Lithium sell-off is 'overdone' — Goldman Sachs

Developing new mines will be hard but demand will rise, analysts said

The sell-off in lithium equities this year is "overdone," according to Goldman Sachs.

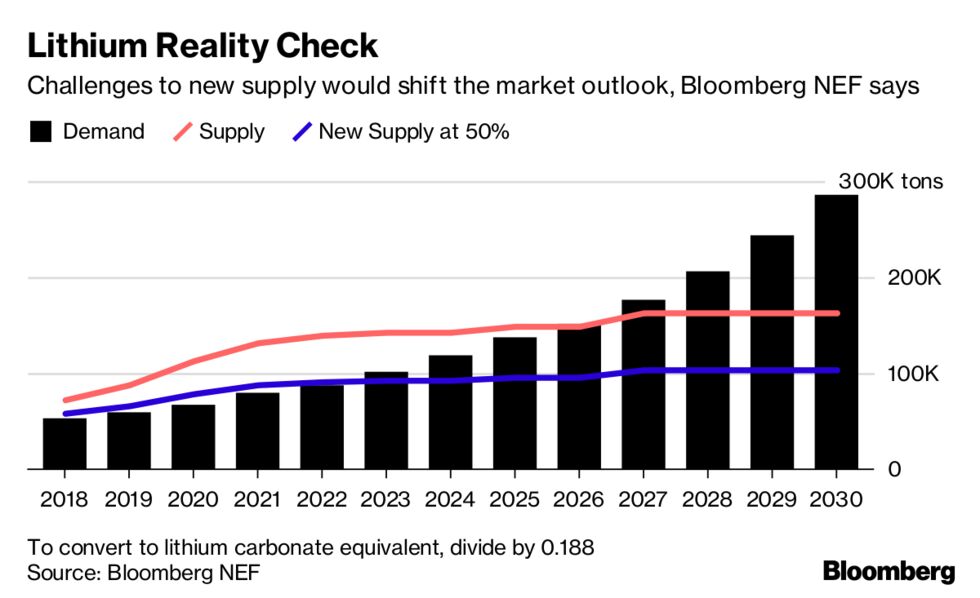

Investor concerns about a wave of supply of the electric car battery material from new mines are unfounded, according to the investment bank, one of the biggest commodity traders.

Instead, it will be harder to develop new lithium mines that most people think, Goldman Sachs said. At the same time, demand for lithium is expected to rise fourfold by 2025, due to rising sales of electric cars.

"Coupled with ongoing rising demand expectations as auto OEMs look to electrify their fleets, we expect lithium markets to remain sufficiently tight to handsomely reward incumbent producers," Goldman Sachs said.

The bank recommended investors buy US producers Albemarle and FMC Corp, predicting their shares could rise by a further 34 per cent and 30 per cent respectively.

Shares in the world's largest producers of lithium, a white metallic powder which is used in all electric car batteries, have slumped this year, following double-digit gains in 2017.

Investors have grown increasingly concerned about a wave of new lithium projects that have sprouted up from Australia to Nevada to take advantage of rising prices.

Prices of lithium carbonate, a key lithium ion battery raw material, have increased nearly 40 per cent in the past 12 months on the back of increasing electric car production, according to Benchmark Minerals Intelligence.

But lithium is not like other commodities, according to Goldman Sachs.

The current market is small, with only around 200,000 tonnes of production a year, and has to grow rapidly to meet demand. The only other time commodity production has had to grow so fast was in the early 1900s, when oil and natural gas production almost quadrupled in ten years, Goldman Sachs said.

"While we hesitate to claim 'this time is different,' we see several key reasons why this may actually be true for lithium," Goldman said.