Citigroup sees prices rising to $25 in the next six to 12 months, with the potential for $30 based on the bank's bull case.

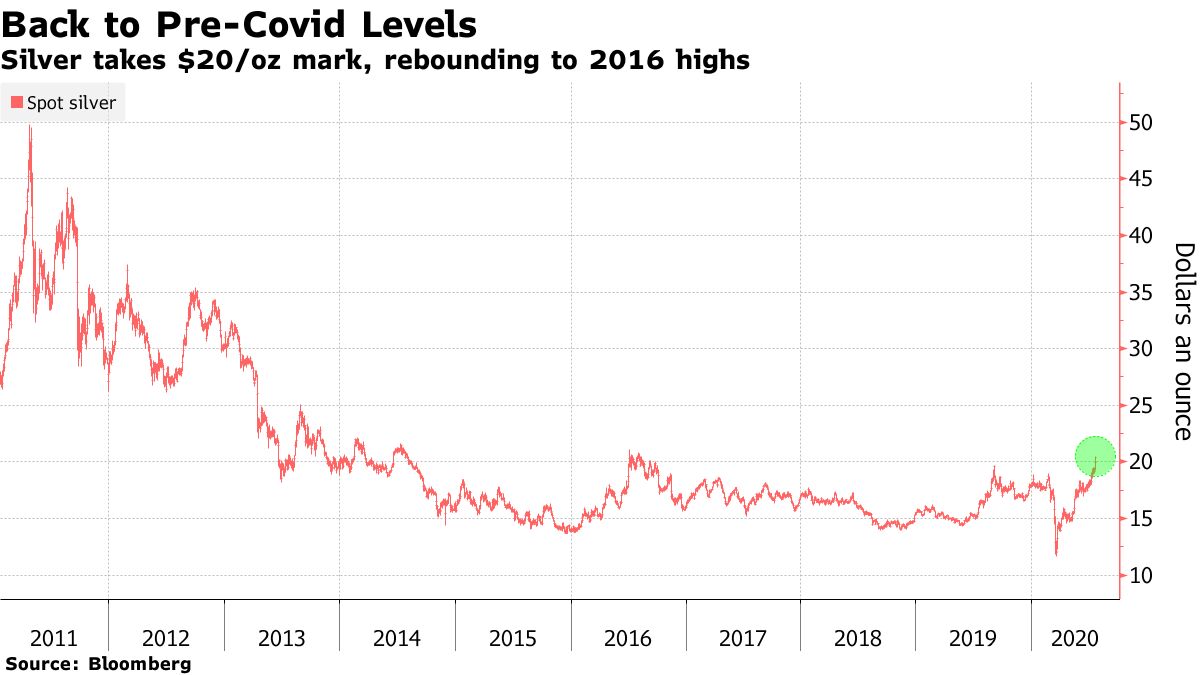

Spot silver powered through $20 an ounce Tuesday and is trading near a four-year high. The cheaper metal has outpaced gold's own gains this month, and holdings in silver-backed exchange-traded funds have increased for 12 straight weeks to a record.

"Silver is now leading the charge"

https://www.bloomberg.com/news/articles/2020-07-21/it-s-silver-s-turn-to-shine-as-prices-surge-to-four-year-high?sref=VxHCy32x