attached the chart (2) of URA, Global

X Uranium ETF. URA provides investors

access to a broad range of uranium mining

companies (Cameco is weighted 20%). Just

look at the volume of URA since the beginning

of the year. It exploded. This means strong

accumulation.

Attachment 3 shows the uranium price over

the last 5 years. After declining to US$ 18 per

pound early December 2016, the price recovered

to US$ 25.50 as per March 6, 2017. The reason

is the planned annual uranium production cut of 10%

by Kazatomprom. This amount translates into

roughly 3% of 2015 global production. Kazakhstan

is globally the largest supplier or uranium (39%)

followed by Canada (22%) (attachment 4).

At the current market price almost no new uranium

project is economic. Generally speaking, a uranium

price of US$ 70 is needed in order to bring a new

uranium mine in production.

Attached is the Quarterly Commodity

Outlook by Cantor Fitzgerald. Page

1 to 9 is a comment on uranium. Page

5 explains Japanese uranium inventories.

Page 27 to 53 has comments on uranium

companies.

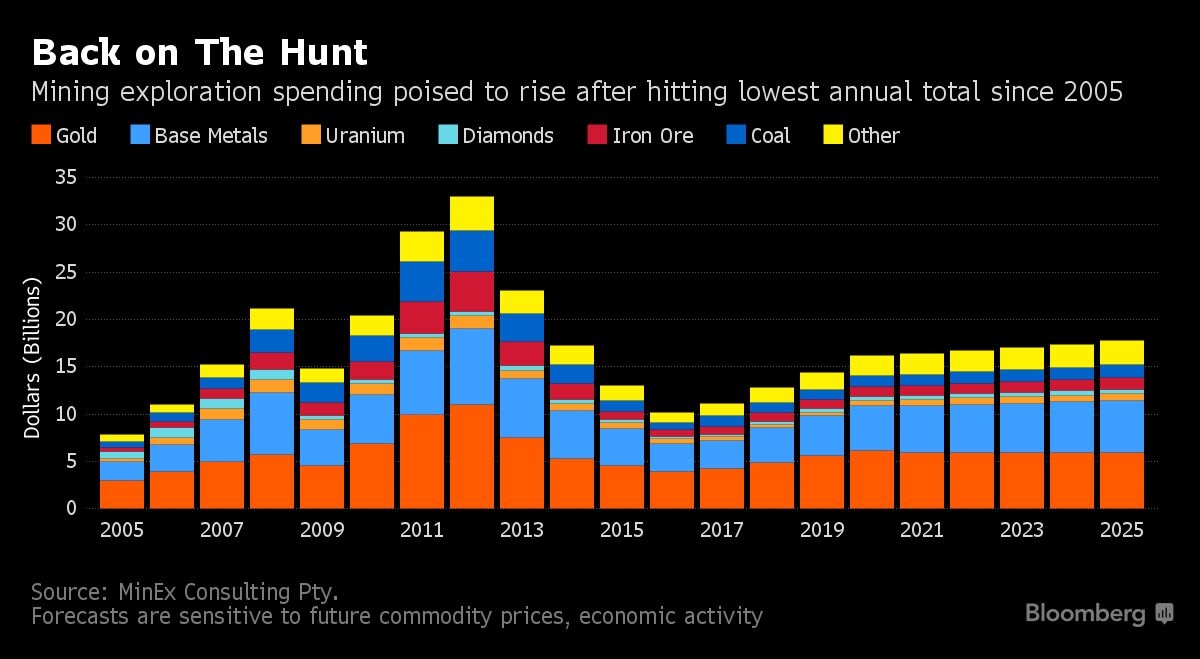

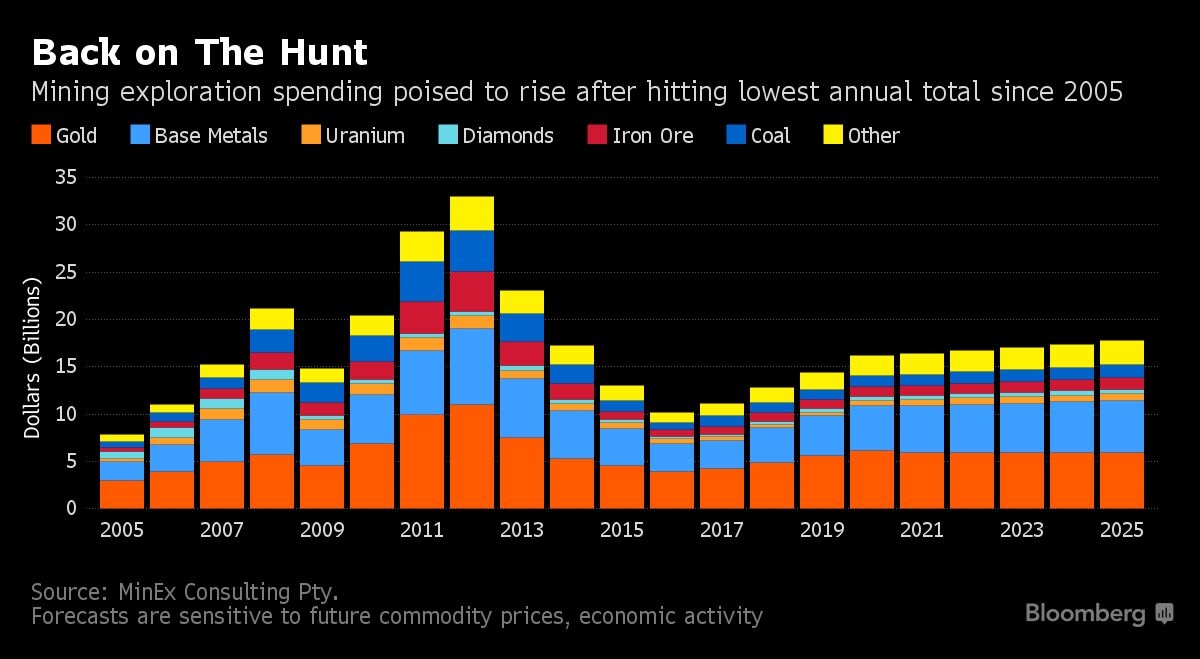

Exploration Spending forecast to rise more than 75% through 2025 to $18 Billion: MinEx

Exploration Spending forecast to rise more than 75% through 2025 to $18 Billion: MinEx