited a significant amount of control over its domestic monetary policy.

The End of the Golden Years

When Triffin introduced his theory to the world, he accurately predicted the collapse of Bretton Woods and the end of an era of U.S. trade surpluses. Triffin told Congress that, at some point, foreign central banks would become saturated with Treasury securities and seek to redeem them for gold. However, because this would appreciate their currencies and slow growth, it was difficult to envision a set of circumstances that would lead foreign central banks to stop accumulating more dollars.

By the middle of the 1960s, the U.S. was escalating the war in Southeast Asia while expanding social welfare programs under Lyndon Johnson's Great Society. As the U.S. pursued a policy of both 'guns and butter,' its trading partners questioned the country's willingness to restore fiscal balance. Over time, the U.S. trade surplus deteriorated as America imported more than it exported. Further, the increasing trade deficit in the U.S. accelerated the accumulation of dollar reserves around the world. As a result of the massive growth in reserves, the Bretton Woods nations saw domestic inflation rise by an average of 5.2% during the 1960s, relative to U.S. inflation, which was 2.9%.

European countries began to consider that the price of dollar-denominated inputs such as oil would fall dramatically if their currencies were revalued upward. By abandoning Bretton Woods, they could reduce their domestic inflation by reasserting control over their domestic money supply. However, the possibility of an exit from Bretton Woods had not been contemplated in the original 1944 plan.

How would member states leave Bretton Woods? The answer could be found in Trffin's prediction. Forced to swap dollars for gold, the U.S. would have to admit that it could no longer keep its pledge to exchange gold for $35 per ounce. Between Bretton Woods' establishment in 1944 and its demise in August 1971, the U.S. exported almost half of its gold reserves. In the 12 months leading up to the end of Bretton Woods, the Fed lost nearly 15% of its total gold reserves; a rate at which the U.S. would have depleted all of its reserves in a short time. This led then-President Richard Nixon to abruptly end the dollar's gold convertibility by 'closing the gold window.'

While the United States' trading partners immediately reaped the benefits of reduced inflation and cheaper imports, the end of gold convertibility for the dollar would set in motion a decade of subpar growth and high inflation. In the early 1970s, members of the Organization of the Petroleum Exporting Countries (OPEC) saw the purchasing power of their dollar-denominated oil receipts rapidly erode. They seized the opportunity to raise prices. Between 1973 and 1980, oil prices would rise by more than 1,000%. As a result, during the 1970s, countries that had pursued relatively weaker currencies under Bretton Woods began to seek relatively stronger exchange values to constrain their energy costs. The resulting fall in demand for the dollar led to a drastic reduction in its purchasing power.

Bretton Woods II: The Sequel

The early success of Bretton Woods, which relied upon weak currencies to successfully promote exports looks surprisingly similar to the policies being practiced by central banks around the world today. Some have referred to the current policies in foreign exchange markets as Bretton Woods II. Although not officially acknowledged, central banks are once again tacitly pegging their currencies to the dollar. As the U.S. is expanding its monetary base through quantitative easing (QE), other countries have few options but to join this race to the bottom. This situation is as unsustainable today as it was in the 1960s. (For a more in-depth discussion, read one of my previous commentaries, The Return of Beggar-Thy-Neighbor.)

Once global growth begins to accelerate and capacity utilization increases, economic bottlenecks will cause the price of inputs, such as energy, to rise. There will then be another inflection point when countries will realize that by allowing their currencies to appreciate, reduced import prices will spur productivity and domestic growth. This will happen when it becomes apparent that the savings resulting from lower input prices exceeds the export losses associated with a stronger currency. Though the timing of this event is difficult to forecast, its occurrence will likely cause Bretton Woods II to collapse.

Investment Implications: A Green Light for Gold

Gold was an important component of the Bretton Woods system. As a monetary anchor, it provided stability for the dollar as a global reserve currency. With the demise of gold convertibility under Bretton Woods, global price stability began to unravel. After being depegged from its official price of $35 per ounce in 1971, gold rose by more than 2,000% over the next 10 years. Investors migrate to gold when currencies no longer function as good stores of value.

