Departure of trader's head of copper signals break-up of 'billionaire boys' club'

Hundreds of pages of legal filings describe how the LME sleepwalked into a crisis, "that the LME was largely in the dark about Tsingshan's role as the major driver of the price spike until after it had decided to cancel billions of dollars of nickel trades; that the exchange's top decision makers were asleep as the market spiraled out of control; and that Chamberlain made the key decision that the market was disorderly in about 20 minutes after he woke up on March 8 – unaware until much later that the LME's staff had allowed prices to move more rapidly by disabling its own automatic volatility controls."

…

Jane Street alleges the very fact that the LME's key decision makers were asleep was a breach of the exchange's regulatory duties, since it meant that "no-one had been monitoring transactions in order to assess whether there were disorderly trading conditions." The LME disputes that it was in breach.

What oversight there was came from the exchange's trading operations team. They were in charge of operating the LME's price bands, a form of speed bump designed to limit extreme price moves, such as in the case of "fat finger" trades.

But in the early hours of March 8, the operations team received numerous complaints from market participants that the price bands were preventing them from booking trades. At 4:49 a.m., they suspended them altogether.

Dizzying Ascent

It was soon after this that nickel prices started the most dizzying part of their ascent. By the time Chamberlain woke up, at 5:30 a.m., the price was already $60,000 a ton. In the next 38 minutes, it rose another $40,000.

"The abandonment of price bands caused or at least materially contributed to the speed and scale of the increase in prices," Jane Street said in its court filing. "Without price bands in place, the LME could not control price volatility at all."

Chamberlain wasn't aware that his operations team had suspended the price bands, as he made his pivotal decision to suspend the nickel market.

The exchange still didn't have a handle on the scale or the importance of Tsingshan's position — the real reason behind the runaway rally.

…

Brokers on the LME would normally need to pay their first margin call of the day by 9 a.m., based on prices prevailing at around 7 a.m. If that had happened on March 8, the LME would have needed to request $19.75 billion from 28 banks and brokers – an unprecedented sum that was more than 10 times the previous daily record before March 2022.

See the whole article on Bloomberg here:

Here (courtesy of Nanex [8]) are

several examples in the June 2015 Comex Gold Futures this morning. All

times are Eastern Daylight. In each of these cases, no trades (or a

tiny few) executed against the large "spoof" order. You can see how

prices were influenced by the sudden appearance (and disappearance) of

these large, outsized orders.

1. June 2015 Comex Gold

Note how large buy and sell orders push prices up and down. [10]

[10]

2. Another set of instances appear about 50 minutes after the first set (shown in chart 1).

[11]

3. Another set of spoofing instances appear about an hour after the second set (shown in chart 2).

[12]

You're welcome CFTC — it's the least we can do.

Best wishes,

Zero Hedge

Reminder: We won't stop this until you are forced to address theMuch to our dismay, overnight we learned that while the CFTC

glaring hypocrisy and utter incompetence of everyone involved in the

regulation of market microstructure.

We expect the CFTC and the DOJ to unleash the wrath of god now thatNOTICE OF SUMMARY ACCESS DENIAL ACTION: COMEX 15-0103-SA-1

NON-MEMBER:

NASIM SALIM

CME RULE: 413. SUMMARY ACCESS DENIAL ACTIONS (in part)

A. The Chief Regulatory Officer or his delegate, upon a good faith

determination that there are substantial reasons to believe that such

immediate action is necessary to protect the best interests of the

Exchange, may order that: 1) any party be denied access to any or all

CME Group markets; 2) any party be denied access to the Globex platform;

3) any party be denied access to any other electronic trading or

clearing platform owned or controlled by CME Group; or (4) any Member be

immediately removed from any trading floor owned or controlled by CME

Group.

FINDINGS

On April 30, 2015, CME Group’s Market Regulation Department (“Market

Regulation Department”), through its Chief Regulatory Officer, summarily

denied Nasim Salim (“Salim”) direct and indirect access to all CME

Group markets, the CME Globex electronic trading platform, any other

electronic trading or clearing platform owned or controlled by CME

Group, and all trading floors owned or controlled by CME Group. The

summary access denial prohibits trading, placing orders, and controlling

or directing the trading for any person or entity in any CME Group

exchange product. The summary access denial further prohibits the

affiliation or business dealing with any member or member firm of CME,

CBOT, NYMEX, or COMEX.

CME Group’s Chief Regulatory Officer’s summary access denial of Salim

was based upon the findings of an investigation conducted by the Market

Regulation Department, which revealed that on multiple trade

dates during the time period of March 1, 2015 through April 28, 2015,

Salim engaged in a pattern of activity in which he repeatedly entered

orders or layered multiple orders for Gold and Silver futures contracts

without the intent to trade. Specifically, Salim entered these

orders or layered multiple orders to encourage market participants to

trade opposite his smaller orders resting on the opposite side of the

book. After receiving a fill on his smaller orders, Salim would

then cancel the resting order or layered multiple orders that he had

entered on the opposite side of the order book.

