Search This Blog

October 12, 2020

October 8, 2020

#Pucara #Gold $TORO.v New Listing On @TSX_TSXV Venture Exchange

| Company Stock Issues - PUCARA GOLD LTD |

| Symbol | Name |

|---|---|

| TORO | PUCARA GOLD LTD |

| Fundamental Data - TORO |

| Security Type | Equity |

| Shares Issued | 61,894,460 |

| Market Cap | 47,659,000 |

| Year High | 1.50 |

| Year Low | 0.20 |

| Sector | 15104020 - Diversified Metals & Mining |

bit.ly/MasterMetals

October 1, 2020

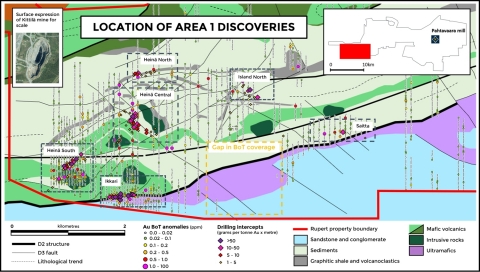

The Long High Grade Hits Continue! @RupertResources $RUP Drills 4.2g/t #Gold Over 167m & 3.6g/t Gold Over 65.3m at #Ikkari Discovery Finland

Rupert Resources Ltd (TSX-V: RUP) is the 100% owner of the Pahtavaara project in Northern Finland.

The latest set of fantastic results stem from four further holes from the Ikkari discovery in Area 1 (please see figure 1 in the news release), including two new holes from the eastern end of the currently identified 550m of strike. They include headline intercepts of 4.2g/t gold over 167m (including 8.9g/t over 22m) and 3.6g/t over 65m. These are the best exploration results from Area 1 so far, even better than those issued on 14th September 2020.

Importantly, these results demonstrate the significant grade potential of Ikkari, with higher grade zones developing within a broad mineralised envelope. And a higher average grade would of course increase any resource estimate, that the company intends to issue next year.

Currently, if one makes assumptions on strike (550m), width (100m), and depth (300m), one would get to approx. 48Mt of ore. At an estimated average grade of between 2.0g/t to 2.5g/t, this would imply a possible resource of between 3.1 Moz. and 3.8 Moz. However, these sort of assumptions are really only as good as the last hole drilled. Ultimately, the key statement in all of Rupert's news releases thus far is that the Ikkari mineralisation remains open in all directions and that three diamond rigs continue an aggressive drill programme. There is therefore plenty of upside with regards to resource potential.

The company is spending CAD 1.5 million per month, most of that on drilling, and has over CAD 30 million in the treasury. Also, a large part of the outstanding warrants and options are in-the-money and therefore represent a further source of funding over the next 18 months. In other words, if you want shares, you'll have to go into the open market...

Three rigs are now turning at Ikkari with assays from 17 holes pending.

Please also see the second attachment. This is slide number 5 from the company's updated investor presentation. It shows the top 30 gold drilling intercepts in Europe since 2019. It is interesting to note, that over 75% of these top 30 intercepts come from projects in Finland, and that the majority of the top 10 intercepts were produced by Rupert Resources. Today's fantastic results from Ikkari rank at the No. 2 position of the chart.

For the full presentation, please consult: https://rupertresources.com/presentations/

ShareThis

MasterMetals’ Tweets

- $SBSW Watusi move from the lows last week! 🚀 https://bit.ly/4jnGCcA https://bit.ly/4jEhZZd - 4/16/2025

- 🥇Done!🥇 https://bit.ly/3YufDUs - 4/16/2025

- $LUM.V Seeing the light with the Noboa election in Ecuador--his aunt owns a part 😉 https://bit.ly/4jrpouK - 4/15/2025

- Dr. Copper has recovered YTD, +13%. The same can't be said for the miners. Only $RIO is up, every other one is down for the year--with $IVN.TO & $GLEN.L the worst performers down ±30% https://bit.ly/4jDITjT - 4/15/2025

- Aldebaran $ALDE.v completes earn-in (80%), delays PEA on Altar to Q3 https://bit.ly/44oAcp0 https://bit.ly/42fl5wT - 4/15/2025

- Trump & Metals - 4/16/2025

- Gold Miners (Finally) Performing - 4/15/2025

- Gold Just Had Its Best Day Since 2023 - 4/10/2025

- Niche “Strategic” Minerals Surging in Price as Defense Spending Booms & Shortages Loom - 3/31/2025

- Gold rally finally attracts investors back to mining stocks after months of outflows - 3/25/2025