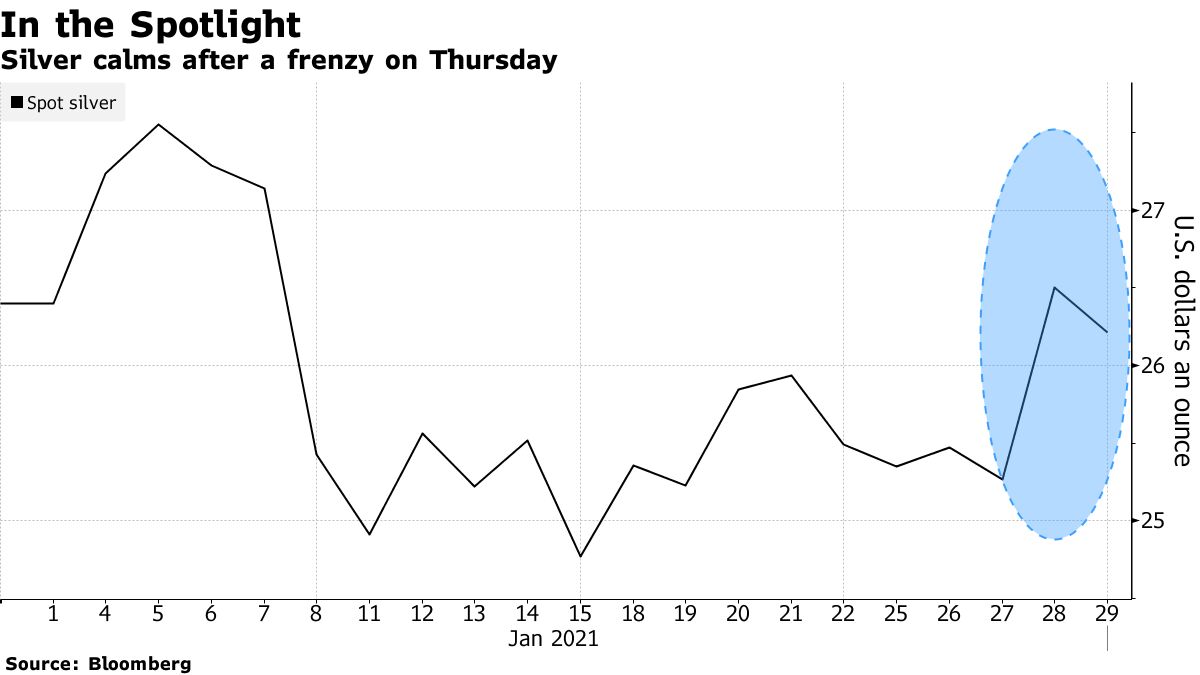

#Silver frenzy calmed on Friday as investors in miners' shares to ETF's and even the physical metal weigh whether a push by Reddit posters to create a short squeeze has legs. Silver has emerged as one of the latest targets of the r/wallstreetbets board

Posts encouraged people to pile into IShares Silver Trust, the largest silver exchange-traded fund, and one described it as "THE BIGGEST SHORT SQUEEZE IN THE WORLD".

"It is true that the combined efforts of those on the Reddit forums can dramatically influence the price of individual stocks, but if you compare the size of the entire silver market to the market cap of the individual companies that forums have recently targeted, we don't see this as having potential to significantly move silver into a short squeeze scenario," said John Feeney, business development manager at Guardian Vaults, a Sydney-based dealer.

"Silver's market cap is too large and those on the forums typically want to see quick gains, so I wouldn't read into it too much," he said.

| More on the silver market's volatile Thursday |

|---|

|

See the whole story on Bloomberg here: https://www.bloomberg.com/news/articles/2021-01-29/silver-seizes-the-spotlight-following-reddit-day-trader-frenzy?utm_campaign=socialflow-organic&cmpid%3D=socialflow-twitter-commodities&utm_source=twitter&utm_medium=social&utm_content=commodities&sref=VxHCy32x

.jpg)