The U.S. gold coverage ratio, which measures the amount of gold on deposit at the Federal Reserve against the total money supply, is currently at an all-time low of 17%. This ratio tends to move dramatically and falls during periods of disinflation or relative price stability. The historical average for the gold coverage ratio is roughly 40%, meaning that the current price of gold would have to more than double to reach the average. The gold coverage ratio has risen above 100% twice during the twentieth century. Were this to happen today, the value of an ounce of gold would exceed $12,000.

The possibility of an upward revaluation of the official price of gold should not be minimized. Although I do not anticipate or advocate a return to the gold standard, an upward revaluation of gold by one of more central banks is possible. If the Federal Reserve, for instance, announced that it stood ready to purchase gold at $10,000 per ounce, the gold-coverage ratio of the dollar would return to 75%, roughly where it stood at the beginning of Bretton Woods. This could restore confidence in the value of the dollar if its ultimate role as a reserve currency were to be challenged.

Gold's industrial use only represents .03% of global GDP. Therefore, its upward revaluation would not cause a significant economic shock associated with rising input prices. Likewise, a higher price would probably not affect the behavior of the world's largest holders, which are central banks and sovereign wealth funds.

Prescient investors should consider making allocations to gold and other precious metals as a hedge against the erosion of purchasing power of the dollar as well as for the potential upside from positive market price appreciation or a possible intervention at the policy level. Despite the sizable appreciation in gold prices in the last decade, gold is far from overvalued. This makes gold a low-risk investment and leads me to believe that gold will never again trade below $1,600 an ounce.

The Precarious Balance Continues

Almost 70 years later, the global monetary system is still living in the long shadow of Bretton Woods. Triffin's views are as relevant today as they were when they were first published more than half a century ago. The current paradox in the global monetary system is as unsustainable as it was under the original Bretton Woods Agreement. The exact timing of an inflection point for Bretton Woods II remains unclear, and although it is not imminent, its eventual occurrence is virtually certain. As was the case in the 1960s, a reversal of the acquisition of Treasuries by foreign central banks will cause a major shift in global capital flows and insecurity about the value of dollar-based assets, particularly Treasuries.

The most likely outcome will be renewed support for precious metal, which functions as a store of value and a hedge against currency depreciation. In contrast to the 1960s, bullion is free to float at market prices and gold markets have already begun discounting a future set of circumstances which is much different from today. The time to buy insurance on the end of Bretton Woods II is before the inevitable occurs.

None of this should come as a surprise given the unorthodox growth of central bank balance sheets around the world. The collapse of Bretton Woods in 1971 caused a decade of economic malaise and negative real returns for financial assets. Can anyone afford to wait to find out whether this time will be different?

November 29, 2011

Jim Rogers Says Gold Due for Correction; Owns Dollar

News Headlines

US News

Jim Rogers Says Gold Due for Correction; Owns Dollar

CNBC.com | November 29, 2011 | 06:13 AM EST

The price of gold is due for a correction and this could be used as an entry point by investors eager to get exposure to the precious metal, while the dollar is likely to strengthen as there has been too much pessimism about it, famous investor Jim Rogers told CNBC Tuesday.

Gold [ XAU= 1712.09 +1.50 (+0.09%) ] hit record after record high this year as investors scared by central banks printing money around the world and by the protracted debt crisis in the euro zone sought refuge in precious metals.

"I own gold and I'm not selling my gold," Rogers said, but pointed out that the price of the commodity has been up for 11 years in a row.

He advised that a drop in price wouldn't be such a bad thing. "Somewhere down the line gold will have a correction. Gold will continue to do what gold does best. Just give it a chance."

If the gold price retreats towards $1,200 per ounce, Rogers said he would get "extremely excited."

"I'd probably get more interested at $1,600. At $1,710 or whatever it is today I'm not buying gold, I'm just watching. And likewise for silver[ XAG= 31.85 -0.22 (-0.69%) ] ," he said.

