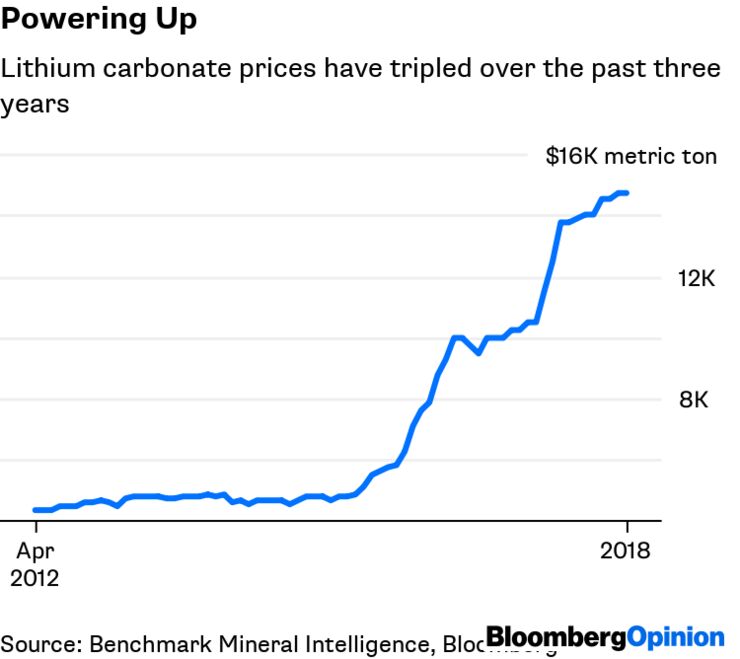

1- Lithium prices are only starting to rise. See charts below.

2- We now see prices for lithium carbonate going from $6,75k/t today to $7,5k/t in 2021 and then average $10,0k/t by 2023

3- WE now see EV penetration to grow from 3.9% in 2020 to 5% in 2020 and 12% by 2025.

4- Recent data have shown an acceleration with Chinese EV sales up 120% in November yoy and Europe tripling

5- Joel also sees lithium supply basically not rising in 2021 before a supply boost in 2022/23. See charts below.

6- Joel is now using 18X EV/EBITDA multiple targets up from 12X justified by: 1- 20% demand CAGR for lithium, 2- Scarcity of liquid investments in the space, 3- ALB’s lithium unit has traded at 18X for the past five years

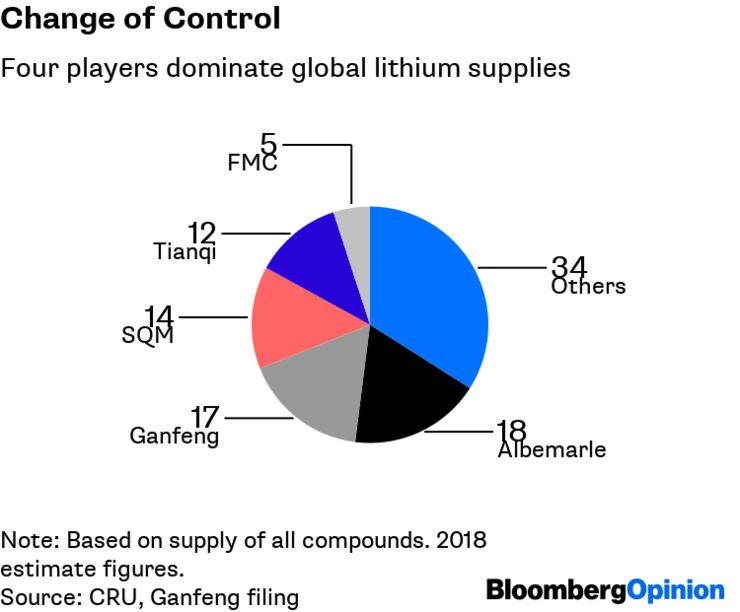

7- SQM and ALB trade at 30% discount to their SOTP. Details below and attached. Joel is upgrading SQM to Outperform.