Integra Resources ($ITR.V | $IRRZF) with its DeLamar Gold project in Idaho is gearing up for what could potentially be an interesting summer and fall. On its recent investor deck, Integra states "DeLamar has what it takes to be a mine. The PEA has demonstrated an economically robust, low cost operation." This is certainly valid and a nice determination of where they have been. What could potentially be uncovered and thus the future prospects of the project is where my excitement is focused on today.

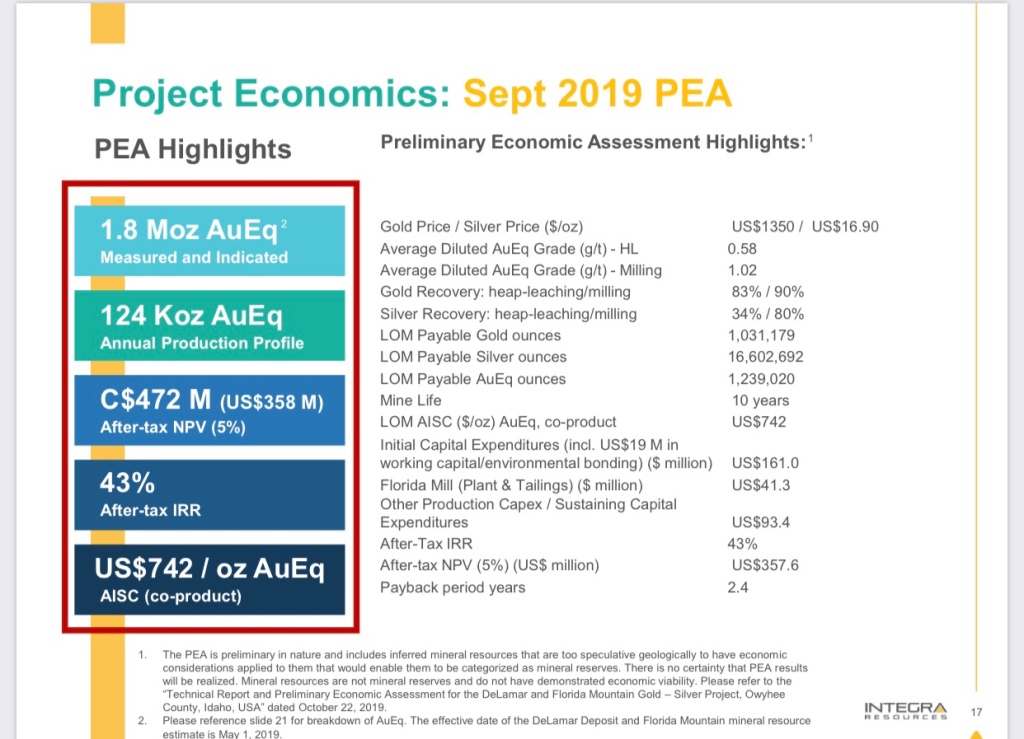

Integra last year put out a robust PEA that envisages a project that will produce 124,000 ounces gold equivalent with a LOM AISC of $619 net of silver by-product with a 10 year mine life at a reasonable capital cost of US $161M. A very nice starting point.

https://www.integraresources.com/site/assets/files/2678/19-09-09_integra_announces_maiden_pea.pdf.

Since the PEA was published, the price of Gold is up another $250 an ounce yet the stock price has remained flat. Here's a snapshot of the sensitivity to the price of Gold and the associated leverage. At $1350 the project has an NPV5 of $357M US with an IRR of 43% and a 2.35 year payback. At $1500, the NPV increases nearly 30% and at $1700 it rises by nearly 70%.

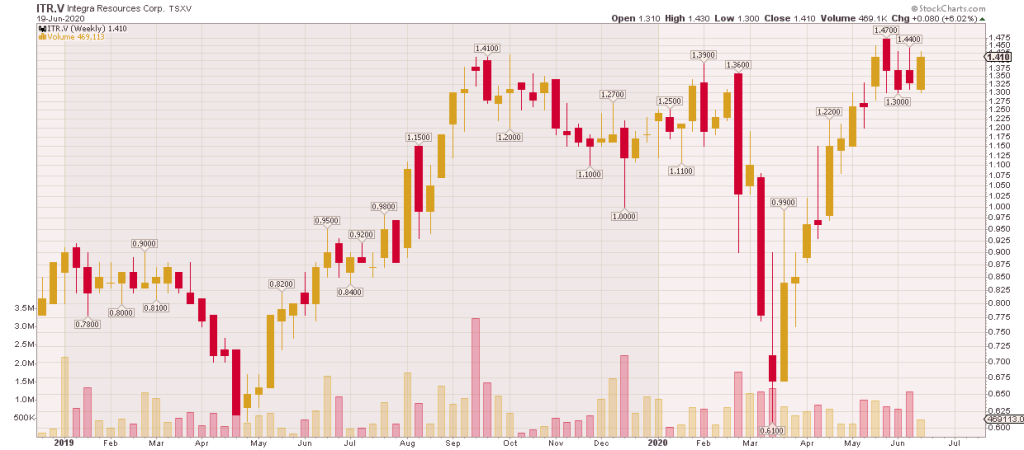

Here's the stock price over the past year, hovering near all time highs, looking for a catalyst, rising Gold price notwithstanding. Chart looks very constructive ahead of a very busy summer and fall drilling campaign.

All seems good so far. Which brings me to the upcoming exploration campaign, and where I see the potential for a re-rating if they can demonstrate success. The objective for the upcoming drilling program is two-fold: grow the higher grade milling contribution and the oxide component in order to potentially step up production creating additional shareholder value.

At Florida Mountain, the plan is to drill 5-7k meters in 20 holes beginning with the high grade targets (for the milling augmentation). Then the oxide targets focused on the large geochemical anomaly.

War Eagle RC drilling is scheduled to begin July 2020. 5k meters will be focused on high grade results adjacent to results reported in late 2019 https://www.integraresources.com/site/assets/files/2691/19-12-10_integra_intercepts_high_grade_at_we_and_fm_vf.pdf. There is a large anomaly 300m away that has never been tested before and that will be.

Read the rest of the post on High Grade here: https://economicalpha.blog/2020/06/21/integra-resources-a-summer-and-fall-to-watch/

.jpg)

No comments:

Post a Comment

Commented on MasterMetals