"If I had to buy one today, I would buy silver just because silver is 40 percent below its all time high, gold is 20 percent near its all time high. But I'm not buying any of the four precious metals today."

On currencies, Rogers explained why he bought the US dollar[ .DXY 78.90 -0.36 (-0.45%) ] .

"I own the dollar, I own some other currencies as well," he said. "A year ago everybody was pessimistic about the dollar, including me…when everybody is on the same side of the boat, you go to the other side of the boat for a while."

But Rogers warned against piling into one currency. "If you have all of your money in anything, be very careful. Some are going to totally disappear."

Rogers said he also owns the Chinese renminbi [ CNY=X 6.3769 -0.007 (-0.11%) ]and the Japanese yen [ JPY=X 77.78

-0.20 (-0.26%) ] and criticized governments for their ongoing drive to print money and inability to cut debt.

"Governments around the world continue to print money. Paper money everywhere is being debased. If the US dollar turns into confetti, there is no high for the price of gold, because the dollar will become worthless," he warned.

Europe Getting 'Out of Control'

Rogers also said that no solution would be found for the ongoing crisis as long as European powers remained so heavily debt burdened.

"The solution to too much spending and too much debt is not more spending and more debt. Nobody shows debt going down," he said.

"This situation in Europe is getting out of control. It already is out of control in the US. You're going to have to take your pain sometime. If you did it now, you could ring-fence everybody; the system would survive. Right now governments have some credibility left…if you wait a year or two or five, when the market forces you to deal with reality, then the markets and the banks have no credibility."

"I'd rather take the pain now, rather than the markets force us to take the pain. And that could be the end of the system," he said.

Rogers pointed to the Scandinavian banking crisis of the early 1990s, saying that difficult policies enacted at the time to allow some banks to fail went on to save the long-term future of the region.

"It was a horrible two or three years, but since then Scandinavia – especially Sweden - has had a wonderful rise for the last 15 years or so. And Sweden is one of the most stable and solvent countries in the world."

"The world is full of risk right now. I own Scandinavian currencies because they are probably less risky," he said.

Rogers is still optimistic on commodities and said it was understandable that in the wake of major financial derivatives broker MF Global's recent bankruptcy there would be some uncertainty.

"When a huge player goes bankrupt, it has a lot of ramifications. Once this is past, I would suspect that commodities would continue to go higher and that you would continue to see more inflation. I own all commodities; I especially own food and precious metals," he said.

What is Rogers' tip for a high performing asset class over the next three to six months?

"I am wildly bullish on Myanmar, if I could find a way to put all of my money into Myanmar, I probably would. It is at the place where China was in late 1978; they are opening up, they've changed. They've got 60 million people, they are right there between China and India," he explained.

"I cannot think of anything in the world about which I'm more bullish than Myanmar."

July 18, 2011

Gold`s journey toward $1,600

Gold's journey toward $1,600

The yellow metal briefly touched a record high above $1,600 dollars on Monday as deft fears continued to grow, but there have been other steps in gold's rise toward a new record

Posted: Monday , 18 Jul 2011

The yellow metal briefly touched a record high above $1,600 dollars on Monday as deft fears continued to grow, but there have been other steps in gold's rise toward a new record"

May 23, 2011

Euro Price of Gold Hits Record High As "Debt Woes Spreading" Beyond Greece - Gold Matters

Euro Price of Gold Hits Record High As "Debt Woes Spreading" Beyond Greece

The MasterMetals Blog

May 19, 2011

MasterMetals: Precious Metals Charts in Euros

Prices in Euros per ounce and per kilo in 8 and 24 hour intervals

| ||||||||||||||

The MasterMetals Blog

April 5, 2011

Jim Rogers: Dollar will be debased; gold and silver to hit new highs | 05 April 2011 | www.commodityonline.com

Dollar will be debased; gold and silver to hit new highsChinese economy:

There is some overheating and inflation

setback in urban, coastal real estate is under way

China has been overbuilding ever since I have been visiting. There is at least eventual demand for much of it, but that does not preclude some bankruptcies in the future.Europe:

I think we are getting closer and closer to the point where someone in Europe is going to have to take some losses, whether it's the banks or the countries, but somebody has to acknowledge that they are bankrupt.Following is an interview that The Daily Bell had with Jim Rogers:

Jim Rogers: Dollar will be debased; gold and silver to hit new highs

05 April 2011 | www.commodityonline.com

Daily Bell: We've interviewed you before. Thanks for spending some time with us once again. Let's jump right in. What do you think of the Chinese economy these days?

