We've picked up a noticeable increase in the amount of electrification conversations among industry participants and an acceleration in investor expectations for the pace of electric vehicle penetration. With that in mind, we took a fresh look at our electric vehicle forecast, out through 2050, and present a primer on electric vehicles and how different industry participants are preparing for the future.

Forecast global BEV sales penetration of ~7.5% by 2025

We estimate that globally, battery electric vehicles (BEVs) represented ~0.8% of 2017 global demand, while hybrid-electric vehicles (HEVs) and plug-in hybrid-electric vehicles (PHEVs) represented ~2.9%. But we see robust growth off these low figures. The growth will be driven in two phases. The first phase, through 2025, is primarily regulatory driven. By then, we see ~7.5% BEV global penetration of new demand representing a ~34% CAGR from 2017's levels and ~12% HEV/PHEV penetration representing a ~21% CAGR. By 2025, we see BEV penetration in China at ~15%, Western Europe at ~8% and the US at 5%. Our ~7.5% global BEV penetration rate compares to IHS at ~5%.

Forecast global BEV sales penetration of ~66% by 2050

In the second phase, we see change factors aligning to impart more significant revolution. Battery costs decline, infrastructure is built out, and the regulatory-driven push gives way to a consumer-led one. BEVs become more cost efficient than ICE vehicles and take share from HEV/PHEV. By 2050, we see ~66% BEV global new vehicle penetration, representing a ~9% CAGR over a 25-year period from 2025. We see regions like China and Western Europe reaching 85% penetration. We forecast the US at 60% penetration.

BEVs will represent ~35% of global VIO by 2050

Our modeling shows that for global vehicles in operation (VIO) by 2025, ~91% will be ICE, ~3% 48V, ~4% HEV/PHEV (so ~98% still have some sort of ICE), and ~2% BEV. By 2050, we model the global VIO to be ~49% ICE, ~8% 48V, ~8% HEV/PHEV (so vehicles having some sort of ICE down to ~65%), and ~35% BEV. Please see regional analyses inside and ask your RBC salesperson for our EV model.

What it means for automakers?

Automakers are accelerating electrification efforts. R&D increases, limiting profits today. But electrification is also an opportunity to rethink production/supply chains/capability, which may represent an opportunity for OEMs to re-capture value. German OEMs doing the most. GM ahead of Ford to-date but Ford spending to catch up. Tesla increasingly competes on attributes besides electrification.

What it means for suppliers?

For ICE/exhaust products, expect margin pressure driven by lower volumes. Ultimately, we see the need for powertrain consolidation. There are opportunities for evolution and new parts such as batteries, electric motors, and power electronics come into vehicles. But evolution means investment now. Suppliers may look to JVs to fill competency gaps. Interim solutions such as 48-volt technology can be a strong growth opportunity (41% CAGR through 2025) for companies like BWA, DLPH and LEA. However, the majority of future electrified platforms likely PHEV/BEVs creating opportunities to add value from motors (BWA) and power electronics (DLPH, BWA). Meanwhile, axle makers (AXL, DAN, MTOR) may have an underappreciated opportunity to grab more value.

Will EVs make China an automotive powerhouse?

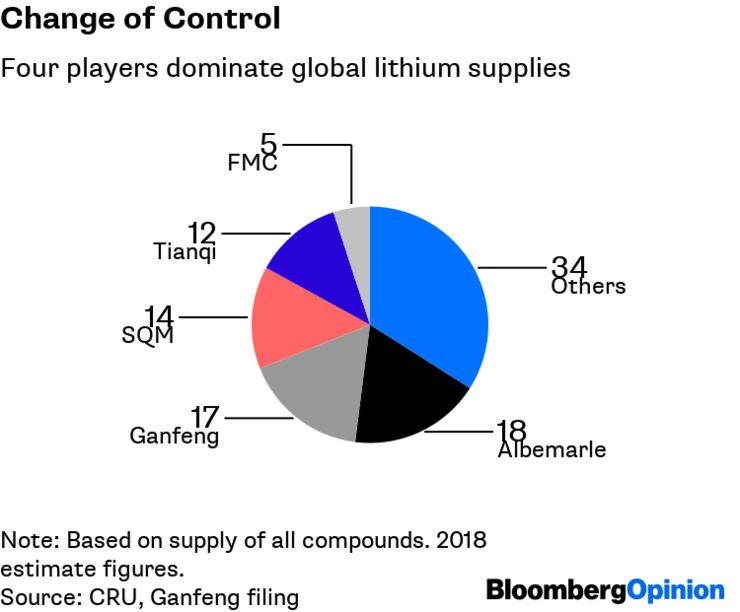

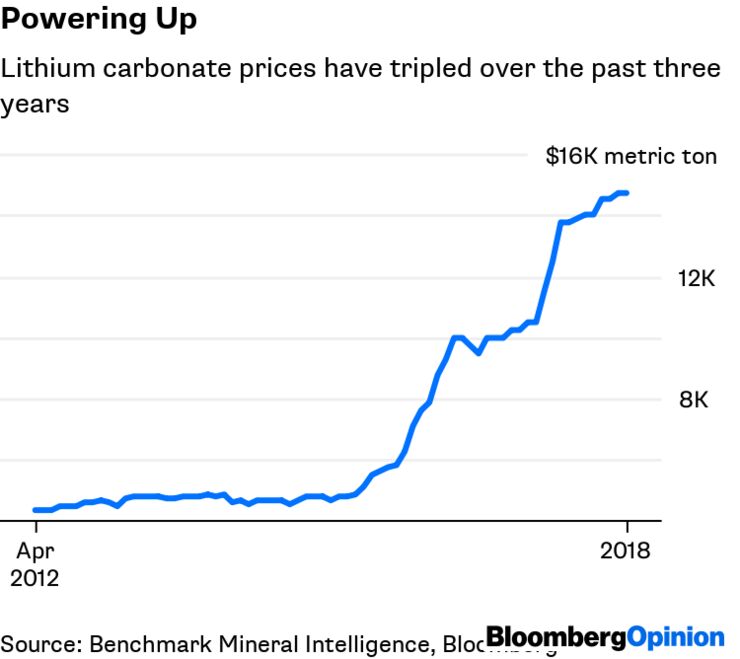

EVs present a significant opportunity for China to assert itself within the automotive industry. Our view is informed by: 1) a government that is very supportive of EVs; 2) Chinese companies pushing EV product; 3) China appears to control a large portion of battery supply...; 4) ...and the battery supply chain.