Search This Blog

July 16, 2020

Just in the first two weeks of July, there have been 95 #TradeHalts on the #TSX, @tsx_tsxv ...some are repeats... $LI

July 6, 2020

#MiningStocks Financings Coming Back to Life with #Gold at Multi Year Highs

Freeport-McMoRan’s Recent Strength Is Just the Start $FCX @FM_FCX

That level of profitability would produce annual earnings of about $1.10 a share, which would mean that the stock is trading for just 10 times earnings. That expectation assumes no additional rise in the prices of copper or gold.

But that's not my assumption.

I expect copper prices to continue trending higher toward $3 a pound and gold prices to top $2,000 an ounce on their way to $3,000.

At $3 copper and $2,000 gold, Freeport's annual EBITDA could approach $7.5 billion.

But that's not all…

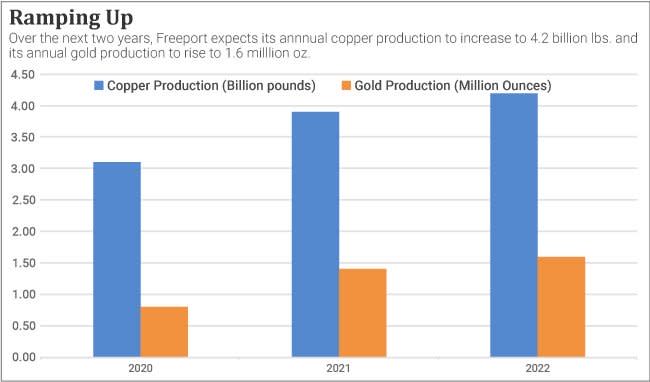

The company's massive investments to increase production at its Grasberg mine in Indonesia are just starting to bear fruit. As a result, company-wide annual copper production should jump about 40% over the next two years to 4.2 billion pounds. At the same time, gold production should double to 1.8 million ounces.

Source: Chart by InvestorPlace

Those hefty production numbers could produce EBITDA well over $10 billion and earnings per share (EPS) in the range of $2.