Jim Rogers: There is some overheating and inflation, which they are wisely trying to cool – especially in urban, coastal real estate. They have huge reserves so will suffer less than others in any coming downturn.

Daily Bell: Is price inflation more or less of a problem?

Jim Rogers: More. At least they acknowledge inflation and are attacking it. Some countries still try denying there is inflation worldwide. The US is even pouring gasoline on these inflationary trends with more money printing instead of trying to extinguish the problem.

Daily Bell: Is China headed for a setback as you suggested last time we spoke?

Jim Rogers: Did I say a setback or a setback in real estate speculation? I think you will find it was the latter. Yes, the setback in urban, coastal real estate is under way.

Daily Bell: They are allowing the yuan to float upward. Good move?

Jim Rogers: Yes, but I would make it freely convertible faster than they are.

Daily Bell: Will that squeeze price inflation?

Jim Rogers: It will help.

Daily Bell: Why so many empty cities and malls in China? Does the government have plans to move rural folk into cities en masse?

Jim Rogers: That is a bit exaggerated. China has been overbuilding ever since I have been visiting. There is at least eventual demand for much of it, but that does not preclude some bankruptcies in the future.

Daily Bell: Is such centralized planning good for the economy?

Jim Rogers: No. Centralized planning is rarely, if ever, good for the economy. But the kind of construction you are describing is at the provincial level – not the national level.

Daily Bell: The Chinese government is worried about unrest given what is occurring in the Middle East. Should they be?

Jim Rogers: We all should be. There is going to be more social unrest worldwide including the US. More governments will fall. More countries will fail.

Daily Bell: Are they still on track to be the world's biggest economy over the next decade?

Jim Rogers: Perhaps not that soon, but eventually.

Daily Bell: Any thoughts on Japan? Why haven't they been able to get the economy moving after 30 years? Will the earthquake finally jump-start the economy or is that an erroneous application of the broken-windows fallacy?

Jim Rogers: It has been 20 years. They refused to let people fail and go bankrupt. They constantly propped up zombie companies. The earthquake will help some sectors for a while, but there are serious demographic and debt problems down the road.

Daily Bell: The Japanese were going to buy PIGS bonds. What will happen now? Does that only leave China?

Jim Rogers: Obviously the Japanese have other things on their mind right now. I think we are getting closer and closer to the point where someone in Europe is going to have to take some losses, whether it's the banks or the countries, but somebody has to acknowledge that they are bankrupt. The thing that the world needs is for somebody to acknowledge reality and start taking haircuts.

ShareThis

MasterMetals’ Tweets

- @J_Wise_geology @MartianCopper Gu'on - 4/30/2025

- @TheWealthMiner I'd say the market is getting the gist of it... $AYA.TO https://bit.ly/3YOWigL - 4/30/2025

- @RealRickRule I think this should be done across the board! - 4/29/2025

- #Silver: iShares Silver Trust $SLV DOWN 1.1593%! Last at $29.84 on April 29, 2025 at 02:00AM. https://bit.ly/2uOmXzN https://bit.ly/3Etyrg0 - 4/29/2025

- $AYA.TO Things ain’t getting any better… https://bit.ly/4cTirQZ https://bit.ly/3SawesL - 4/29/2025

- $BHP - Q3 2025 Activities Report - 4/17/2025

- Trump & Metals - 4/16/2025

- Gold Miners (Finally) Performing - 4/15/2025

- Gold Just Had Its Best Day Since 2023 - 4/10/2025

- Niche “Strategic” Minerals Surging in Price as Defense Spending Booms & Shortages Loom - 3/31/2025