The Lithium Cartel Should Be Stopped

Why are we so relaxed about an emerging oligopoly in the key battery element?

The stuff of lithium dreams in Chile.

Photographer: Michael Smith/Bloomberg

The world doesn't like its essential commodities being controlled by a small group of producers.

…

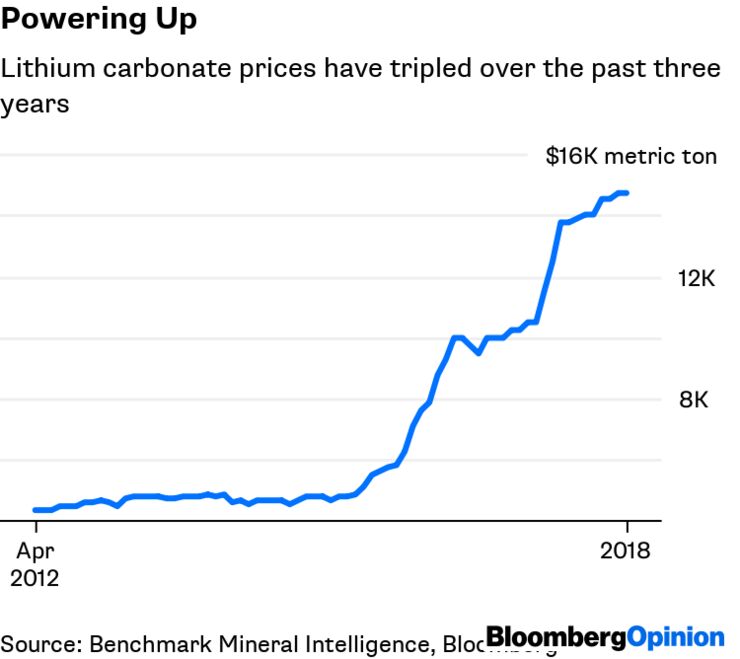

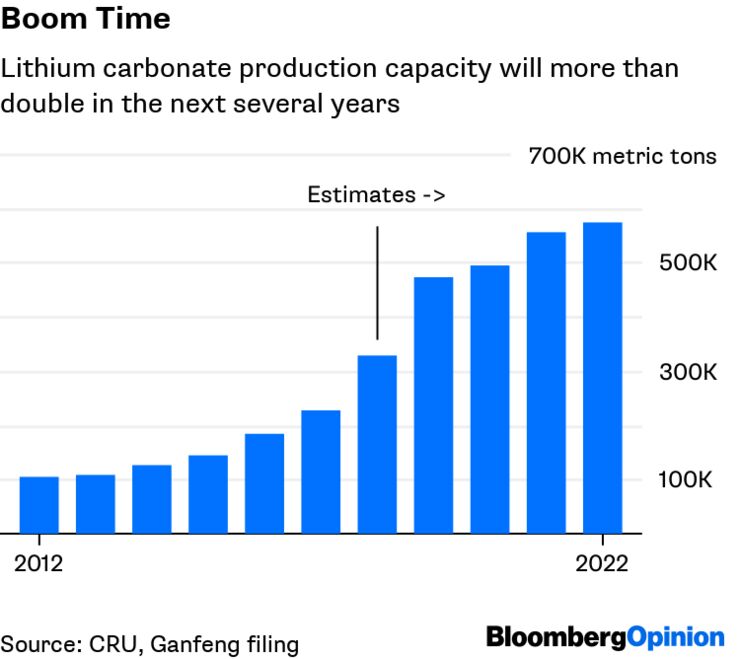

So why is there so little noise about the emerging oligopoly in one of the hottest elements on the periodic table, lithium?

Tianqi Lithium Corp. will pay $4.1 billion to buy Nutrien Ltd.'s 24 percent stake in Soc. Quimica & Minera de Chile SA, or SQM, in a deal that will entangle the biggest and fourth-biggest producers of the battery metal. The transaction could theoretically give Tianqi half of the board seatsThe transaction could theoretically give Tianqi half of the board seats, though other major shareholders who've historically guarded their interests have opposed such a path.

