Consumption and production patterns need to change in the energy transition

5 hours ago

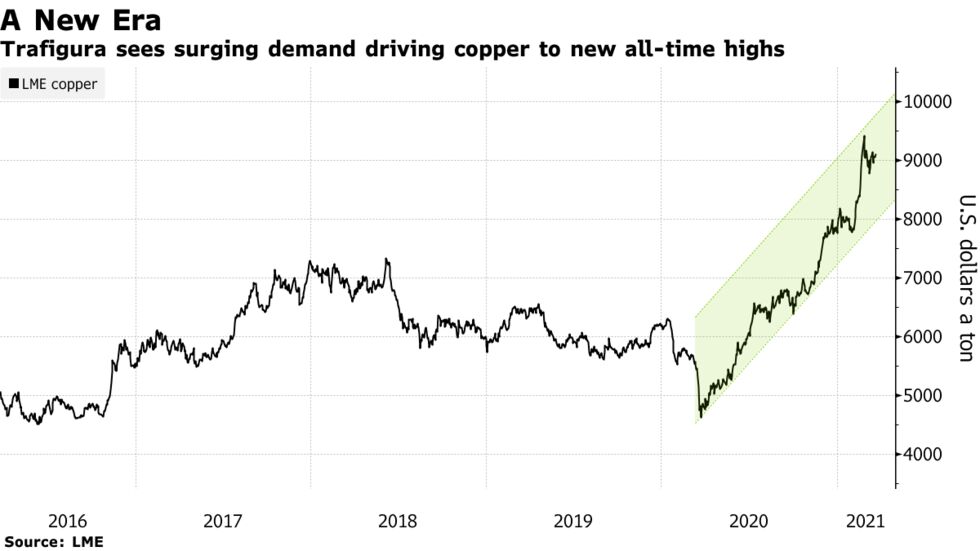

The mining industry is currently alight with talk of a new commodity "supercycle".

The last one coincided with China's rapid industrialisation growth spurt, and whether it is a supercycle or not, a major boom looks likely because of infrastructure-led spending to speed recovery from the pandemic coupled with the energy transition. Indeed, the talk of Green New Deals seeks to wed this energy transformation with that economic stimulus.

Mining companies, and their investors, are obviously enthusiastic about such an expansion. Mining entrepreneur Robert Friedland gloated that "if we get a Green New Deal where bankers just hit the zero keys . . . it would make our day".

However, miners are also taking advantage of their role supplying metals to renewables, batteries and electrical infrastructure to create a new green narrative for mining — the "black-to-green revolution".

In this new world, mining companies are the climate heroes saving the world, although it also conveniently downplays overall demand for critical metal end-uses, in the likes of construction, aviation, electronics and the arms industry. For example, even in the highest demand scenarios, under no circumstances will the renewable energy sector consume the majority of the annual production of copper.

The new demand supporting the energy transition does not change the act of mining. Extracting minerals, such as lithium, cobalt or copper, is still a dirty business with significant environmental and human impact.

This new boom threatens to open new extractive frontiers, in the global south but also in North America and Europe. There is an urgent need to deal with the potential widespread destruction and human rights abuses that could be unleashed.

Although it is crucial to tackle the climate crisis, and rapidly transition away from fossil fuels, this cannot be achieved by just expanding our reliance on other materials. The energy crisis is fundamentally a resource-usage crisis.

Our use of natural resources has more than tripled since 1970 and is on a continued growth path. According to the International Resource Panel, 90 per cent of biodiversity loss and water stress are caused by resource extraction and processing and these same activities contribute to about half of global greenhouse gas emissions.

...

On the demand side, there are a number of practical solutions that should be initiated or accelerated to enable better-informed choices about our energy and consumption, and to reduce the need for new resource extraction. However, it is not enough to switch to green growth, such as simply increasing the production of new electric vehicles.

Read the whole article on the FT here: https://www.ft.com/content/59cb407c-bf19-4e2e-8fed-bb3f140e5800?

Andy Whitmore is author of the War on Want 'A Material Transition' report and co-chair of the London Mining Network

The Commodities Note is an online commentary on the industry from the Financial Times.

.jpg)