Salim introduced Heet Khara (“Khara”), who is also the subject of a

summary access denial action, to his first FCM and Salim had an account

at the second FCM at which Khara traded in a disruptive manner. Further,

it appears that on multiple occasions Salim and Khara coordinated

efforts to engage in disruptive activity. In

an example from April 28, 2015, Salim entered small-lot orders on one

side of the market in Gold futures, after which Khara entered large

orders on the opposite side. When Salim’s small orders were filled,

Khara canceled the large orders. Salim has not responded to

correspondence from the Exchange.

The foregoing conduct, as well as Salim’s failure to cooperate with

the Exchange, present a good faith determination that there are substantial

reasons to believe that such immediate action is necessary to protect

the best interests of the Exchanges and the marketplace.

ACCESS DENIAL:

Pursuant to Rule 413, this access denial will remain in effect for 60

days, commencing on the effective date below and continuing through and

including June 29, 2015, unless the Chief Regulatory Officer or his

delegate provides written notice that this access denial will be

extended for an additional period of time.

By Clara Ferreira-Marques and Quentin Webb

LONDON (Reuters) - Commodity trader Glencore, set to list this month in one of London's largest-ever offerings, has detailed its involvement in a Belgian criminal probe as it outlines risks to investors, including fraud and corruption.

Glencore said in a prospectus on Wednesday, ahead of its planned $11 billion listing, that its subsidiary Glencore Grain Rotterdam, a former employee and a current employee had been charged in a criminal case in Belgium.

Glencore said the criminal investigation was probing a public official, the European Commission's Directorate General for Agriculture and others for "violation of professional secrecy, corruption of an international civil servant and criminal conspiracy."

Glencore's unit and its current and former employees have been charged with having committed corruption in exchange for information on European export subsidies, it added.

The case was initiated in 2003, with co-operation from Dutch and French police, and covers facts dating from 1999 to 2003.

Commission agriculture spokesman Roger Waite confirmed that the EU executive expected a trial into alleged corruption by former agriculture department official Karel Brus.

Brus, a Dutch national, is accused of having passed confidential information relating to EU export subsidy application decisions to a French farming lobbyist between 1999 and 2003.

"As far as the Commission is concerned, we cannot comment further on an ongoing investigation," Waite said.

Glencore declined to comment on the case beyond details included in the prospectus. It says it is not involved in legal proceedings which could have a material impact on its profits.

Belgium's federal prosecutor confirmed on Wednesday that there is a criminal case against Glencore but declined to comment further. The case will be heard in Brussels on May 12.

The Commission, the European Union's executive arm, has become a civil party to the case, Glencore said.

FRAUD RISK

Glencore also listed in its prospectus over 30 other risks to the broader company, its marketing and trading operations.

The formerly publicity-averse trader and miner operates around the world and says its willingness to move into riskier countries in Eastern Europe, Central Africa and South America before rivals gives it a "first-mover advantage."

Companies typically outline a vast number of risks to future performance in the run-up to a listing, in order to satisfy requirements to provide a full picture for future investors.

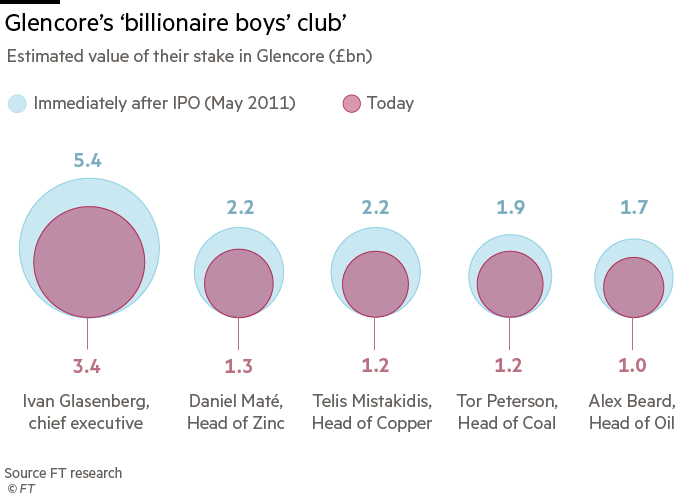

Glencore, however, detailed more than many, with risks including declines in demand for commodities, geopolitical risk and the risk it may not be able to retain key employees.

It also raised the risk of fraud and corruption, "both internally and externally."

"Glencore's marketing operations are large in scale, which may make fraudulent or accidental transactions difficult to detect. In addition, some of Glencore's industrial activities are located in countries where corruption is generally understood to exist," the company said.

Glencore said it has internal controls, external due diligence and compliance policies.