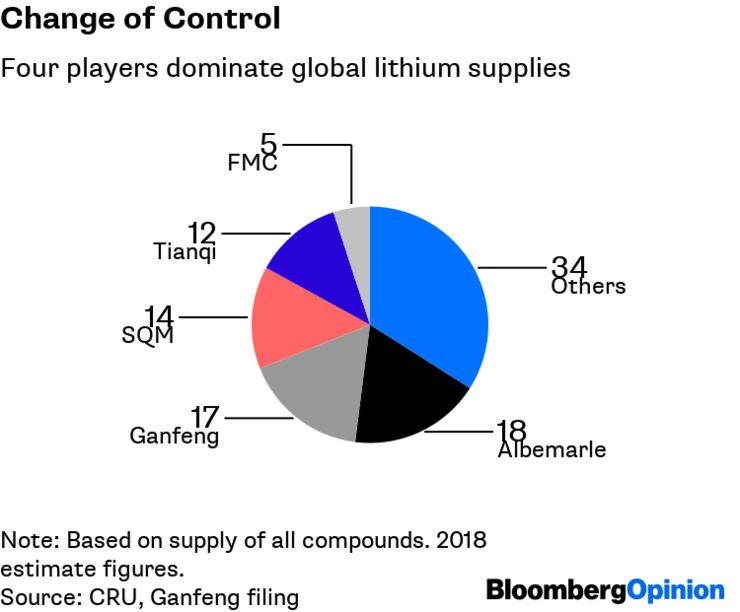

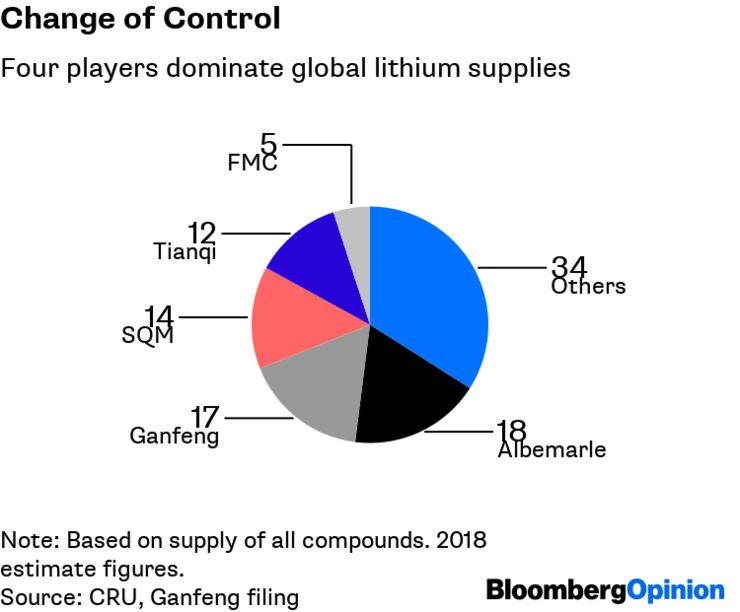

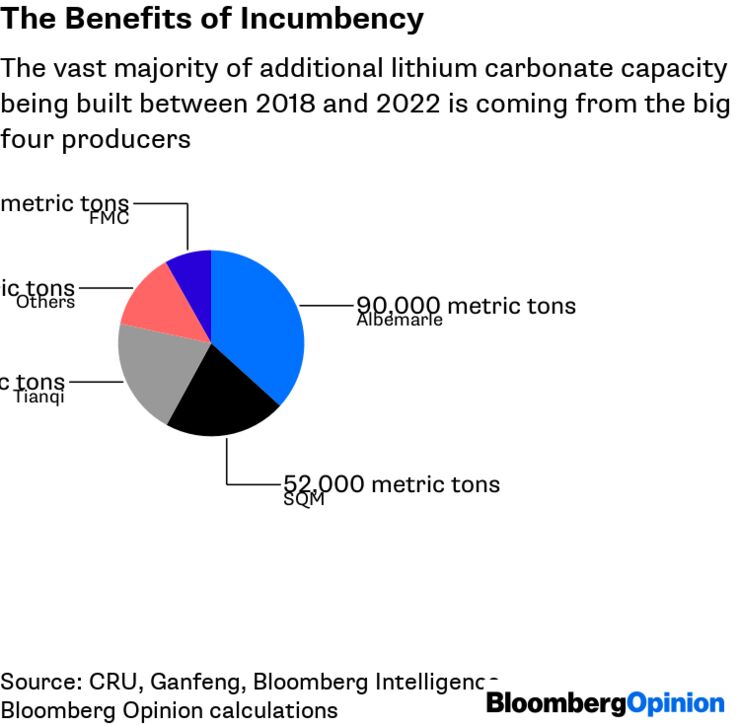

Here's how the lithium carbonate market is structured at present: North Carolina-based Albemarle Corp. is the market leader, with an 18 percent share, followed by Jiangxi Ganfeng Lithium Co. on 17 percent; SQM on 14 percent; and Tianqi on 12 percent. Other players have the 39 percent or so that remains — the largest among them being FMC Corp., which is soon to offer its shares to whoever wants them in a planned initial public offering.

…

On top of that, Ganfeng and Tianqi, while both technically independent private companies, are strategically important businesses operating in the China of 2018. Tianqi Chairman Jiang Weiping is a delegate to China's National People's Congress, according to the company's latest annual report. Ganfeng Chairman Li Liangbin has been a member of the standing committee to the People's Congress in Xinyu city, where the company is based, according to its IPO prospectus.

…

The outlines of the oligopoly are also indistinct. Tianqi is only a minority shareholder in SQM; it's only connected to Albemarle through a joint venture that accounts for a bit less than half of Albemarle's output; and Beijing has no formal control over private Chinese companies, whether they're Tianqi or Ganfeng.

Still, the world's regulators should sit up and take notice of what's happening. Those who've fretted in recent years over Beijing's dominance of rare earths and tungsten — not to mention the current tariffs on steel and aluminum justified on national defense grounds — seem to be asleep at the wheel.

Read the whole article online

.jpg)

No comments:

Post a Comment

Commented on MasterMetals