Search This Blog

July 6, 2020

#MiningStocks Financings Coming Back to Life with #Gold at Multi Year Highs

Freeport-McMoRan’s Recent Strength Is Just the Start $FCX @FM_FCX

That level of profitability would produce annual earnings of about $1.10 a share, which would mean that the stock is trading for just 10 times earnings. That expectation assumes no additional rise in the prices of copper or gold.

But that's not my assumption.

I expect copper prices to continue trending higher toward $3 a pound and gold prices to top $2,000 an ounce on their way to $3,000.

At $3 copper and $2,000 gold, Freeport's annual EBITDA could approach $7.5 billion.

But that's not all…

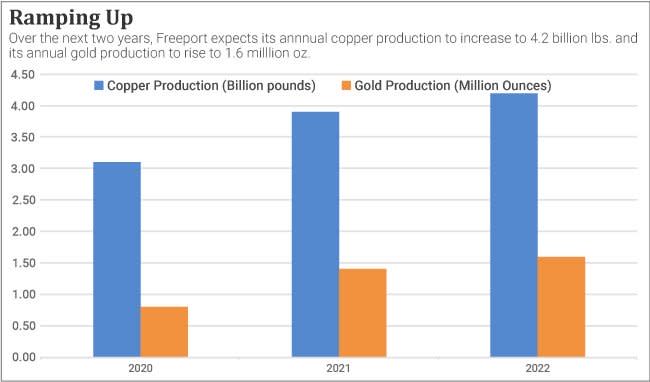

The company's massive investments to increase production at its Grasberg mine in Indonesia are just starting to bear fruit. As a result, company-wide annual copper production should jump about 40% over the next two years to 4.2 billion pounds. At the same time, gold production should double to 1.8 million ounces.

Source: Chart by InvestorPlace

Those hefty production numbers could produce EBITDA well over $10 billion and earnings per share (EPS) in the range of $2.

July 3, 2020

#Gold #MiningStocks vs. Physical - Bottom Line? They're Cheap! $GDX $GDXJ $GLD $XAU

The Philadelphia Gold and Silver Index of mining stocks is still nearly half of where it was at the peak in 2010. It was in 2010 at a record high of 232.72. On Thursday, July 2, 2020 it was 127.06 (attachment 1). That is 45% lower.

Meanwhile spot gold around US$ 1’770 is much closer to its record high of 1'917 per ounce in 2011 or just 8% below the all-time high (attachment 2).

ShareThis

MasterMetals’ Tweets

- $LUM.V Seeing the light with the Noboa election in Ecuador--his aunt owns a part 😉 https://bit.ly/4jrpouK - 4/15/2025

- Dr. Copper has recovered YTD, +13%. The same can't be said for the miners. Only $RIO is up, every other one is down for the year--with $IVN.TO & $GLEN.L the worst performers down ±30% https://bit.ly/4jDITjT - 4/15/2025

- Aldebaran $ALDE.v completes earn-in (80%), delays PEA on Altar to Q3 https://bit.ly/44oAcp0 https://bit.ly/42fl5wT - 4/15/2025

- It was due. $MAU.v moving to the TSX https://bit.ly/42JseFI - 4/15/2025

- @Pete__Panda Double Chutzpah - 4/15/2025

- Trump & Metals - 4/16/2025

- Gold Miners (Finally) Performing - 4/15/2025

- Gold Just Had Its Best Day Since 2023 - 4/10/2025

- Niche “Strategic” Minerals Surging in Price as Defense Spending Booms & Shortages Loom - 3/31/2025

- Gold rally finally attracts investors back to mining stocks after months of outflows - 3/25/2025